_ Andreas Lichter; Max Löffler, assistant professor of economics, Maastricht University; Ingo E. Isphording, senior research associate, IZA; Thu-Van Nguyen; head of research data centre, Stifterverband; Felix Poege postdoctoral associate, Boston University; Sebastian Siegloch; head of research area “Social policy and Redistribution”, ZEW Mannheim; professor of economics, University of Mannheim. 29 January 2022. VoxEU.*

Studies have shown that targeted R&D tax incentives – such as tax credits for R&D spending – induce firms to conduct more R&D. However, little is known about the effects of general profit taxes on firm-level R&D spending and innovation output. This analytical note presents evidence from Germany that points to sizeable negative effects of increasing profit taxes on firms’ R&D spending and patents. However, slashing business tax rates may not be the most efficient policy instrument to spur innovation altogether.

In order to stimulate economic growth, policymakers and economists alike have long been interested in identifying the key drivers and obstacles of firm-level innovation (e.g. Akcigit et al. 2020, Aghion et al. 2021). In this context, the role of tax policies has received increasing interest over the last few years.

There exists a large set of well-identified studies demonstrating that targeted R&D tax policies – such as R&D tax credits, deduction possibilities or subsidies – indeed increase firms’ R&D activities (e.g. Dechezlepretre et al. 2016, Nguyen and Van Reenen 2016, Guceri and Liu 2019, Agrawal et al. 2020), even if parts of their responses are due to the relabelling of general expenditures to R&D spending (Chen et al. 2018, 2021).

In contrast to this large literature, little is known about the possible disincentive effects of general profit taxes, which – unlike R&D tax credits – are in place in almost every country. From a theoretical perspective, general profit taxes should have sizeable disincentive effects on innovative activity, as higher taxes reduce the after-tax returns on investment. Due to differences in deduction possibilities, this is particularly true when investments are financed via equity rather than debt – which frequently applies to R&D projects because investments carry high risks and lack collateral.

Optimal R&D tax policies should take into account both incentives via general profit taxes and targeted R&D credits or subsidies (Akcigit et al. 2021). Yet, to set optimal taxes, we need to better understand how firms react to general profit taxes in the first place. To date, the only available evidence is based on US data. Exploiting state-level variation in corporate and personal income taxation, Akcigit et al. (2022) show that higher taxes reduce the quantity and quality of innovations, as well as affect the geographic spread of innovative activities across the US.

