_ Dr. Ulrich van Suntum, formerly University of Münster, former Secretary-General of the German Expert Council for the Assessment of Overall Economic Development (SVR). 3. September 2021.*

Introduction

The task of the present paper is to introduce a new idea for organizing global decision-making in view of various, simultaneously existing global threats. Among the most severe challenges there are global warming and other environmental damages, war and terrorism, re-emerging protectionism, and resulting international refugee streams.

Current global institutions like the UN and the WTO are obviously overstrained by tackling all these challenges, not at least because their limited scope and commission. The present paper proposes a new approach for making global contracts, mainly based on the Coase-theorem (Coase 1960; Acemoglu 2003). In particular, it is argued that combining several, normally unrelated issues to a bargaining bundle could facilitate Pareto-efficient contracts that benefit all, even including future generations.

For this ends, a new institution called Global Protection Agency (GPO) is suggested that should be organized quite similar to the WTO, however with a much larger scope of competences.

The paper is organized as follows:

(1) In the first section, we outline our general approach of tackling clashes of national interests without a supra-national government existing. In particular, we argue that, is such a situation, incentives are far more powerful than rules, particularly because the latter can and will be broken. We also state a theorem of radical subjectivism: According to this theorem, not the “objective” threats and benefits do really count, but the only relevant issues in negotiations are the subjective fears and hopes which are related to them. Moreover, as opposed to the general opinion, we argue that a multitude of problems does not necessarily hamper their solution. On the contrary, it is just the variety of issues which often allows for mutually beneficial agreements by the way of giving and taking.

(2) In the second (and main) section we present a simple, but yet powerful theoretical model in order to demonstrate how mutual beneficial agreements can be achieved even in seemingly hopeless cases of international conflict. The model is based on widely known economic principles and ideas such as the Coase theorem, the compensation and equivalent compensation ideas by J.R. Hicks, and the general theory on externalities and public goods.

(3) The third part of the paper applies this model to the global conflicts issue. In particular, we propose to establish a Global Protection Organization (GPO). It should be based on a General Agreement on Global Protection (GAGP) and be equipped with a Global Protection Agency (GPA) which has the main mission to identify, initiate, and facilitate a system of mutually beneficial agreements and contracts. We propose an incremental development of these institutions, as it has proved successful with the GATT resp. the WTO.

The paper builds on a broad literature on property rights and rational decision making in the presence of externalities, such as Schelling (1960), Bucahanan/Tullock(1962), Demsetz (1967), McKelvey/Page (1999), and Libecap (1989). The underlying model is explained in more detail in the appendix, also a respective excel-sheet can be provided by the author on demand.

1. Some basic propositions for the general approach

In this section we briefly outline the basic ideas of the present paper. At first sight, our ambition may sound utopian: Are not the global conflicts so numerous and severe, that even solving one of them would nearly border a miracle? Indeed, many global problems are yet unsolved. On the other hand, however, we do not at all start at zero, and considerable progress has already been made in some respects. For example, protectionism has been fought quite successfully by the GATT resp. the WTO for a long time at least, until the wind has changed in recent years. There is also remarkable progress in combating starvation, extreme poorness, and the shelter of rare animal species. Even the environment is much better protected now in most countries than it was some decades before, although much is left to do on this issue of course. Hence, although there are severe problems unsolved yet, global government has not been completely unsuccessful in the past.

Thus, in order to make further progress, it appears reasonable to build on proven principles and ideas rather than searching for a silver bullet. In particular, economics provides a number of useful tools and insights which we will employ below. For example, a general economic conviction is that incentives do normally better than laws. The ultimate reason is that incentives make use of the selfish interest of people, while laws frequently are opposed to them. Hence, international contracts should look for mutually advantageous rules with minimum incentives to deviate. History offers an endless number of examples, that internationally binding contracts have been violated or simply disregarded when their observance appeared no longer opportune. Therefore, we need incentives that make it profitable for every player to stay with the game. In other words: Adam Smith`s invisible hand theorem should be adopted to the global conflicts issue by working out an appropriate international bargaining scheme.

By definition, whenever there is a genuine interest, there is also the willingness to offer something for it in reverse. This can be exploited to arrange mutually beneficial contracts.

Moreover, solving two or more problems is not necessarily more difficult than dealing with just one of them, because additional problems also afford additional options for arrangements. For example, while poor countries normally seek to increase their wealth, wealthy countries put more weight on improving the environment and maintaining their safety. Hence, the rich can bribe the poor for being more ecological and peaceful, thereby creating a net benefit for both of them.

Gross sums in such a collective bargaining approach may be huge, but net transfers may nevertheless be relatively small. In particular, the more issues are handled simultaneously, the easier mutually beneficial contracts can be found without the need of outstanding net financial transfers. It is also important to note that not the physical goods and bads do really matter in bargaining, but only the subjective perceptions of their relevance. Hence, negotiations need not be based on “genuine” physical impacts, but on their subjective evaluation by those who benefit or suffer respectively. For example, for international bargaining it does not really matter if CO2 contributes to global warming or not. On contrast, it is sufficient that some people believe in such a connection, because this makes them willing to pay for respective reductions.

2. A simple bargaining model

In this section we employ a simple bargaining model based on the well-known Coase theorem (Coase, 1960; Medema/Zerbe 1995). According to that theorem, even with negative or positive externalities, an efficient allocation is possible even in the absence of any superordinate authority, provided respective negotiations between the relevant agents are possible. Because no global government exists, the Coase theorem is of particular interest concerning global conflicts.

