_ René Springer, member of the German Bundestag. Berlin, February 2020.*

Preface

Germany is experiencing profound economic and social changes. Demographic change, Agenda 2010, precariousness of work, child and old age poverty, social division, fears of decline as well as digitization and change in the world of work are recurring terms that accompany this development. Statements about the future performance of the social security systems hardly seem possible. Politics, science and business are looking for solutions more or less unsuccessfully.

In this situation, no idea polarizes as much as that of a basic income. The citizenship money (citizenship allowance, German: Staatsbürgergeld, SBG) presented here is a specific variant of the basic income, which is paid directly to the citizen in the form of a negative income tax. It is a modern tax and welfare system with overwhelming advantages over the current system. The tax system in the citizenship money model is not only simple, fair and transparent, but also leads to significant income relief for low and middle incomes. “More net of the gross” is no longer an empty promise. Families in particular will be much better off financially. On the expenditure side, many of today’s more than 150 social benefits will be combined, making the welfare state clearer, leaner, more efficient and cheaper. Opportunities for benefit fraud will be reduced. Hartz IV will be abolished. Instead, significantly more incentives are created to take up gainful employment. Work and performance will be worth it again. Especially in times of digitization and automation, the model brings more social security. Citizenship money also has an added value for people at the end of their working life, as it secures their existence in old age without going to the social welfare office and without bureaucratic hurdles.

The citizenship money model can not only be financed, but is firmly rooted in the social market economy, the economic and social order that today – as in the past – was and is the basis for the economic success of the Federal Republic of Germany and which, thanks to a promise of prosperity, guarantees the stability of the democratic community in Germany. The German welfare state is a civilizational achievement, and it should be preserved in the long term, also with a view to social peace.

The present article aims to raise awareness of the future opportunities of alternative welfare state models. Approaches such as basic income, negative income tax and citizenship allowance have to be scrutinized, but without ignoring the risks. That is why there is no plea for the introduction of such models here. Rather, I want to encourage pilot projects to be carried out to test and evaluate basic income models.

Stocktaking

Digitization replaces jobs

A quarter of all employees subject to social security contributions (7.9 million) already work in professions in which at least 70 percent of the work involved could be done by computers or computer-controlled machines.[1] In the next 20 years, 18.3 million jobs could be lost as a result of new technologies. In contrast to earlier developments, digitization will primarily affect the service professions in the future. The risk is particularly high for office workers, postal and delivery services, salespeople, cleaning assistants and catering service workers, but also mechanics and machine operators.[2] Even if new jobs are created in the course of digitization, the old qualification profiles will often not be sufficient to meet the new requirements. The fears of losing jobs and meaning are therefore increasing.

Digitization endangers the financing of the welfare state

The trend towards digitization and automation is clear. In the future, people will contribute less and less to added value, while more and more work will be performed by machines and software.[3] This is a continuation of a trend that has lasted for decades. In Germany, for example, the number of hours worked per capita and year has fallen by 38 percent since 1960.[4] For human work, wages and social security contributions have to be paid. However, this does not apply to software, robots and machines that replace human activities. Sustainable financing of the welfare state is hardly possible under these conditions.

Digitization increases the pressure to adapt to work

Due to digitization, old jobs are becoming less important and new jobs are emerging. Employees have to be prepared for the fact that their initial training is less and less sufficient for an entire working life and that they are increasingly confronted with unfamiliar tasks and new roles. The current welfare state model hardly creates any leeway or security in order to be able to keep pace with the changing demands of the labour market through training and further education measures. Studies show that the further training trend is even in the opposite direction. The proportion of Germans in further training has decreased since 2012. Participation in further training is lowest among the low-skilled.[5]

Families and single parents are increasingly at risk of poverty

Studies on the income situation of families show that, according to the latest estimations, the poverty risk rate of families is almost three percentage points above the values determined so far: According to this, 13 percent of couples with one child are at risk of poverty. With two children it is already 16 percent, with three children even 18 percent. In short: with every additional child, the financial situation of families becomes more difficult. Children are at risk of poverty in Germany. The situation of single parents is particularly drastic. Their at-risk-of-poverty rate is 68 percent.[6]

Old-age poverty is spreading rapidly

Around 50 percent of retirees currently receive a monthly pension of less than EUR 800.[7] In December 2017, around 1.06 million people received basic security benefits in old age and with reduced earning capacity. This number has doubled since 2004.[8] Due to the increase in atypical employment, the continuing growth of the low-wage sector and a falling pension level, the number of people living in poverty in old age will rise significantly.[9] All that remains for them is the often humiliating visit to the social welfare office.

