_ Prof. Dr. Thomas Jost, Faculty of Economics and Law, Technical University Aschaffenburg; Dr. Karl-Heinz Tödter, former director, Deutsche Bundesbank. Institute for Monetary and Financial Stability (IMFS). Frankfurt, 23 May 2022.*

Executive summary

Debt levels in the eurozone have reached new record highs. The member countries have tried to cushion the economic consequences of the corona pandemic with a massive increase in government spending. End of 2021 public debt in relation to GDP will approach 100 percent on average. There are various calls to abolish or soften the Maastricht rules of limiting sovereign debt. We see the risk of a new sovereign debt crisis in this decade if it is not possible to bring public debt down to an acceptable level.

Our new fiscal rule would be suitable and appropriate for this purpose, because obviously the Maastricht criteria have failed. In contrast to the rigid 3 percent Maastricht-criterion, our rule is flexible and it addresses the main problem: excessively high public debt ratios. And it lowers the existing incentives for highly indebted governments to exert expansionary pressure on monetary policy. If obeyed strictly, our rule reinforces the snowball effect and reduces the excessively high debt ratios within a manageable period, even if nominal growth is weak.

This is confirmed by simulations with different scenarios as well as with the hypothetical application of the new fiscal rule to eurozone economies from 2022 to 2026. Finally, we take up the recent proposal by ESM economists to increase the permissible debt ratio from 60 to 100 percent of GDP in the eurozone.

1. Introduction

How independent is the ECB today in its monetary policy decisions in view of the interests of highly indebted euro states? It is indisputable that the ECB today plays a very significant role in the financing of national sovereign debt. A recent ZEW study on the monetary policy conflicts in the ECB Governing Council sees the ECB under the threat of fiscal dominance (Heinemann/Kemper 2021).

With a current debt level approaching 100 percent of GDP, the 60 percent debt limit of the Maastricht Treaty is far away as ever before. In the first two decades of European Monetary Union (EMU), from 1999 to 2019, there was no progress in reaching this goal as sovereign debt in the eurozone did not fall but increased from 72 percent to 84 percent of GDP. Mainly due to the corona crisis sovereign debt in the eurozone has further increased strongly to a forecasted 99 percent end of 2021 (IMF 2021a). The Maastricht criteria and the rules of the Stability and Growth Pact (SGP) for limiting the increase in public debt were suspended during the pandemic. With a view to the post-corona period, the sustainability of public finances in all member states of EMU is of paramount importance to avoid a new sovereign debt crisis.

According to IMF forecasts economic output is likely to be only slightly negatively affected by the pandemic in 2022. The economies of the eurozone should grow strongly in 2022 (by 4.4 percent; IMF 2021a). It therefore makes sense to take the debt levels end of 2021 as a starting point in order to examine how sovereign debt could be reduced sustainably in coming years with a simple fiscal rule that we propose.

Limiting and reducing sovereign debt is a controversial issue. We give a brief overview of currently discussed reform proposals for fiscal rules in the eurozone (Section 2). We then discuss weaknesses of the Maastricht 3 percent – rule (Section 3). We contrast our criticism with a new deficit rule that is simple, transparent and controllable (Section 4). Our rule targets the excessive debt levels in the eurozone and mitigates the existing incentives for over-indebted member countries to exert expansionary pressure on monetary policy. With this rule sovereign debt levels can be reduced within a reasonable time even without stronger economic growth.

We develop two scenarios using our new deficit rule to show how member states can reduce their high sovereign debt ratios and contrast our results with the outcomes of adhering to the Maastricht 3 percent – rule (Section 5), followed by an empirical application of our rule to EMU for the years 2022-2026 (Section 6). Finally, we take up the recent proposal by ESM economists to raise the debt limit to 100 percent of GDP (Section 7). Section 8 concludes.

2. On the current discussion about fiscal rules

In a monetary union, binding fiscal rules are necessary because financial markets cannot offer sufficient protection against excessive fiscal policy. The Delors Report of 1989, which paved the way for European Monetary Union (EMU), followed this insight. The Maastricht Treaty (1992) therefore contained fiscal rules and the so-called “no bail out” clause (Gaspar and Amaglobeli 2019, p. 1f.).

The Maastricht 3 percent budget deficit ceiling is an important and probably still the crucial part of the reformed SGP (Jost/Tödter 2019). In fact, in the corrective part of the pact, an “excessive deficit procedure” is initiated. If the reference value of a budget deficit in relation to GDP of 3 percent is exceeded, the alarm bells will ring, in the media, in the public, and in the political process as well. When it comes to quantifying the failures of the fiscal rules in EMU, overshooting the 3 percent upper limit in particular is criticized.