2.1. The general model

Leaving all formal details to the appendix, we confine us to the case of only two countries 1 and 2 for the moment (which we will then extend to three or more countries). Each country has a production capacity Y1 and Y2 respectively, that can be used to produce two different kinds of goods (or, more generally, activities):

- Good X is a home-good, which has no impact on the other country at all.

- Good Z is an internationally relevant good, the use of which generates some externalities to the other country, either positive or negative.

Thus, while the people in country 1 can only chose X1 and Z1, their welfare W1 depends also on the volume of Z2 which is out of their control, and vice versa. For our numerical examples below we choose a most common formalization of welfare in economics, which is the Cobb-Douglas-Utility function:

W1 = X1a Z1b Z2g resp. W2 = X2a Z2b Z1g a;b < = 0 |g| £ 0

We assume α + β =1, so we have linear homogeneity of the welfare function as far as those goods are concerned which are commanded by the country itself. In contrast, γ can have any value and be either positive or negative. In particular:

- With γ > 0, we have a positive externality. For example, Z could then be an animal protection program operated by one country which is also appreciated by the other country.

- With γ < 0 , we have a negative externality. For examples, Z could then be an activity of one country which causes greenhouse emissions and is thus disliked by the other country.

- With γ = 0 , there is no externality by Z and it thus is a home good like X for the respective country.

As was already noted, the variables X and Z in our welfare function do not represent physical quantities but subjective values which are given to them by the respective country. For example, after the Tsunami-disaster in Fukushima in 2011, the German government changed their assessment concerning the danger of nuclear plants and decided to abolish them all. This happened although the danger of a Tsunami is totally absent in Germany and, hence, nothing had really changed in physical terms. However, public opinion had changed rapidly, and this is what lastly determines both political action and the preparation to bear the respective costs. Therefore, it is also the relevant issue for our purpose.

As a consequence, welfare W in the function above (or utility, as it is usually called in economics), is a entirely subjective concept, which cannot be measured empirically. Nonetheless, it is a most useful theoretical concept for deriving and explaining both the sign and the amount of money which a country would be willing to sacrifice in order to change the behaviour of the other country. This so-called “willingness-to-pay” was invented by J.R. Hicks into welfare economics. It is thoroughly determinable and can thus be employed for our bargaining scheme, as will be demonstrated later.

Moreover, it need not necessarily be defined in monetary terms, but can also mean the readiness to offer any change in one`s own behaviour as an offset.

For simplicity, we generally assume that a, β and b have the same value in all countries. This allows us to isolate the effects of differing externalities (along with different income Y) which is in our main focus. Thus, in contrast we allow for asymmetry in both Y and γ between the two countries. In particular, it is well possible that country 1 generates negative externalities at the cost of country 2 (i.e. γ2 < 0), while country 2 does not generate any (or even generates positive) externalities to country 1 (i.e. γ1 ≥ 0). Indeed, such asymmetries are prevalent in the real world and thus relevant for our purpose.

On the supply side, we assume a linear (“Leontief-“) production function where the costs of producing Z are normalized to unity, while the costs of producing X are b per unit. Thus, formally we have

Y1 = b1 X1 + Z1 resp. Y2 = b2 X2 + Z2

We also assume that country incomes Y1 and Y2 are defined in equal terms, i.e., in a common currency (or in two currencies the exchange rate of which is unity). Indeed, we will later propose that the so-called special drawing rights could serve as such a common currency in practice.

With the help of this simple model, we can now derive a number of important issues that a global bargaining scheme would have to take into account. In particular, we postulate the following propositions, which are all derived from well-known economic principles:

- Inefficiency of externalities: Whenever there are international externalities (i.e., direct impacts of one country on the welfare of other countries), purely autonomous decisions of each country generally create an inefficient allocation of income.

- Coase theorem: With (international) externalities being present, there always are incentives for mutually beneficial contracts which lead to an optimal allocation of income.

- Marginal principle: Generally, the optimal solution does not require total elimination of harmful activities. They should rather be reduced only to that level where the global willingness to pay for a further reduction just equals the welfare-loss which that would cause in the country of their origin.

- Compensation payments: An efficient internalization scheme generally requires some compensation payments from one country to another. However, the required net compensation transfers are normally much lower than the total value of externalities and can even be zero.

- Pareto-improvements: Generally, there are many efficient solutions with different distributions of welfare. However, every voluntarily concluded contract will leave each country involved at least with its previous level of welfare.

2.2. Conflicts between only two countries

(1) We start with the simplest case, where both countries have equal income Y at the beginning. As was stated above, we generally also assume that α, β, and b are identical for them as well. In particular, in the following examples we generally assume α1 = α2 = β1 = β2 = 0.5 and b1 = b2 = 2.

Nevertheless, in the autonomous state, the level of welfare W will differ between the two countries, if the “externality parameters” γ1 and γ2 are unequal. Moreover, even with γ1 = γ2 ≠ 0, we will have an inefficient situation because the mutual externalities are not taken into account by the autonomous country-decisions.

As an illustration, suppose Y1 = Y2 = 100 and γ1 = γ2 =| -0.25, i.e., we have mutual negative externalities. For example, Z could be an activity like car driving that emits CO2 and thus contributes to global warming. Even if people in both countries were fully aware of the resulting danger, they would nevertheless keep on car driving at a certain extent, because with β > 0 it also generates a certain utility for them.[1] However, they do not regard the worries of people in the respective other country in their decisions and, hence, the level of car driving will be too high in both countries. This “international market failure” can only be healed by either any global authority, which enforces a better allocation in both countries, or by a mutual agreement between the two countries (which is our proposal here).