High hidden poverty

According to calculations by the Institute for Employment Research (IAB), an estimated 3 to 5 million people in Germany live in hidden poverty. These people do not apply for Hartz IV, although they would be entitled to it due to low income or assets. This means that around 34 to 44 percent of those entitled to it forego state support, i.e., more than a third of all those in need. According to the IAB study, the main reasons for not making use of state support services are, among other things, a low level or duration of entitlement, the cost of submitting an application, potential administrative requirements, values, shame or simply ignorance of the regulations.[10]

Work precariousness

A trend that has been observed for a long time is the erosion of the normal employment relationship, which for decades has been the model of the social market economy in terms of labour market policy. What is meant is the decline in permanent, socially secure and collectively remunerated full-time work in favour of a steadily increasing number of atypical, precarious, fixed-term, temporary and part-time jobs.[11] The labour market reforms of Agenda 2010 have led to a large low-wage sector, which is associated with income insecurity, a lack of labour and social protection, few pension options and dissatisfaction due to a lack of prospects. Precarious employment ultimately leads to low pensions.[12]

Poverty trap – work is hardly worthwhile for Hartz IV recipients

The basic security for employable persons (Hartz IV) sets the wrong incentives. Deductions of currently up to 90 percent devalue additional earnings in the basic security benefit, which makes taking up work unattractive for benefit recipients. For example, out of an additional monthly income of 900 euros with Hartz IV, after all deductions, just 260 euros remain with the Hartz IV recipient.[13] Often, wages and social benefits are not far enough apart so that work is hardly worthwhile for low-wage earners. In short: Hartz IV inhibits work and is therefore counterproductive.

High tax and social security burden on labour income

The burden on average gross earned income with taxes and contributions in Germany was 39.9 percent in 2017, well above the average of the OECD countries of 25.5 percent. According to the OECD study “Taxing Wages 2018”, only Belgium was with 40.5 percent ahead of Germany in terms of the tax rate. The tax rate for single average earners without children is no less severe. In 2017, the OECD average was 35.9 percent, but in Germany it was a full 49.7 percent.[14] More and more people feel exhausted by the state due to the high tax burden.

Rural exodus and loss of home due to economic decline

More and more people are leaving rural areas and moving to the cities because there they find better professional prospects, a developed infrastructure and more cultural offers.[15] Today 16.4 percent of the German population lives in a large city. According to forecasts, this share will rise to 19 percent by 2030.[16] Increasing urbanization is leading to a decline in population and an investment deficit in rural areas, which is associated with the loss of jobs, the deterioration of village infrastructures and, in turn, renewed migration. A vicious circle that leads to obsolescence, loss of home and the economic shrinking of entire regions in both East and West Germany. The growing gap in living conditions between town and country endangers social cohesion.[17]

Lack of appreciation for work beyond traditional wage labour

The currently prevailing and seldom questioned concept of work understands work essentially as paid or wage work. In a modern working society like Germany, it has a central mediating function with regard to life opportunities and social security. Other forms of work that are indispensable for maintaining society, but which do not take place on the market and which are not paid, often receive neither moral nor financial recognition – with risks especially for women.[18] Since, predominantly women shoulder unpaid but valuable welfare and family work, cultural and citizen work as well as voluntary work. In 2013, around 35 percent more hours were worked in unpaid work than in paid work.[19]

Confusing and ineffective tax and transfer system

The German welfare state has grown steadily over the last few decades; its expenditure now amounts to almost 30 percent of the gross domestic product (GDP).[20] In 2021, welfare state expenditure will already amount to around 1.1 trillion euros, which corresponds to more than 1,000 euros per citizen per month.[21] The current tax and transfer system is highly complex, opaque and inefficient. There is talk of a downright jungle of hundreds of individual achievements. Due to misconduct and bureaucratic hurdles, not all those entitled to benefits receive benefits, which creates gaps in justice and a loss of trust in the welfare state. 46 percent of Germans are of the opinion that, all in all, things tend to be unfair in Germany.[22]

Stigmatizing welfare state

Anyone applying for basic security benefits today must undergo a comprehensive means test and provide information about their financial and family circumstances. This is often perceived as humiliating by those affected. Older beneficiaries in particular perceive regular visits to the office as a devaluation of their person and life situation. In addition, the Hartz IV stigma has a socially marginalizing effect. Not infrequently, the feeling of shame ultimately leads to passivity, so that any cooperation with the job centre is refused, which in turn entails sanctions, i.e. a reduction in the standard benefit. In short: The fear of surveillance and reprisals endanger the health and participation of those in need in the long term, which counteracts protection against poverty and social participation.