The preventive arm of the SGP provides that the member states have a budget that is structurally balanced. However, the provisions of the pact contain many options for deviating substantially from this budget target in accordance with the rules, and the EU Commission has a wide margin of discretion in its assessment (Deutsche Bundesbank 2017a, p. 35 f., Wyplosz 2019). So far, no significant deviation from the planned adjustment path has been recorded for any eurozone country failing to meet the criterion in the preventive part – even if the structural deficit ratio had deteriorated further after it was exceeded (Jost/Tödter 2019).

In the EU, breaking the agreed budget rules is the norm, not the exception. In the period from 1999 to 2016, for example, there were 37 excessive deficit proceedings in the EU with violations in 203 event years, which corresponded to 48 percent of the observation period.

Only 3 out of 28 EU countries were never in a proceeding (Estonia, Luxembourg and Sweden) (Gaspar/Amaglobeli 2019, p. 3).

Over the past two decades, the number of countries around the world that have submitted to fiscal rules has increased significantly. Most countries have – similar to the eurozone – fiscal rules for government budget deficits and/or debt levels. In 2015, national or supranational fiscal rules applied in 92 countries (Gaspar/Amaglobeli 2019, p. 2). Research by the IMF and other research teams shows that the application of fiscal rules goes hand in hand with better fiscal performance. Countries with fiscal rules have, on average, lower budget deficits compared to countries without rules (Caselli/Reynaud 2019, Heinemann et al. 2018). Fiscal rules also prevent sovereign debt levels from increasing without limit as governments have more incentives to undertake appropriate countermeasures (IMF 2021b p. 29).

On the other hand, there have been various proposals calling for a rule specifically for government spending (spending rules) (Bénassy-Quéré et al. 2018, Fuest/Gros 2019, European Commission 2017, European Fiscal Board 2020). However, similar points of criticism apply to the spending rules as to the rules for achieving structural budget balances.

They are difficult to implement in political practice and offer many possibilities of circumvention (Caselli and Wingender 2018, Deutsche Bundesbank 2019, p. 82). They also depend heavily on uncertain forecasts about the development of profit-related taxes, changes in tax law, development on the revenue side and the enforcement of tax law.

In contrast to these proposals we argue that it is necessary to limit the size of outstanding government debt in relation to GDP: (1) Past crises (e.g. the eurozone sovereign debt crises) have shown that an economy is more vulnerable the higher its outstanding sovereign debt is. (2) In times of crises, fiscal policy has much more leeway with lower sovereign debt levels. (3) The emission of joint debt of the EU countries in response to the corona pandemic by Euro 1 trillion additionally increases the national debt in the eurozone. It is not included in the national debt figures but it increases the risk and overall debt burden of eurozone economies (Deutsche Bundesbank 2020). It could also open the door for future additional debt outside the national budgets and the Maastricht rules. (4) Official sovereign debt levels according to Maastricht rules exclude implicit government debt that will increase the future burden of eurozone economies due to population aging. (5) The strong increase in government expenditure in the eurozone in past 20 years, the major cause of the high debt levels, has not improved the performance and efficiency of governments. Smaller governments tend to do better in many cases (Schuknecht 2021). (6) Rule-based fiscal frameworks increase credibility and lead to lower funding costs even after a strong increase of public debt during economic crisis (European Fiscal Board 2021, p. 76).

3. The Maastricht rule and its weaknesses

The Maastricht Treaty and the corrective arm of the SGP oblige the participating countries of the eurozone to limit their annual budget deficit to a maximum of 3 percent of GDP.

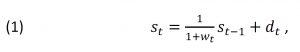

We have shown (Jost/Tödter 2019) that the 3 percent deficit rule is inconsistent. The main arguments are as follows. The Maastricht rule requires that the budget deficit (Dt) of a country in one year (t) according to the national accounts standards must not be greater than d* = 3 percent of the nominal GDP (Yt): Dt ≤ d* Yt. Gross national debt (St) must not exceed s*= 60 percent of GDP: St ≤ s*Yt. The debt level at the end of year t results from the accumulation of budget deficits: St = St-1 + Dt. The debt ratio st = St / Yt thus develops according to

where wt is the nominal GDP growth rate. Positive growth rates have a similar effect on the debt ratio as negative interest rates: with a balanced budget (Dt = dt = 0) the debt ratio drops almost automatically if the growth path remains stable, regardless of whether the growth is real, i.e. based on higher economic output, or whether it is due to increasing prices (inflation). This mechanism explains the desire of highly indebted euro countries for an expansionary monetary policy and more inflation. That may explain, but not justify, why the ECB has tried to stimulate inflation and nominal growth with its extremely expansionary monetary policy in recent years.