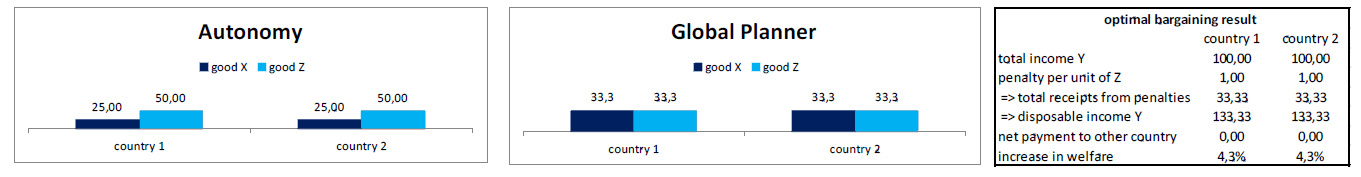

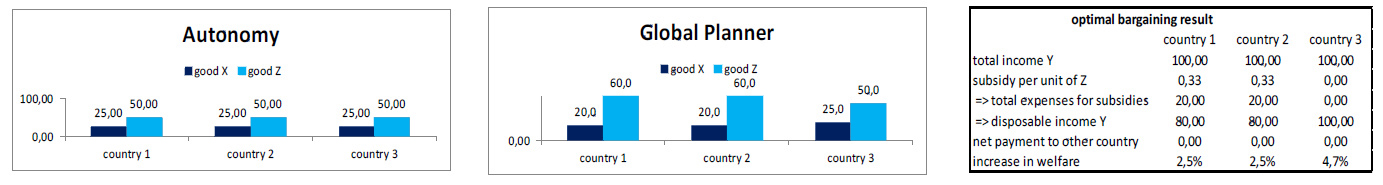

In our numerical example, autonomous maximization of national welfare W yields the allocation in the left-hand side of Figure 1. Relatively much is consumed of the externality good Z in both countries, because its price is only half the price of the home good X.[2]

In contrast, a both omniscient and fair global planner would advise both countries to reduce the noxious good Z in favour of X to the extent which is shown in the middle part of the figure. Welfare would then increase in both countries by 4.5 percent because of the reduced global CO2 emission, which is the maximum equal increase that is possible with the parameter values assumed above.

Unfortunately, however, there is no global planner. Even if he would exist, he would certainly not know about the exact welfare and production functions of both countries and, thus, fail to find the ideal solution. Moreover, a global planning agency would hardly have the power to carry it through.

Hence, we are only left with the Coase option of a voluntarily concluded contract. Ideally, this would generate exactly the same solution that an omnipotent global planner would choose, but on a totally voluntary basis. In our example, both countries would have to agree to impose a penalty on activity Z , e.g. a carbon tax. The table on the right-hand side of the figure shows the ideal penalty rate, which is unity in our example in both countries. Although the tax receipts (of 33.33 respectively) increase disposable income, this scheme creates an incentive to consume less Z , because its price has increased from formerly pz = 1 to now pz = 2 (including the penalty). The result is exactly the same allocation of resources as it would be chosen by a benevolent and omniscient global planner.

In other words, the voluntary contract has internalized the international externalities that have formerly failed to be recognized by each country. As a result, welfare increases in both countries (by 2.5 percent). Because everything is symmetrical in this example, this would not even require any net transfer between the two countries, as can be seen from the table in Figure 1.

Note that, although welfare W itself cannot be measured directly, the increase in welfare can thoroughly be both interpreted and measured in a straightforward way. In particular, we can employ the concept of an equivalent variation (EV) which was invented by J.R Hicks. The EV is here defined as that increase in total income Y of the country that would generate the same increase in welfare (with the original level of externalities) as the contract does. Because we have assumed linear homogeneity of the welfare function (i.e. α + β =1), the required increase in Y is the same as the increase in welfare W is. In other words: The contract in our example is equivalent to an increase in total income of 2.5 percent for each country.[3]

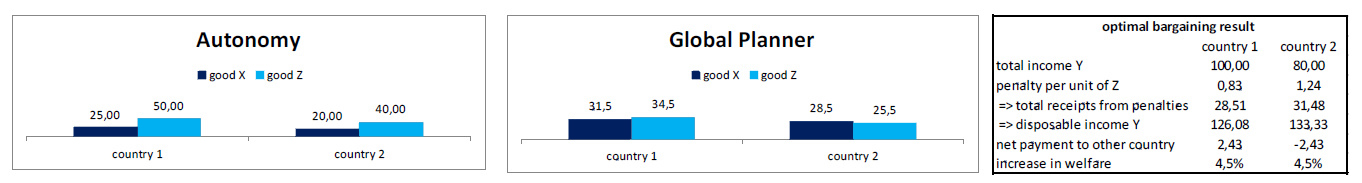

(2) If country incomes differ from each other, with mutual negative externalities the optimal contract generally requires a net payment from the richer to the poorer country (see the table in Figure 2). Moreover, the optimal penalties per unit of Z are then no longer equal. Surprisingly, the penalty must be higher in the poorer country and lower in the richer. This can be explained intuitively by the higher value that people in the richer country attribute to the externality (just because they are richer). For example, in a wealthy region like Western Europe more weight is given to environmental issues than in a poor region like e.g., China, where they are more concerned with increasing material wealth still.

Nevertheless, this does not at all mean that the poorer land is worse off in this contract. In contrast, including the net payment from the richer country to the poorer, both countries enjoy the same increase in welfare in the end (which is again 4.5 percent in our example). Note that the net transfer is much less than the sum of penalties (that represents the value of externalities internalized).