Complicated and non-transparent tax system

The tax system in Germany is complicated and particularly favours those who are aware of the multitude of circumvention and deduction options in tax law. Many citizens no longer understand their own tax return and companies are increasingly suffering from the high time required to meet all the requirements of the tax authorities.[23] Another problem is that with the growing complexity of living and working conditions, tax law is becoming more and more complex and no longer does justice to the principle of performance-related taxation. The call for simplification, more transparency and fair taxation is loud again and again. Speaking of justice: tax avoidance and tax evasion cause the German state tax losses of up to 160 billion euros every year.[24]

Citizenship money as a new welfare state model

The preceding stock-taking shows that our welfare state is confronted with many problem areas. These problem areas are not only the result of changed social and economic framework conditions, but also the consequence of incorrect socio-political decisions with a great symbolic effect but with little sustainability. The citizenship money model does not follow the logic of short-term showmanship but claims to be a new tax and transfer system made for the challenges of the 21st century.

Basic idea of citizenship money

The citizenship allowance is a concrete model of a conditional basic income that is financially designed as a negative income tax. It is tied to conditions that, in principle, only German citizens are entitled to it if they have their habitual residence in Germany and have not been convicted of offenses under tax, labour or social security law. Citizens’ money is a modified form of “solidarity citizens’ money”, which was first presented to the public by the former Thuringian Prime Minister Dieter Althaus in 2006 and has been continuously developed since then.[25]

Components

The citizenship money model has two components (Tab. 1). A tax reform with a two-tier tax on all income and the introduction of the citizenship allowance of 500 euros per month for every German citizen from birth to death. The citizenship allowance covers the socio-cultural subsistence level (today Hartz IV or social welfare). The socio-cultural subsistence level guarantees every person those material prerequisites that are essential for their physical existence and for a minimum level of participation in social life. The citizenship allowance is referred to as a partial basic income due to its purely livelihood security structure.

| Two-tier income tax

|

Citizenship money

|

| Uniform tax rate of 25 percent on all income up to 250,000 euros per year or 20,833 euros per month and 50 percent tax rate on all income above 250,000 euros per year. | 500 euros per month for every German citizen from birth to death. At a tax rate of 25 percent, this corresponds to a basic tax allowance of 2,000 euros per month or 24,000 euros per year. |

Income tax and the citizenship allowance are two sides of the same coin. The income tax obligations are offset against the citizenship allowance. If your income tax is above a certain limit, no citizenship allowance will be paid out. If you are below this limit or have no taxable income, you will receive a state transfer in the form of a negative income tax (formally a tax credit).

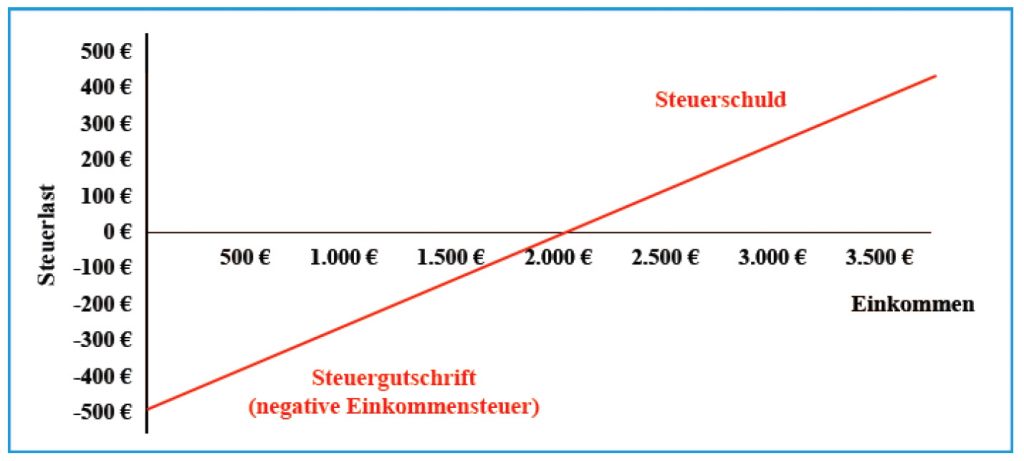

Diagram 1. shows: If the monthly income is less than 2,000 euros, a citizenship allowance is paid out; If the monthly income is over 2,000 euros, income tax must be paid.

Regardless of how high the income is, the tax relief effect is always 500 euros per month for every recipient of citizenship.

