_ Prof. Dr. Ulrich van Suntum, University of Münster, former Secretary-General of the Expert Council for the Assessment of Overall Economic Development. 22 April 2021. Translated by Yuri Kofner from Oekonomenstimme (ETH Zurich).*

The volume of sales on the financial markets is a multiple of the gross domestic product. Under these circumstances, can the monetarist theory still be valid? Yes, if you adjust them accordingly.

The monetarist theory is increasingly criticized as out of date or even refuted. On the one hand, goods prices have increased only relatively little in recent years, despite the massive expansion of the money supply. On the other hand, it is pointed out that most payment transactions today take place in the financial markets anyway. Braunberger (2021) describes the order of magnitude as “breathtaking” and, citing an IMF study (Stella et al. 2021), writes “The sum of payments processed by American commercial banks through their accounts at the central bank in 2007 was 77,874 times the sum the balances of the commercial banks at the central bank (which together with the cash in circulation make up the vast majority of the central bank money supply)!!!” The processing of goods transactions makes up “perhaps one percent of the total payments”. In addition, money circulates in the financial markets at a disproportionately higher rate of circulation than in the goods markets.

Inclusion of the financial markets in the monetarist quantity equation

So, can one confidently dispense with the money supply as a variable in macroeconomics and in inflation forecasts, as is often the case, especially in New Keynesian models? That would not only be negligent, it would also be methodologically questionable. Because if the financial markets play such a big role today, on the contrary, it makes more sense to integrate them into quantity theory. In any case, the quantity equation originally referred not only to the gross domestic product (GDP), but to the total trade volume, as Braunberger also points out. In addition to the financial products, this also includes, for example, intermediate consumption, which is known to be factored out in GDP. Since the latter have a relatively stable share of GDP, neglecting them in the quantity equation does not lead to any particular problem, one only gets a slightly lower velocity of the money. But it is different with the financial markets. Since their volume has increased sharply compared to GDP, they would have to be explicitly included in the quantity equation, at least for longer-term analyses.

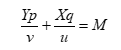

Amazingly, this not only confirms key statements made by monetarism, but can also explain its apparent “failure” in recent decades. If, as usual, we denote the real product (including intermediate consumption) with Y, the price level with p, the money supply with M and the velocity of money in the goods markets with v, the quantity equation in its usual form reads:

![]() or

or

![]()

A quantity equation expanded to include the financial markets, on the other hand, looks in its simplest form as follows:

Here we have designated the number of financial market assets with X, their price or average market value with q and the velocity of money in the financial markets with u. For the sake of simplicity, we now consider real production Y and the number of financial market assets X as given and maintained the two rotational speeds are constant at first, but with u >> v. Then one can already draw a number of very important conclusions from this simple equation. We dispense with the rather simple mathematical proofs here and instead use simple numerical examples for illustration.

Little money required despite high transactions on the financial markets

First of all, it is easy to see that the extended quantity equation leads back to the simple form if we set either the number X or the price q of the securities equal to zero. With a constant velocity of circulation v, trivially, the proportionality of the amount of money and the price level, as claimed by the monetarists, results.

More interesting, of course, is the case of actual financial assets. Since these are handled much more frequently than the goods, their speed of money circulation u is incomparably higher than that of the goods v. At the same time, however, this means that much less money is required for financial transactions than for goods transactions of the same nominal value. Therefore, the share of the money supply M that is used for financial transactions is significantly lower than its share in the total transaction volume T (= Yp + Xq). This also puts the relationships mentioned by Braunberger into perspective. In fact, many financial transactions require almost no money in relation to their volume. For example, if I transfer € 100 to my wife’s account every day and she sends it back to me in the evening, the transaction volume is T = 2 * 365 * 100 = € 73,000, although there is only € 100 in money. And on the financial markets, transactions do not only take place on a daily basis, but sometimes even every second. The astronomical sums that Braunberger mentions are hardly surprising, but the amount of money required for this is many dimensions lower.

Financial markets absorb increased money supply

What happens now if the money supply M increases, say by 100%? In the simplest case, both the price of goods p and the price of securities q double, and the monetarist theory would be confirmed. It can also be the case, however, that financial assets become more expensive in relative terms. Then the prices of goods p inevitably rise less strongly than q, and this is exactly the scenario that we have seen in recent years. So this is not a contradiction to quantity theory, but rather follows directly from it. Monetarism has never claimed that all individual prices must rise equally, and these individual prices today also include the rates of financial assets.

A special punchline arises from the fact that the disproportionate rise in asset prices can in turn be explained directly by the expansionary monetary policy. Because this implied massive interest rate cuts, which is known to drive securities prices up. Fears of inflation and the lack of investment alternatives for the savings were added. If the financial markets are explicitly included in the monetarist theory, the result is a picture that is both coherent and in good agreement with the empirical facts.

However, the relationships cannot simply be reversed in the event of a collapse in security prices. In purely arithmetical terms, this would free up money for the goods markets, but at the same time the liquidity preference is likely to rise sharply in such a scenario, as the financial crisis of 2009 demonstrated. The result of a stock market crash would be deflation rather than inflation on the goods markets. A long-term downward correction in securities prices would, however, require a cautious reduction in the then rather too large amount of money.

Another interesting question is how increasing efficiency and speed of financial transactions affect the price of goods. In purely arithmetical terms, this would mean that the speed of money circulation in the financial markets will increase again, so that even less money is needed there than is already needed. Taken in isolation, given the total amount of money M, this would have an inflationary effect on the prices of goods. However, the quantitative significance of this effect would be rather small, since relatively little money is needed on the financial markets anyway. In addition, increasing financial market efficiency should also boost prices, which in turn increases the need for money in these markets.

The death bell for monetarism rings too early

Ultimately, the comparatively low demand of the financial markets for central bank money is due to the fact that neither cash nor minimum reserves play a major role there. It is well known that the money creation multiplier tends towards infinity under such conditions, at least in theory. Anyone who wants to keep price developments on the financial markets under control will therefore have to resort to regulatory rather than monetary policy means.

However, the death bell for monetarism should first be repacked. The path indicated here of integrating the financial markets – as well as alternative means of payment – into the macroeconomic theory, with explicit consideration of the money supply, appears far more sensible. The fact that the latter is not as easy to define or delimit in practice as the simple quantity equation suggests should not be an obstacle. In truth, capital and labour are heterogeneous goods that can hardly be aggregated more easily than monetary quantities. Ultimately, money is always what people see and accept as money, and this can vary greatly from time and region. Ultimately, empirical research must decide which aggregates are best suited for controlling the monetary policy target variables. This is how monetary policy has always done, even in the heyday of monetarism in the 1970s and 1980s.

Notes

Braunberger, Gerald (2021): Kehrt der Monetarismus zurück? Fazit-Blog, 5.März 2021, https://blogs.faz.net/fazit/2021/03/05/kehrt-der-monetarismus-zurueck-12100/#more-12100

Peter Stella ; Manmohan Singh ; Apoorv Bhargava (2021), Some Alternative Monetary Facts, IMF Working Papers, 8.1.2021, https://www.imf.org/en/Publications/WP/Issues/2021/01/08/Some-Alternative-Monetary-Facts-49975

Source: https://www.oekonomenstimme.org/