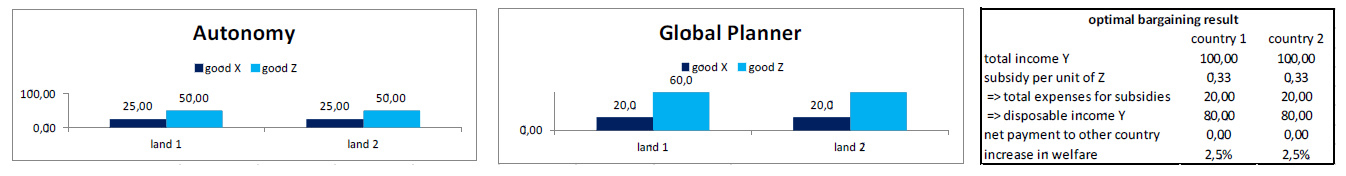

(3) Things are quite similar in the case of positive externalities. For example, let Z be an activity like coast protection that benefits both countries, with γ1 = γ2 = 0.25. Then, with equal incomes Y1 = Y2 = 100 again, we get the results shown in Figure 3.

Now the level of Z is too low with purely autonomous decisions in both countries, so we need a subsidy instead of a penalty per unit in order to increase it to its optimal level respectively. As a result, disposable income is now lower than total income, because the subsidies must be financed from the latter.

As the table in Figure 3 reveals, everything is symmetrical again with equal incomes. No net payments between countries are implied, and again they both enjoy an equal increase in welfare due to the internalization of the (now positive) externality.

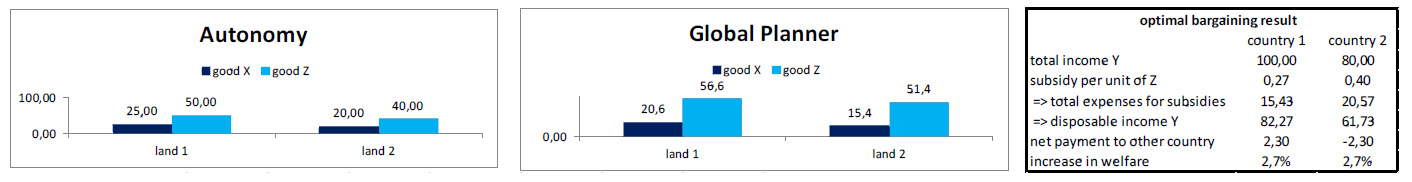

(4) Finally, we take a look at the case with positive externalities (γ1 = γ2 = 0.25) and differing country incomes (see Figure 4).

Like in the case with negative externalities, the optimal subsidy is higher in the poorer land for the reasons given above. On the other hand, with unchanged assumptions otherwise, we need again a net payment from the richer country to the poorer one. Thus, we have the interesting result that the richer country must pay irrespective of whether the mutual externalities are positive or negative. Nevertheless, with this solution, again both countries lastly enjoy the highest possible equal increase in utility, which is 2.5 in this example.

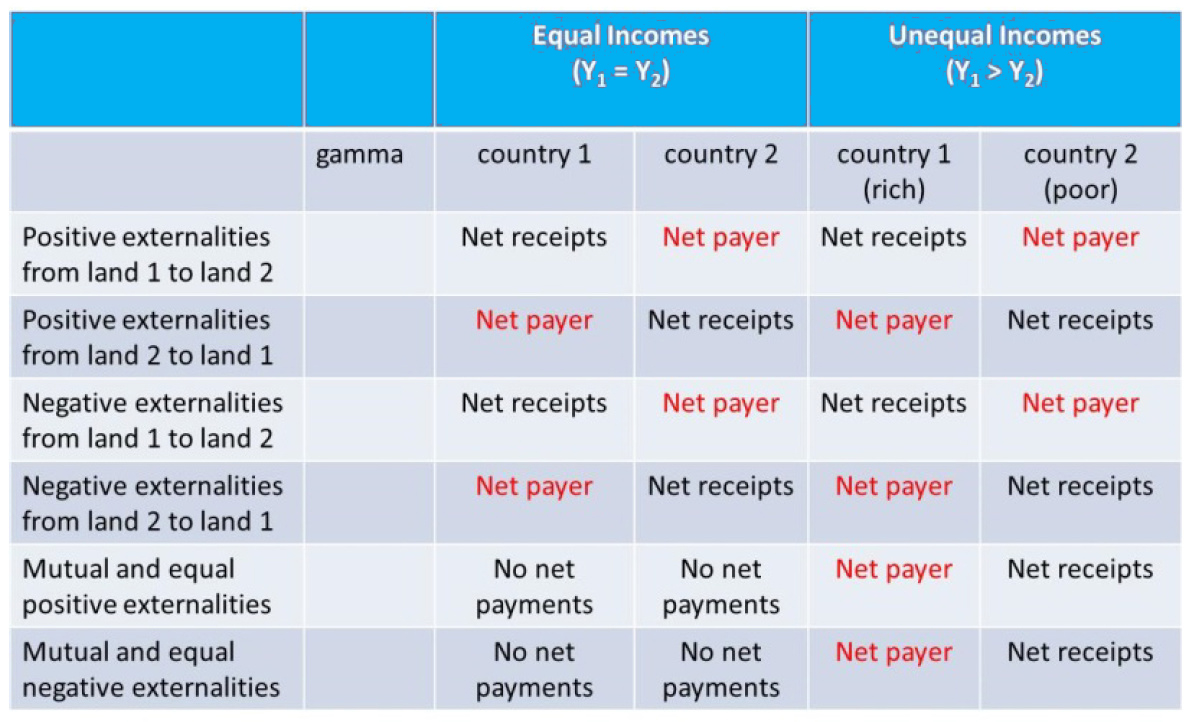

(5) Many other cases are conceivable, e.g. zero externalities of one country with (either positive or negative) externalities of the other, or negative externalities from country one to country 2 and positive externalities in reverse. Table 1 gives an overview for the assumptions made above.