Varying tax rates on business profits at the local level in Germany

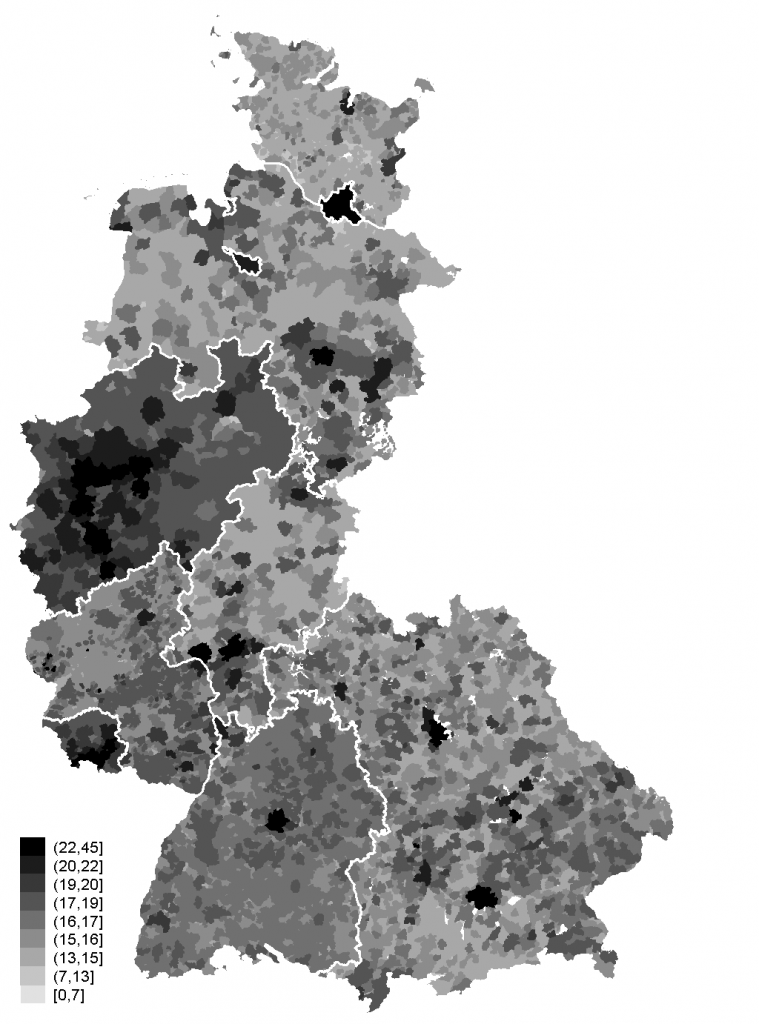

In our work, we aim to further fill this knowledge gap by empirically analysing the effects of profit taxation on firms’ R&D spending and innovation output (Lichter et al. 2021). We exploit the institutional framework of Germany, where municipalities independently set the local business tax rate that applies to (almost) all firms in their jurisdiction on an annual basis.1 Using around 7,300 local tax changes over 1987–2013 (see Figure 1 for cross-sectional and temporal variation in the German local business tax rate), we link the resulting variation in tax rates to detailed, geocoded panel data covering the approximate universe of all R&D-active plants in Germany.

Figure 1. Variations in German local business tax rate, 1987–2013

(A) Cross-sectional variation

(B) Temporal variation

The survey dataset forms the key basis for Germany’s official R&D reporting to EU authorities and the OECD and provides plenty of information about firms’ R&D activities. Among others, it allows the distinction of firms’ expenses on internally versus externally conducted R&D projects, or their spending on R&D staff and R&D materials.

To test whether tax-induced changes in R&D expenses affect innovation output, we further complement the survey data with annual information on the patenting activities of all surveyed plants from the European Patent Office.

To derive causal effects, we ultimately relate changes in plants’ R&D activities to changes in the applicable business tax rate over time, while flexibly controlling for common, time-varying shocks at the level of the federal states, commuting zones, and economic sectors in an event study model. The design is based on the assumption that – net of controls – tax changes are not systematically correlated with (trends in) local factors that also affect the outcomes of interest.

Small and insignificant coefficients for the treatment effect on outcomes measured before treatment in the event study support this assumption, as most confounding effects that violate the identifying assumption can be expected to show up as diverging pre-trends.2