Sample calculations

In the following (Tab 2.)., some specific income situations are used to illustrate the effect that citizenship money would have. To ensure clarity, the examples do not take into account any social security contributions, additional needs (e.g. the cost of accommodation), solidarity contribution and church tax. The comparative calculations were carried out for examples A-E with tax class I and for F with tax class IV.

| A | Monthly income: 0 euros

Income tax: 0 euros (25 percent on 0 euros) Citizenship allowance: 500 euros Tax difference +500 euros (tax advance) Net income: 500 euros (0 euros + 500 euros) |

Net income so far:

424 euros (Hartz IV after application) |

| B | Monthly income: 400 euros

Income tax: 100 euros (25 percent on 400 euros) Citizenship allowance: 500 euros Tax difference +400 euros (tax advance) Net income: 800 euros (400 euros + 400 euros) |

Net income so far:

424 euros (after Hartz IV addition) |

| C | Monthly income: 2,000 euros

Income tax: 500 euros (25 percent on 2,000 euros) Citizenship allowance: 500 euros Tax difference +0 euros Net income: 2,000 euros (2,000 euros + 0 euros) |

Net income so far:

1815 euros |

| D | Monthly income: 4,000 euros

Income tax: 1,000 euros (25 percent on 4,000 euros) Citizenship allowance: 500 euros Tax difference -500 euros (tax rate of 12,5 percent) Net income: 3,500 euros (4,000 euros – 500 euros) |

Net income so far:

56,796 euros |

| E | Monthly income: 100,000 euros

Income tax: 44,791 euros (25 percent on 20,833 euros and 50 percent on 79,167 euros) Citizenship allowance: 500 euros Tax difference -44,291 euros (tax rate of 44,5 percent) Net income: 55,709 euros (100,000 euros – 44,291 euros) |

|

| F | Family

Mother Monthly income: 1,200 euros Income tax: 300 euros (25 percent on 1,200 euros) Citizenship allowance: 500 euros Tax difference +200 euros (tax advance) Net income: 1,400 euros (1,200 euros + 200 euros) Father Monthly income: 2,000 euros Income tax: 500 euros (25 percent on 1,200 euros) Citizenship allowance: 500 euros Tax difference 0 euros Net income: 2,000 euros (2,000 euros + 0 euros) Child 1 Citizenship allowance: 500 euros Net income: 500 euros Child 1 Citizenship allowance: 500 euros Net income: 500 euros

Net family income: 4,400 euros

|

Net family income so far: 3,401 euros (1,178 euros + 1,815 euros + 204 euros + 204 euros) |

The examples show that there is a strong relief effect especially with low and middle incomes. Families in particular benefit from citizenship allowance. Further examples can be found at www.staatsbürgergeld.de.

Citizenship money bundles many of today’s tax-financed social transfers and thus contributes to a massive reduction in bureaucracy. For example: the social benefits Hartz IV, basic security in old age and reduced earning capacity, social allowance, social assistance, financial aid for students (BAföG), vocational training allowance, parental allowance, housing allowance, child allowance, etc., which results in savings of billions by reducing bureaucracy.

Special features

Additional needs for disabilities, need for care, costs of accommodation etc. can, as before, also be applied for after an official means test. The citizenship allowance can also be combined with the well-known social insurances (Tab. 3).

| Pension insurance

|

Unemployment insurance | Health insurance

|

Care insurance

|

| Additional needs after means test | |||

| Citizenship money | |||

Budgetary financing

If one uses the national accounts, the data of which serve as the basis for expert reports, growth forecasts, tax estimates and pension adjustments, the introduction of the citizenship allowance would lead to an annual surplus of around 11.7 billion euros. A detailed calculation follows in the next section.

Citizenship money is a slightly modified form of solidarity citizenship money, which was first publicly presented by the former Thuringian Prime Minister Dieter Althaus in 2006 and has been continuously developed since then (Althaus model).

The main difference to the solidarity citizen allowance is that the citizen allowance is only granted to German citizens. Foreign nationals (including EU citizens) with the right of permanent residence in Germany are not entitled to the citizenship allowance. Otherwise, massive immigration into our social system would be expected. Social benefits to this group of people are made – as before – after an official means test.

It is conceivable that integrated foreigners with permanent right of residence can acquire a citizenship allowance if they have earned taxable income in Germany for ten years and were thus able to earn their living without state help or the help of third parties. This would be a strong incentive to integrate into our society.

The following proof of the financial viability of the citizenship allowance is based on the calculations for the solidarity citizen allowance.