All of these cases can also be analysed with differing parameters in both the national welfare functions and the respective production functions. We cannot go further into detail with that here but only resume that mutually beneficial contracts are always possible. Normally they imply transfers from the richer to the poorer country, although some would require the opposite, as the table reveals. Note that this has nothing to do with justice or any other normative issue, but simply results from the fact that the contract must be beneficial for all parties.

2.3. Conflicts between more than two countries

With more than two countries being involved, the same ideas can principally be applied, with only two reservations:

- The transfer scheme gets more complex, because transfers made by one country do no longer automatically equal the receipts gained by the other.

- A moral hazard problem arises, because some countries could refuse to cooperate hoping that they can benefit as a free rider from the efforts made by other countries.

In particular, the second point is frequently objected to the Coase theorem, which has been originally demonstrated for the two-party-case only, so we have to tackle it here. Related literature is e.g. Dixit/Olsen (2000) and Holmström/Nalebuff (1992). We do that by introducing a third country, which has equal welfare and production functions like the other two, but takes a free rider position.

For example, let country 3 do not generate any externalities itself, but be affected by the Z-activity of country 2. Formally, we assume the same welfare functions for country 1 and country 2 as above, while welfare of the additional country 3 is given by

W3 = X3a Z3b Z2g

Again, depending on the sign of g, the impact of country 2 on the welfare of country 3 can be either negative or positive. Let us assume the latter, i.e. an increase in the Z-activity of country 2 does not only benefit country 1 but also country 3. An example could be aid payments made by country 2 in order to mitigate extreme poverty in the third world, which are welcomed by the other two countries too (i.e. both γ1 and γ3 have a positive sign). As a numerical example, we assume γ1 = γ2 = γ3 = 0.25 and otherwise equal parameters for all countries like above with equal incomes Y1 = Y2 = Y3 = 100

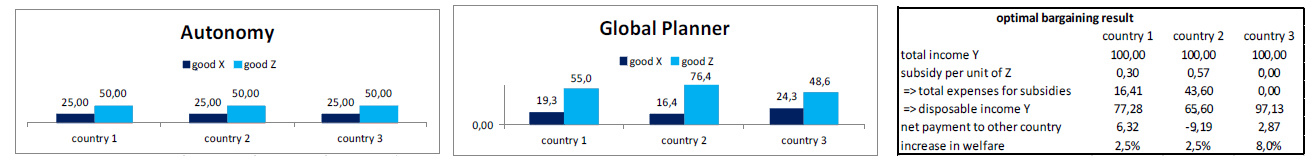

If country 3 takes the free-rider position and the other two countries cooperate, we get the results shown in Figure 5. As far as the cooperating countries are concerned, everything is the same as in section 2.1 (3):

Both countries increase their level of Z at the cost of their home good X and increase thereby their welfare by 2.5 percent each. This is again the solution that a global planner would realize as well if he ignored the existence of country 3 (see the middle part of Figure 5). However, now country 3 is benefited as well, although it does not contribute anything. Moreover, its increase in welfare of 4.7 percent is even higher than in the cooperating countries. Obviously, this is a misdirecting incentive that seems to jeopardize the whole bargaining idea.

Fortunately, however, even in this case there exists a voluntary compensation scheme that does not only generate an overall efficient solution but is beneficial for all three countries as well. Suppose that countries 1 and 2, after having realized their optimal bilateral contract, seek to get country 3 involved as well. For this purpose, they must offer country 3 a contract that is more beneficial for that country than keeping the free rider position. As can be seen in Figure 6, this is definitely possible without losing any welfare themselves: While the welfare gain of country 3 is now 8.0 percent instead of only 4.7 percent, countries 1 and 2 enjoy still the same welfare increase of 2.5 percent as opposed to the autonomous situation.

Interestingly, country 3 gains although it is now a net payer and, thus, can consume less of its own goods X3 and Z3 respectively. However, this is more than compensated by the further increase of Z2 (which means more aid payments by country 2). Countries 1 and 2 also gain from that and, in addition, from the net payment that country 3 now contributes.

This result is not at all by chance or an exception. On the contrary, it can be generalized to all conceivable constellations and with a voluntarily chosen number of countries. The reasoning is very simple: Whenever a potential free rider has a genuine interest in affecting an externality (either positively or negatively), he must also have a respective willingness to pay for its change by definition, principally at least. This in turn implies that he has an incentive to bribe the already cooperating partners to further increase (resp. reduce) the externalities which he is affected by.

Because he will do this only to the extent where his own welfare is at least equal to the free rider position, there must necessarily exist a solution that benefits all, q.e.d.

The only exception to this lemma could be a “digital” externality good, i.e., a good that cannot be varied in quantity for technical reasons and is thus either exists or does not. Examples could be a dam or a nuclear power plant the benefits resp. hazard of which is independent from its size. Hence, once the dam or plant is built, the free rider would have no incentive to voluntarily contribute to its funding. Fortunately, such examples are rare in the global context. In contrast, most externality goods like environment protection, fighting poorness and disease, or disarmament can be varied to voluntarily chosen levels. Hence, each potential free rider can significantly affect their volume and thus has an incentive to get involved.