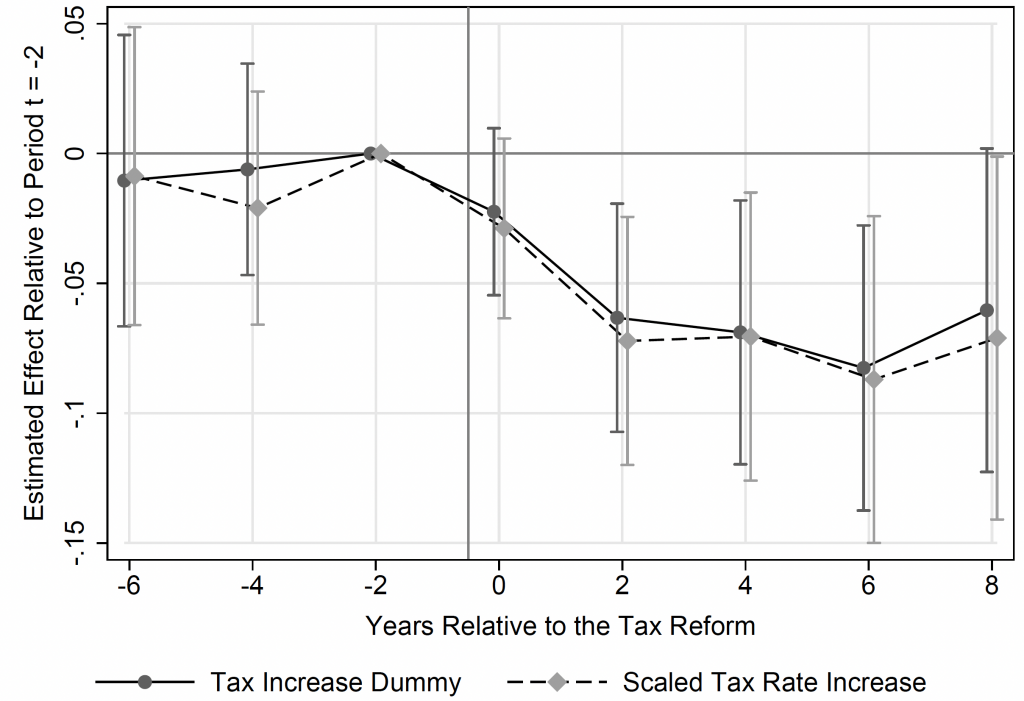

An increase in the local business tax rate reduces firms’ R&D spending and patents

Our estimates show that an increase in the local business tax rate has a statistically significant negative effect on plants’ total R&D expenditures (see Figure 2, Panel A). The effect builds up over time and is of sizeable magnitude: the long-term elasticity of R&D expenditures with respect to the business tax rate amounts to -1.25.

Interestingly, this negative R&D expenditure response appears to be entirely driven by reductions in internally conducted R&D. The scale of R&D activities that is outsourced to external partners/companies remains unaffected, which might be because of contractual arrangements that are costlier to alter at the margin.

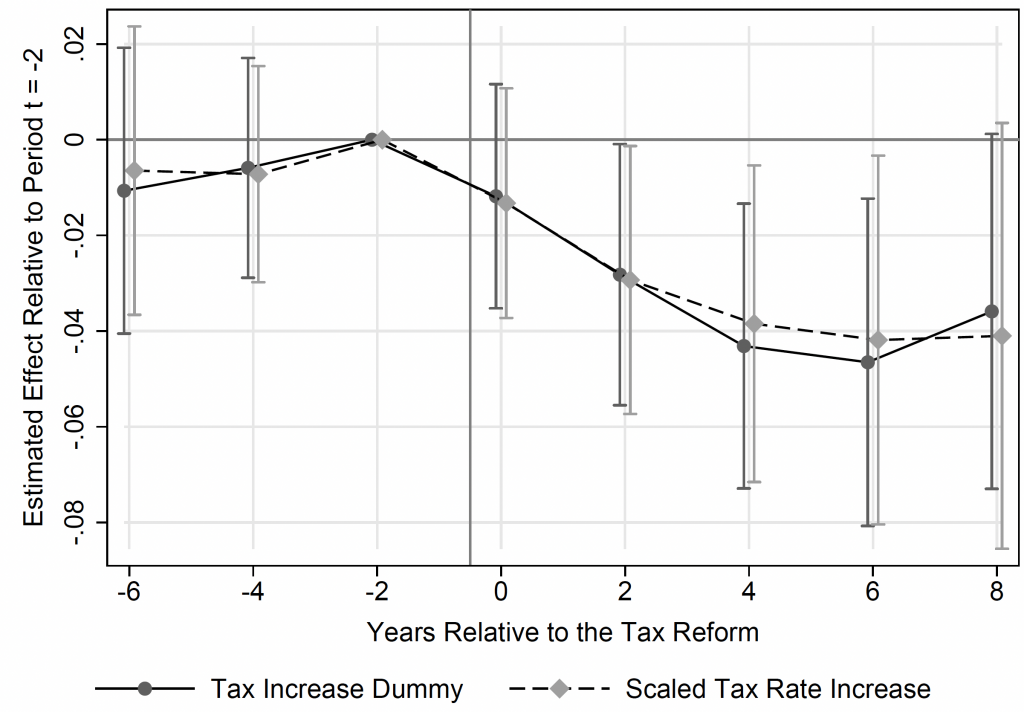

In line with our expectations, we further find that the tax-induced reductions in R&D expenditures are accompanied by lower innovation output (see Figure 2, Panel B). The corresponding effect on the citation-weighted number of patents is of sizeable magnitude, too. The long-term elasticity of filed patents with respect to the tax rate amounts to -0.9, a finding close to that of Akcigit et al. (2022).

Figure 2. Effect of local business tax rate

(A) On plant’s total R&D expenditures

(B) On innovation output

Notable effect heterogeneity across the distribution of R&D-active firms

The analysis further reveals notable effect heterogeneity across the distribution of R&D-active firms. Reductions in R&D spending are substantially stronger among plants that are credit-constrained (as approximated by their age and relative level of non-current liabilities) than those that are not.