Government expenditure

For the sake of simplicity, it is assumed that the citizenship allowance is paid out to the entire population. With this simplification, the gross costs can be calculated well. One multiplies the gross citizen allowance expenditure per inhabitant and year (500.00 euros x 12) by the number of inhabitants:

82,2 million citizens x 6,000 euros per annum = 496,8 billion euros

Government revenue

The government revenue can also be shown well: The national income in the Federal Republic of Germany totalled 2.34 trillion euros in 2016. Most of the national income is subjected to a so-called flat tax, a 25 percent uniform income tax. Only with annual income of over 250,000 euros is an income tax of 50 percent payable on income over 250,000 euros. This dual flat tax leads to gross income tax revenues of 730 billion euros.

| 438.4 billion euros (25 percent income tax on income under 250,000 euros per annum)

+ 292.3 billion euros (50 percent income tax on income above 250,000 euros per annum) |

| =730.7 billion euros gross income tax in the citizenship money model |

Proof of financial feasibility

From this you have to deduct a good 290 billion euros, which the state now collects through wage tax, assessed and non-assessed income tax, flat tax, corporation tax, as well as increased and normal trade tax apportionment.

| 184.3 billion euros in wage tax

+ 52.9 billion euros income tax + 19.4 billion euros of unassigned income tax +5.7 billion euros withholding tax + 23.5 billion euros in corporate income tax +4.0 billion euros in trade tax apportionment +3.4 billion euros higher trade tax allocation |

| = 293.2 billion euros of previous tax revenue lost |

If all citizens receive citizenship benefits, the benefits that the state currently finances will become superfluous. This means that all expenses that previously had to be paid for unemployment benefit II, social benefits, child benefit and the child allowance, parental benefit, basic security in old age and financial support for students (BAföG) are eliminated – a total of over 70 billion. euros. The bottom line is that more than 220 billion euros in tax revenue that is missing due to the elimination of previous taxes has to be offset.

| 293.2 billion euros in foregone tax revenue

– 710.0 billion euros in foregone social benefits |

| = 222.2 billion euros |

If one subtracts the foregone tax revenues that are no longer included in the citizenship allowance concept – such as the old wage and income taxes, etc. – from the gross revenue from income tax of 730.7 billion euros, one arrive at the amount, which is left for financing the citizenship money: over 500 billion euros.

| 730,7 billion euros gross income tax

– 222,2 billion euros |

| = 508,8 billion euros |

If one subtracts the gross expenditure of the citizenship money from the revenue that the new income tax brings in – after deducting the taxes that are no longer necessary and offsetting the expenditure that is no longer necessary – the result is a slight surplus of over 10 billion euros.

From this it can be seen: Citizenship money can be financed.

Effects and opportunities

More security and freedom despite automation and digitization

The citizenship allowance simplifies reorientation in every phase of life – be it due to personal interests or changed requirements on the job market. It reduces the consequences of a loss of earnings unbureaucratically and effectively. Professional failure or a job loss as a result of digitization and automation do not endanger the existence. Citizenship money will give many people a greater sense of security. Only those whose existence is materially and socially secure can act freely and independently.

Better adaptability in times of technological change

Citizenship allowance enables employees to reduce their working hours at any time for further training or to temporarily stop working. Above all, it creates incentives and opportunities for low-wage earners to adapt to the changes in an increasingly digital world of work through qualification measures. Incentives for lifelong renewal and expansion of what has been learned are to be assessed positively not only from an individual but also from a macroeconomic perspective – especially in times of rapid devaluation of old knowledge and skills.

Sustainable financing of the welfare state

Digitization leads to an increase in labour productivity and value creation. Fewer people create more value with the help of new technologies. Only allowing the added value to flow to the owners of these technologies leads to a widening gap between labour and capital income. With the citizenship money model, the entire income is taxed equally at the source, from the first to the last euro. Civil servants, the self-employed as well as investment income, interest, dividends, rental income, etc., as well as the wages of the employees or the company profits achieved with robots and value creation on the Internet, are included in the solidarity obligation. This is how the welfare state can be financed sustainably.

Security of existence in old age

The citizenship allowance is paid out to all German citizens over the entire lifespan. Thus, a minimum living wage is guaranteed even in old age. Regardless of how high the individual statutory old-age pension is, every beneficiary is entitled to the poverty-proof citizenship allowance without a means test. Additional needs due to illness and care can also be applied for. Income poverty and the renunciation of social benefits out of shame, fear, ignorance or excessive bureaucracy – as can often be observed in older people – are a thing of the past with the citizenship model.

Noticeable relief effect for low and average earners

The citizenship allowance has a tax relief effect of 500 euros per month for each recipient. Taxes only have to be paid to the state if one has an income of EUR 2,000 or more per month. Employees in the low-wage sector benefit particularly strongly from this.

Hartz IV will be abolished

The citizenship money will replace unemployment benefits II (Hartz IV), as the socio-cultural subsistence level will be secured through the negative income tax. The abolition of Hartz IV also overcomes the social degradation and exclusion of the unemployed.