Note that an equal increase in welfare for all participants is not the only conceivable efficient outcome of the bargaining process. Indeed, every outcome where no party is worse off than before can emerge, depending on the bargaining power and tactical skills of those who are involved. Obviously, all kinds of tactics and strategic behavior can and certainly will be observed. However, according to the Pareto-principle, which is the core of welfare economics, all of these outcomes are equally efficient, although with differing distributions of welfare.

Hence, the only remaining problem is how to organize the bargaining process in practice. A frequently argument raised against the Coase theorem says that the respective transaction costs were prohibitive. This is surely true for a purely private solution, because normally too many parties are involved. Moreover, monitoring compliance would also be a serious problem.

These problems are much less aggravating, however, in the global context. This is because we then have a manageable number of countries only, and not all of them are actually pivotal. For example, a comprehensive green-house gas commitment between the EU, China, and Russia would already be a huge success. Similarly, preventing or ending regional wars does ordinarily require only the commitment of a countable number of actors.

Hence, there is much more room for auspicious bargaining processes than in the private economy. In the next section, we propose to implement a Global Protection Organization (GPO) that could launch and support international bargaining processes as a both neutral and competent agent

3. Design of a Global Protection Organization

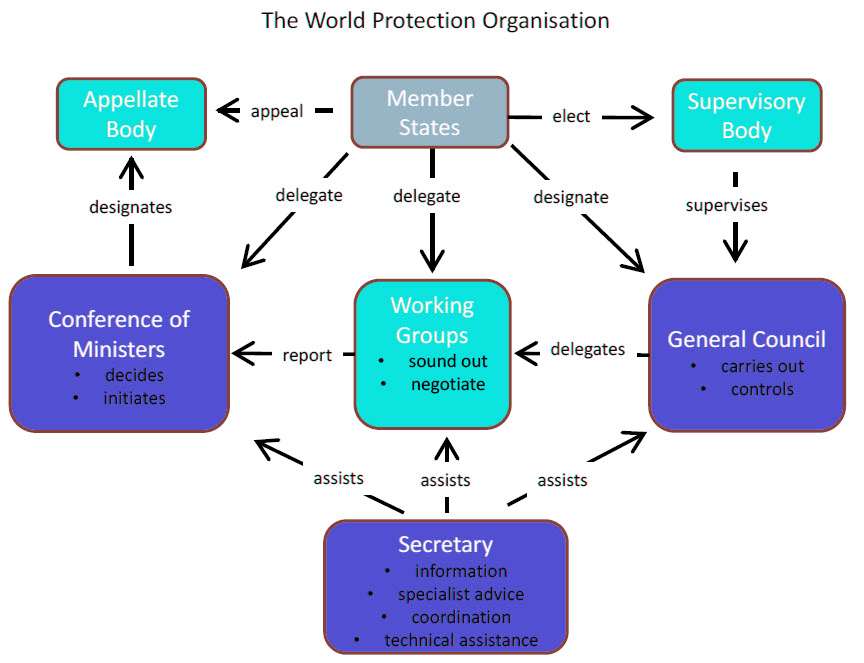

In this section, I propose to establish a Global Protection Organization (GPO) that is organized similar to the World Trade Organization, although with some substantial differences.

The WTO emerged from the General Agreement on Tariffs and Trade (GATT) in 1995 and is located in Geneva, i.e., in a neutral country, for more details see e.g. Krueger/Aturupane (2000), Guzman (2004) and Hoekman/Kostecki (2009). The GATT still exists under the roof of the WTO, along with two other agreements called GATS and TRIPs, one of which is on services, the other on property rights.

The GATT is a multilateral contract aiming to liberalize international trade. It started with only 23 nations in 1947. By and large, it was a tremendous success story, in particular in the first decades after World War II. In eight negotiation rounds, tariffs and other protectionist measures could be substantially reduced and global trade volume grew by far more than GDP of the countries involved.

Moreover, the number of signatories constantly increased and reached 128 at the end of 1994. The WTO has even 164 member countries today (2016). In the past 50 years merchandise exports grew on average by 6 percent annually, which was much more than GDP-growth. The average tariff applied dropped from around 50 percent in the 1930s to only 9 percent among the WTO members today.

Indeed, with more and more members and issues, making further progress has become increasingly harder meanwhile. Nevertheless, in total the GATT/WTO bargaining approach has proven a tremendous success story. (This is true independent of the assessment of free trade per se.)

The WTO also acts as a conflict arbitrator in bilateral international trade issues. For that purpose, the Dispute Settlement-Body (DSB) was established, which consists of representatives of all member states. The latter does also apply to the other two organs of the WTO, which are the Conference of Ministers and the General Council. As a rule, each member state has one vote, and decisions are mostly made in consent. There is also a WTO secretariat with 250 staff members, which serves as an advisor as well as an administrator.

For our purpose, the DSB is of particular interest. Since 1995 there have been 491 disputes, of which 28 percent could be resolved in an early stage by amicable settlements after all. In the other cases, generally a panel of experts is convened, who must decide on the ground of existing contracts similar to a state court. Appeals of the defeated party are also possible and are then submitted to the Appellate Body, which consists of seven members which are appointed for four years respectively.

The GPO should be based on the model of WTO/GATT concerning the following aspects:

- It should be located at a neutral place, ideally in Geneva as well.