We reconcile this finding with the institutional feature that the costs of debt financing can be deducted from a firms’ tax base whereas the costs of equity financing cannot, and the fact that liquidity-constrained firms need to rely on equity to a considerably higher extent.

In contrast, we do not observe heterogeneity by firm size, whether we split firms along their stock of employees or their sales volume. When facing a tax increase, firms cut R&D spending irrespective of their firm size.

Should politicians slash business tax rates to boost firm-level R&D?

The results of our study ultimately raise the question whether politicians should slash business tax rates to boost firm-level R&D and, consequently, economic growth. To answer this question, we calculate the cost-effectiveness of business taxes in raising R&D expenses. Our estimates imply that firm-level R&D spending increases by €0.34 for every euro of foregone local business tax revenues.

Notably, this cost-effectiveness estimate is rather low compared to similar estimates for targeted R&D tax incentives. For example, Dechezlepretre et al. (2016) and Guceri and Liu (2019) estimate that the UK R&D tax relief scheme generated around £1.0–1.7 of additional R&D spending for each pound of lost tax revenue.

We consider these differences in the cost efficiency to be plausible as changes in general business taxes also affect firms that do not innovate. Given that the share of those non-innovative firms is rather large, reducing profit taxes might be costlier than the implementation of targeted R&D tax credits altogether.

However, the results of our analysis question policymakers’ common practice of linking eligibility criteria for targeted R&D tax incentives to firm size, given that we do not detect stronger tax-induced reductions in R&D spending along the firm-size distribution. Size-based eligibility thresholds for R&D tax incentives may even cause unintended consequences: size-dependent R&D tax incentives may boost the expansion of relatively unproductive firms, which may mitigate firm selection and hinder aggregate economic growth in turn (Galaasen and Irarrazabal 2021).

References

Aghion, P, A Bergeaud and J Van Reenen (2021), “Regulation chills minor (but not radical) technological innovations”, VoxEU.org, 1 February 2021.

Agrawal, A, C Rosell and T Simcoe (2020), “Tax credits and small firms R&D spending”, American Economic Journal: Economic Policy 12(2): 1–21.

Akcigit, U, J Pearce and M Prato (2020), “Tapping into talent: Coupling education and innovation policies for economic growth”, VoxEU.org, 10 October 2020.

Akcigit, U, D Hanley and S Stantcheva (2021), “Optimal taxation and R&D policies”, Econometrica, forthcoming.

Akcigit, U, J Grigsby, T Nicholas and S Stantcheva (2022), “Taxation and innovation in the 20th century”, Quarterly Journal of Economics, forthcoming.

Chen, Z, Z Liu, J C Suárez Serrato and D Y Xu (2018), “How relabelling increases the fiscal cost of R&D incentives”, VoxEU.org, 28 August.

Chen, Z, Z Liu, J C Suarez Serrato and D Y Xu (2021), “Notching R&D investment with corporate income tax cuts in China”, American Economic Review, forthcoming.

Dechezlepretre, A, E Einiö, R Martin, K-T Nguyen and J Van Reenen (2016), “Do tax incentives for research increase firm innovation? An RD design for R&D”, CEP Discussion Paper 1413.

Galaasen, S M, and A Irarrazabal (2021), “R&D heterogeneity and the impact of R&D subsidies”, Economic Journal 131(640): 3338–64.

Guceri, I, and L Liu (2019), “Effectiveness of fiscal incentives for R&D: Quasi-experimental evidence”, American Economic Journal: Economic Policy 11(1): 266–91.

Lichter, A, M Löffler, I Isphording, T-V Nguyen, F Pöge and S Siegloch (2021), “Profit taxation, R&D spending, and innovation”, CEPR Discussion Paper 16702.

Nguyen, K-T, and J Van Reenen (2016), “Credit where (R&D tax) credit’s due”, VoxEU.org, 21 March.

Endnotes

1 Note that municipalities have no discretion over firms’ tax base. It is uniformly defined by the federal government.

2 See the accompanying paper for a more nuanced discussion about the identification of causal effects in the context of this analysis (Lichter et al. 2021).

* Republished from the original on VoxEU according to their copyright rules.