Appreciation for all forms of work

The citizenship allowance as a guaranteed subsistence level enables the coexistence and cooperation of different forms of work over different phases of life. It offers financial recognition and thus appreciation for forms of work that preserve society beyond traditional gainful employment. All those forms of care work and voluntary work, without which a society cannot survive, and which are unpaid or underpaid in today’s welfare state, are put on a secure income basis with the citizenship money.

Guaranteed higher family income

Families win in particular from the citizenship allowance model. Adults and children receive the citizenship allowance in the same amount. Thus, the household income per child rises from the current 204 euros to 500 euros, so that a family of four has a monthly net minimum income of 2000 euros. Family work is rewarded, i.e., parents can take more time for their children – without having to fear for their own existence. The family and demographic policy effects of the citizenship allowance are positive.

An opportunity for rural areas and structurally weak regions

Citizenship money can help stabilize rural areas by breaking the vicious circle of declining investment, business relocation, job loss and emigration. The threatened village culture and way of life could be revived if everyone would bring the citizenship money to where they want to live and build an existence with like-minded people. The citizenship allowance increases the purchasing power in rural areas by means of income security and thus ensures economic prospects.

Massive reduction of bureaucracy in the social benefit system

Citizenship money bundles many of today’s tax-financed social transfers and thus contributes to a massive reduction in bureaucracy. For example, the social benefits Hartz IV, basic security in old age and reduced earning capacity, social allowance, social assistance, financial aid for students (BAföG), vocational training allowance, parental allowance, child benefit, child allowance, etc. result in savings in the billions by reducing bureaucracy.

Work and performance are worth it again

With its high deductions of up to 90 percent in the additional earnings of Hartz IV recipients, today’s social system takes the incentive for the transition from unemployment to work. In the case of citizenship money, on the other hand, only the uniform tax rate of 25 percent applies. Those who work improve their income situation from the first euro and regardless of the income level. Against this background, a decline in undeclared work is also to be expected. Citizenship benefits follow the principle of fairness through performance: those who work are much better off than the unemployed.

Simple and transparent tax system

The citizenship money model is the long-awaited liberation for our complicated and non-transparent tax system. It combines tax simplification and tax transparency by introducing a two-tier income tax on all income. The relief effect of the exemption in the amount of the subsistence level applies equally to all taxpayers. In addition, the performance principle is strengthened, especially in the lower income bracket, and tax loopholes are effectively closed. In short: Citizenship money is a one-stop tax and transfer system.

Simple and transparent tax system

The citizenship money model is the long-awaited liberation for our complicated and non-transparent tax system. It combines tax simplification and tax transparency by introducing a two-tier income tax on all income. The relief effect of the exemption in the amount of the subsistence level applies equally to all taxpayers. In addition, the performance principle is strengthened, especially in the lower income bracket, and tax loopholes are effectively closed. In short: The citizenship money is a one-stop tax and transfer system.

Frequently asked questions

Who gets the citizenship allowance?

Every German citizen with habitual residence in Germany is entitled to the citizenship allowance from birth. For children, it is transferred from the tax office to their parents and replaces child benefit and child allowance. Foreign nationals (including EU citizens) with the right of permanent residence in Germany are not entitled to the citizenship allowance. Otherwise massive immigration into our social system would be expected. Social benefits to this group of people are made – as before – after an official means test. It is conceivable that integrated foreigners with permanent right of residence can receive a citizenship allowance if they have earned taxable income in Germany for ten years and were thus able to earn their living without state help or the help of third parties. This would be a strong incentive to integrate into our society. It would also be possible that beneficiaries who have been convicted of offenses under tax, labour and social security law lose their entitlement to the citizenship allowance.

Will people stop working after the introduction of citizenship?

One can’t make big leaps with citizenship money. It just covers the socio-cultural subsistence level. Numerous surveys show that with a basic income of this level, hardly anyone would stop working. On the contrary, through high tax and contribution rates and deductions of up to 90 percent for additional earnings by Hartz IV recipients, individual motivation is regularly nipped in the bud. A Hartz IV recipient who earns an additional 900 euros may only keep 260 euros of this at the end. On the other hand, he has 675 euros (900 euros less 25 percent income tax) left with the citizenship allowance. So work is worth it again. Nevertheless, there are uncertainties as to how the citizenship allowance will affect people’s motivation and behaviour in general. It would therefore be advisable to test such models first in the form of manageable pilot projects.

What about the citizenship recipients who have higher needs?

With the citizenship allowance, many of the social benefits granted today are no longer applicable because they will be combined in a lump sum in the future. This applies to Hartz IV, social assistance, social benefits, basic security in old age and in the event of reduced earning capacity, training grants, child benefit, child allowance, childcare allowance, parental benefit and many other social security benefits. If there is an additional need in individual cases despite citizenship allowance, this can also be granted in the future after an individual means test by the responsible social authorities. This includes, for example, integration assistance for the disabled, assistance with care and incapacity for work, costs of accommodation and similar social assistance benefits.