- Membership should be voluntary and grow gradually, until ideally most nations are involved.

- The GPO should tackle both bilateral and multilateral conflicts resp. contracts.

- Member states should be represented by ministers on the decision level and by senior officials on the working level (General Council).

- There should be a secretariat equipped with high potential diplomats, scientists, and lawyers, whose task is to moderate conflicts and to draw up and monitor respective commitments.

However, the GPO should also differ from the WTO in some respects:

- There should be no ideological bias or specific normative mission of the GPO at all. Its only targets should be enhancing the solution of conflicts and the creation of mutually beneficial agreements among the member nations. This makes the GPO a trustworthy mediator even for states with highly conflicting ideologies and interests.

- The GPO should not be focused on a limited range of issues (like international trade) but be open to handle international problems and conflicts of all kinds, explicitly including the mixture of different issues with each other. This approach offers new bargaining options which could not be found by an isolated proceeding as it is mostly customary now.

- The General Council should consist of country-emissaries who, once being appointed, are independent from their home-government as far as possible. To that end, they should be irrevocably nominated for six years at least. After that time, not their home-country but the secret vote of their colleagues in the General Council should decide whether their mandate is prolonged for another six years (or any shorter time). This gives them an incentive to cooperate instead of narrowly serve the interests of their home country only.

- Generally, there need not be consent among all member countries. In contrast, consensus must be found, and decisions must be made only among those states which are directly involved in the respective issue. Thus, contracts generally need neither be negotiated nor be approved by the whole Conference of Ministers but are concluded by smaller meetings of the representatives of those nations which are directly involved. However, the GPO can at any time decide whether it supports a contract or not. Such decisions are normally left to the General Council unless a certain quorum in that Council raises any objection. In that case, the issue must be decided by the Conference of Ministers. Generally, decisions in both bodies should be made by the simple majority rule.

- Apart from the coverage of GPO-operating costs, member states should be free concerning their contributions (either financial or of other kind). However, once made, a contribution cannot be withdrawn again. Should a member state break a contract, it will ordinarily be punished by reducing or withdrawing its benefits or receipts from other contracts. This possibility is one of the advantages of subsuming different issues under one contractual roof: The more issues a country is involved in, the stronger are the incentives to honour their commitments. Ultimately, a nation which does not stand to their liabilities can also be excluded from GPO-membership.

The budget for the operational costs of the GPO should be funded by the member states, proportionally to their GDP. All funds and transfers should be defined in terms of a currency basket as defined in the special drawing rights (SDR) used by the IMF.

As was argued in the theoretical part of this paper, efficient contracts will ordinarily also require some net financial transfers. For this purpose, respective financial resources are needed. However, we do not propose that these should be under the exclusive control of the GPO only. Following the ideas of our theoretical model, the assignment of financial resources should be as follows instead:

- Each member state maintains full control over the transfer resources which they have contributed for any contract. However, these resources can neither be withdrawn again nor be used for any project of (or in) the respective country itself. For example, suppose Europe and Indonesia pay in 10 billion euros each. Then they are not allowed to finance any own project. However, they could use these funds in a reciprocal way. For example, Europe could pay Indonesia 10 billion euros for reducing the deforestation of rainforests, while Indonesia pays Europe the same sum for liberalizing their imports from that region. Apparently, the net transfer is then zero, so one might ask if that does make sense at all. However, as we have argued in our theoretical model, it actually does. This is because, although no money has ultimately been flowing, both countries now do things which benefit the other and which they otherwise wouldn’t have done. Such agreements – with or without any net transfers – are exactly what we want.

- Generally, transfers can be used to finance or co-finance any project in another region, for example for fighting poorness in Africa. As we have argued above, if there is a genuine interest of a state to improve things, there is also a respective willingness to contribute, so the free-rider position is not the best option for that country. As a consequence, with wise mediation by the GPO, it can be expected that many commonly financed projects will be generated which would not have materialized otherwise.

- Transfers are payed off not by the country of their origin, but by the GPO. This gives the GPO the power to delay or even revoke payments in case of any breach of contracts. Moreover, arbitrary refusal of payments can thereby be prevented. Sanction decisions should require the approval of both the harmed countries and the GPO, with the latter being represented by the majority of the General Council. There should also be an appellate body which is organized like in the WTO.

- If transfer payments have been contributed by one country but, for any reason, cannot be used for the purpose which they have originally been provided for, they stay with the GPO as a credit balance of the respective country.

3.1. Practical work of the GPO

Concerning its practical work, the GPO allows for different ways to proceed:

- Orders: One or more countries (or another international organization like the UN) appeal to the GPO for tackling a certain issue, e.g., concerning global warming.

- Mediations: Some countries ask the GPO to help them finding a solution for a certain conflict (e.g., concerning the flow of refugees)

- Proactive initiatives: The General Council develops ideas for tackling or combining issues, and then approaches the respective countries.

- Larger Programs: The conference of ministers adopts an agenda, which is then executed by the General Council.

Note that all of these instruments can combine completely different issues, which could also be used in a way similar to triangular trade. For example, country 1 could reduce any threats against country two, while country 2 performs any environmental program which is in the interest of country 3, and country 3 liberalizes trade with country 1 as a reward. All what the GPO has to do is exploring and then wisely exploiting the self-interests of the respective parties for realizing a world which, in the end, is better for all of them.