What happens to the amount of citizenship money when inflation rises?

The citizenship allowance is intended to secure the socio-cultural subsistence level. Therefore, it has to be adjusted regularly to the development of the actual cost of living. As with the current Hartz IV standard rate, the amount of the citizenship allowance could also be adjusted to the current price development.

Is the citizenship money eligible for a majority?

Surveys that specifically relate to citizenship money do not exist. However, there are a number of current opinion polls on basic income. According to this, a narrow majority of Germans are positive about the idea. According to a representative INSA survey from June 2018, 51 percent of respondents are in favour of introducing a basic income. Among AfD voters, this figure is even 53 percent.

Will it take away the interest of the youth in work training or studying?

Counter-question: Do young people and young adults only learn today because they are forced to do so? No, the opposite is true. Despite financial dependence on parents, long journeys, low training allowances, tedious BAföG bureaucracy or a necessary part-time job to finance the educational project, a large part of the young generation is completing an apprenticeship or studying. The citizenship allowance enables financially independent learning and study, but it does not prevent anyone from doing so. Last doubts can be dispelled by trying out citizenship money in manageable model tests.

Is the citizenship money socialist in nature?

A main feature of socialist societies is the control of the economy through central planning. The historical findings show: State socialist systems have put political and economic power in one hand – that of the state. Private ownership of the means of production was more or less abolished. The means of production themselves were nationalized. Socialism is also a long way from the free development of the individual. In the case of the citizenship money model, however, property and the market economy remain untouched. In fact, the citizenship money means more equality, but by no means equalization. It’s about real equality of opportunity through a livelihood security. For the individual, this means more freedom and less coercion. Citizenship money is therefore exactly the opposite of socialism.

Does the citizenship allowance lead to higher wage costs?

If people don’t have to take badly paid or unhealthy jobs out of fear to secure their existence can lead to higher wage costs. But what speaks against it? If low wages are due to the necessity of having to pursue activities in order to survive that nobody really wants to do, the income from labour is privatized, but the consequences are socialized. Chronic illnesses, burn-outs and (permanent) incapacity to work cause immense follow-up costs for those affected – as well as for the economy as a whole. That is neither socially nor economically desirable.

If everyone receives a guaranteed income, will prices go up?

Citizenship benefits guarantee poorer households in particular a higher disposable income. Critics fear higher consumer spending, which will lead to higher prices. It can be countered that the citizenship allowance is based on the socio-cultural subsistence level. This is already granted to low-income households in the form of Hartz IV, social assistance or basic security in old age and in the event of reduced earning capacity. The specific effects that citizenship money has at least on local price formation can only be answered by implementing appropriate model tests.

Can the citizenship allowance be financed?

Citizenship money is financed through income tax, whereby all forms of income (e.g. gainful employment, self-employed work, rents, dividends, added value through robots and on the Internet, etc.) are taxed. Furthermore, many of today’s more than 100 social benefits will no longer applicable because they are combined in the citizenship allowance. This will reduce bureaucracy. In short: the citizenship allowance is affordable.

***

The previous sections have shown that the German welfare state has reached its performance limits. The social, societal and economic framework conditions have changed too much. An eternal “business as usual!”, as we know it from the established parties, not only results in a further loss of political confidence in the efficiency of our democracy, but also in increasing social insecurities in ever larger parts of society.

The citizenship money model presented here with negative income tax and other forms of basic income are an answer to the changed social and economic framework conditions. They open up enormous opportunities in a world that is changing rapidly and demands more adaptability from its citizens than ever before. Of course, new models of the welfare state also harbour risks and uncertainties. The question of whether the opportunities outweigh the risks cannot be conclusively answered with thought models and mathematical simulations alone. A responsible way out of this dilemma is practical testing in the form of pilot projects that are limited in time, space and personnel.

A study commission of the German Bundestag should precede or accompany such model tests to deal with basic income models and the fundamental reform of the tax and social system. Study commissions are inter-factional working groups that are supposed to solve extensive and important issues in which different legal, economic, social or ethical aspects have to be weighed up.

Policy recommendations:

- The further development of the German tax and social system should be placed on the federal political agenda.

- A study commission of the German Bundestag should deal with new social security models such as the citizenship allowance, negative income tax and other basic income models.

- In the second and twelfth book of the German Social Security Code, a statutory opening clause should be introduced which opens up the possibility for the federal and state governments to carry out pilot projects with which new social security models, such as citizenship allowance, negative income tax or similar basic income models, can be scientifically tested and rated.

Notes

[1] Institut für Arbeitsmarkt- und Berufsforschung (2018). IAB-Kurzbericht 4/2018, Substituier-barkeitspotenziale von Berufen. S. 7. URL: https://bit.ly/2S9vIuk

[2] INGDIBA (2015). Die Roboter kommen. Folgen der Automatisierung für den deutschen Arbeitsmarkt; S. 2 ff. URL: https://bit.ly/2DLX6uv

[3] World Economic Forum (2018). The Future of Jobs Report; S. VIII. URL: https://bit.ly/2xeWN7e

[4] Institut für Arbeit und Qualifikation der Universität Duisburg-Essen (2018). Arbeitsstunden pro Jahr je Erwerbstätigen 1960-2017. URL: https://bit.ly/2lGOCfH

[5] Bertelsmann Stiftung (2018). Deutscher Weiterbildungsatlas; S. 4, 10. URL: https://bit.ly/2Rc1oiu

[6] Bertelsmann Stiftung (2018). Wie hat sich die Einkommenssituation von Familien entwickelt? S. 16 f. URL: https://bit.ly/2RdMqIM

[7] Deutscher Bundestag (2018). Schriftliche Fragen mit den in der Woche vom 9. Juli 2018 eingegangenen Antworten der Regierung Drs.-Nr. 19/3384; S. 89. URL: https://bit.ly/2zsQ0Yy

[8] Institut für Arbeit und Qualifikation der Universität Duisburg-Essen (2018). Empfänger von Grundsicherung im Alter und bei Erwerbsminderung 2003-2017. URL: https://bit.ly/2TIibex

[9] Deutsche Rentenversicherung (2018). Rentenniveau. URL: https://bit.ly/2AitEZv

[10] Institut für Arbeitsmarkt- und Berufsforschung (2013). IAB-Kurzbericht 5/2013, Simulationsrechnungen zum Ausmaß der Nicht-Inanspruchnahme von Leistungen der Grundsicherung; S. 8 ff. URL: https://bit.ly/2BvU0cu

[11] Butterwegge, C. (2003). Aktivierender oder aktiver Sozialstaat? URL: https://bit.ly/2DKppcJ

[12] Hans Böckler Stiftung (2011). WSI-Mitteilungen 8/2011. Von der Regel zur Ausnahme – Strategien gegen die Prekarisierung der Arbeitsbedingungen; S. 430 ff. URL: https://bit.ly/2QhSi6t

[13] Hartz4.DE – Ratgeber rund um ALG 1 & 2 (2018). Hartz-4-Zuverdienst – was Sie zu den Freibeträgen wissen müssen. URL: https://bit.ly/2zrX4F7

[14] OECD (2018). Taxing Wages 2018, OECD Publishing, Paris; S. 11f. URL: https://bit.ly/2FjoP2t

[15] Institut der deutschen Wirtschaft (2013). Städteboom & Landflucht. URL: https://bit.ly/2QlKsZC

[16] Siems, D. (2014). Junge Menschen ziehen massenhaft in die Metropolen. WELT.DE. URL: https://bit.ly/2sOzhMT

[17] Müller, H. (2018). Demokratie in der Demografie-Falle – Landluft macht unfrei. SPIEGEL ONLINE. URL: https://bit.ly/2PQhBNL

[18] Voßkühler G. (2018). Die unsichtbare Arbeit in Deutschland ist eine Billion Euro wert. WELT.DE. URL: https://bit.ly/2QdeQ8H

[19] Statistisches Bundesamt (2016). Entwicklung der unbezahlten Arbeit privater Haushalte; S. 35, 39 f. URL: https://bit.ly/2HIFn5A

[20] Institut für Arbeit und Qualifikation der Universität Duisburg-Essen (2018). Sozialleistungsquote 1960 -2017. URL: https://bit.ly/29XhbAr

[21] Bundesministerium für Arbeit und Soziales (2018). Sozialbericht 2017; S. 196 f. URL: https://bit.ly/2P5XCWc

[22] Milatz, M. (2018). Wie steht es um die Gerechtigkeit in Deutschland? NDR.DE. URL: https://bit.ly/2DKsxFv

[23] Knop, C. (2018). Unsere Steuererklärung ist viel zu kompliziert, FAZ.NET. URL: https://bit.ly/1NGDK3V

[24] Deutscher Bundestag (2018). Bedeutung und Ausmaß der Steuervermeidung anhand von Steuervermeidungsmodellen; S. 19. URL: https://bit.ly/2SeD7IP

[25] Thüringische Landeszeitung (2017). Die Idee vom solidarischen Bürgergeld lässt Dieter Althaus nicht los. URL: https://bit.ly/2QlRm0Y

*Translated from the original publication into English by Yuri Kofner.