In practice, a contract could for example develop in the following way: At their annual meeting, the Conference of Ministers decides to tackle the problems of starvation in Africa, global warming, and the flow of refugees to Europe and elsewhere. Then the General Council contacts international institutions which already deal with these issues, collects detailed information, and develops a possible plan. Coming next are informal talks with the relevant national agents including those which are not directly affected but nevertheless could be ready to contribute. Surely, there will not emerge a perfect global solution for all of these three issues in the end. However, it could turn out that there can be made some progress to a limited extent at least.

For example, the EU could be prepared to pay a considerable amount of additional development aid to African states which, in return, agree to effectively fight illegal immigration to Europe from their territory. In addition, perhaps some commonly implemented measures for CO2-reduction can be included in the agreement as well.

As has repeatedly been stressed above, in order to get good behaviour of people or nations, it is all about incentives in the end. Therefore, in the following we briefly summarize the GPO-merits in this egard. Concerning member nations, one might argue that contracts could – and actually are – concluded also without a new institution like the GPO. However, the GPO makes that easier and, thus, more likely to happen, because of the following reasons:

- Instead of having to create a platform for each new issue, with the GPO there already is one.

- Because of its informal structure with independent country representatives, both inhibitions and resistances for starting negotiations should be relatively low.

- The combination of different issues is much easier in the GPO than with bilateral negotiations at the department level.

In the language of economics, the GPO thus substantially reduces the transaction costs for efficient bargaining in the Coase-sense.

One could also ask why a country should give transfers to any other country in order to make them e.g., save CO2, instead of taking respective national measures themselves. The answer is very simple:

It is just because the respective costs differ a lot among countries. For example, it is much cheaper to save one ton of CO2 in Russia than it is in Germany. Thus, if the Germans are really interested in mitigating global warming, with a given amount of money they can achieve much more for that end in Russia than in their own country.

Moreover, a firm institution like the GPO puts more pressure on the nations to get involved than occasional conferences do. Ideally, being an active member of the GPO gets a matter of international prestige, if not a matter of course. The GPO could also regularly publish a list of contributions which have been made by the respective nations, either financial or non-financial, in order to increase the pressure.

Because everything is measured in SDR anyway in the GPO, they could even rename this currency basket e.g., in “Global Protection Points” (WPPs). By evaluating all projects in this artificial currency, the respective contributions can be both assessed and made comparable more easily.

However, incentives are also an important issue within the organization itself. Here we point to two features of our GPO-proposal that are both new and particularly promising in this regard:

- Concerning the General Council delegates, we actually have a “two keys principle”: While the nations can voluntarily chose their delegates, once appointed, the latter are quite independent from their home countries. This principle is borrowed from independent central banks like the former Deutsche Bundesbank or the ECB, where it is adopted as well. It gives the delegates both freedom and incentives to commit themselves for a good cause instead of being only lobbyists.

- Concerning the transfer payments, basically the same principle holds: While each nation is free to determine both the quantity and the intended purpose of the money they give, once funded, the resources can neither be withdrawn from the GPO nor be misused for their own benefit.

Likewise, the GPO cannot use this money for any other purpose than those which are confirmed by the donating country. Hence, we have again a two-keys-principle which gives all agents a strong incentive to reach an agreement.

As has been outlined above, there are also strong incentives for potential free-riders to get involved, even if they should not care about prestige at all, but only pursue their own interests. Turning these incentives into concrete contracts for the good of all is the main task of the GPO.

All in all the GPO is a pragmatic approach. Based on both sound theoretical grounds (in particular the Coase theorem) and decade long experience (in particular with the WTO), it could substantially contribute to make this world both safer and more sustainable.

Literature

Acemoglu, D. (2003), Why not a political Coase theorem? Social conflict, commitment, and politics. Journal of Comparative Economics 31, 620 – 652.

Buchanan, J. M., and Tullock, G. (1962): The Calculus of Consent. Ann Arbor, MI

Coase, R. (1960): The problem of social cost. Journal of Law and Economics 3, 1 – 44

Demsetz, H. (1967): Toward a theory of property rights. American Economic Review 57, 347 – 359

Dixit, A., and Olsen, M. (2000): Does voluntary participation undermine the Coase theorem? Journal of Public Economics 76, 309-335

Guzman, A. T. (2004): Global Governance and the WTO. Harvard International Law Journal 45, 303 – 351.

Hoekman, B.M., Kostecki, M.M. (2009): The Political Economy of the World Trading System. The WTO and Beyond. Oxford 3rd. ed.

Holmström, B., Nalebuff, B. (1992): To the raider goes the surplus? A re-examination of the free-rider problem. Journal of Economics and Management Strategy 1, 37 – 62.

Krueger, A.O., Aturupane, C. (eds.) (2000) The WTO as an international organization. University of Chicago Press.

McKelvey, R. D., Page, T. (1999): Taking the Coase theorem seriously. Economics and Philosopy 15, 235 – 247.

Libecap, G. D. (1989): Contracting for property rights. Cambridge

Medema, Steven G.,. Zerbe, R.O. Jr. (1995): The Coase Theorem. CRESP, Center for Research on Economic and Social Policy, University of Colorado at Denver.

Schelling, T.C. (1960), The Strategy of Conflict. Ann Arbor, MI

Notes

[1] We assume that β indicates the net effect of positive and negative effects of Z for the producing country.

[2] From the supply function it is easily derived that the price of Z is unity while the price of X is b.

[3] Alternatively, one could also employ the Hicksian compensating variation concept (CV). It is here defined as that decrease in total income, which would reduce the welfare increase of the contract to zero (i.e., just compensate it). It is (roughly) the same as the equivalent variation, but with opposite sign.

* The original publication together with the appendix can be found here: MPRA (2021).

One comment