With a constant growth rate (w > 0), the debt ratio in the long term tends towards 𝑑 (1 + 𝑤)/𝑤 . Even with a growth rate of w = 5 percent, the 3 percent rule and a debt ceiling of 60 percent are inconsistent: the debt ratio tends to approach 63 percent in the long term. Debt reduction is very slow, even if the 3 percent limit is adhered to. With initial debt at 80 percent of GDP, the half-life of deleveraging is 18 years; that is how long it takes for the debt ratio to drop to 70 percent.

If nominal growth rates are high, there is at least a decline in the debt ratio. However, if growth falls below the critical level 𝑤𝑐𝑟𝑖𝑡,𝑡 = 𝑑𝑡/(𝑠𝑡−1 − 𝑑𝑡), the debt ratio continues to rise despite compliance with the 3 percent rule. With a growth rate of 3 percent, for example, it would increase in the long term from 80 percent to 103 percent of GDP. In order for there to be a decline in the debt ratio at all with a debt level above the 60 percent limit, i.e. (st < st-1), the nominal growth must exceed the above-mentioned critical level. The nominal growth at, e.g., s = 80 percent must be greater than 3.9 percent p.a. Slow economic growth was common in the eurozone, with annual average growth of nominal (real) GDP at 3.0 percent (1.3 percent) in the last two decades (ECB, Key Euro Area Indicators, 2021).

Let Zt be the amount of interest paid on the national debt (debt interest) by a country. The implied interest rate (it) is the average interest rate paid on all outstanding loans:

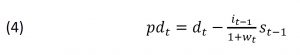

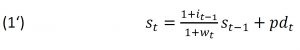

We define the primary deficit (PD) as the budget deficit reduced by the debt interest of the previous year:

![]()

The primary deficit ratio in relation to nominal GDP is:

The interest expenses are determined by borrowing in the past. In the case of the heavily indebted countries (HIC), i.e. those countries with a debt ratio above 60 percent, the upper deficit limit of 3 percent is binding. The primary deficit ratio thus expresses how large the remaining fiscal leeway is. With the primary deficit ratio (4), the equation of motion for the debt ratio (1) becomes:

This expression makes clear that the dynamics of the debt ratio largely depends on the interest-growth-difference (IGD). The IGD is the difference between the nominal effective interest rate on national debt and the growth rate of nominal GDP. With a primary deficit ratio of zero (pdt = 0), the debt ratio would decrease over time if the IGD is negative. The first term on the r.h.s. of (1’) is the so-called snowball effect. The snowball effect shows the influence of interest rates, real growth and inflation on debt levels – economic variables that cannot be controlled directly by policies in the short term. The snowball effect tends to reduce the debt ratio if the IGD is negative (more precisely, if the gross interest rate is lower than the nominal growth factor). In this favorable case, a country can even ‘afford’ a primary deficit (pdt > 0) in its budget and at the same time reduce its debt, provided the primary deficit ratio does not exceed this limit:

![]()

With an IGD of -1 percent and a debt ratio of 80 percent, the primary deficit ratio can be up to 0.78 percent of GDP. Note that the higher the debt ratio, the greater the snowball effect. On the other hand, in the case of a reverse snowball effect (i.e. when the debt interest rate is higher than the growth rate), the quasi-automatic reduction in the debt ratio no longer works; the snowball rolls uphill, so to speak.

4. The new deficit rule for fiscal policy in the EMU

We have developed a new deficit rule (Jost/Tödter 2019) according to six criteria: it should address the core problem of over-indebtedness, be withdrawn from the political evaluation process, preserve the sovereignty of states over their budgetary policy and be as simple, transparent and controllable as possible.[1]

Our rule is designed to reduce the debt ratio even when growth is weak. In the past, assumptions by the EU Commission and other forecasters on economic growth have often proved too optimistic.[2] According to our rule the permissible deficit is tied to the debt criterion. The link between monetary and fiscal policy via debt interest is broken. This eliminates the existing false incentives to push for an expansionary monetary policy instead of implementing structural and institutional reforms in one’s own country.

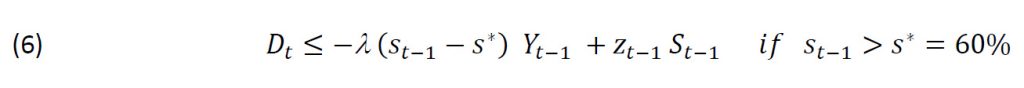

Our proposed rule is based on debt overhang and debt interest. It stipulates that HIC[3] must reduce in each year a fixed fraction λ (0 < λ <1) of the debt overhang from the previous year:

In (6), zt-1 is a policy instrument variable that, if chosen appropriately, decouples the primary deficit from monetary policy:

![]()

By setting 𝑧𝑡−1 ≡ 𝑖𝑡−1, the primary deficit only depends on the debt overhang, but it is independent of the amount of debt interest, as (7) shows. Monetary policy and central bank interest rates lose their influence on the financial scope of the HIC. The rule is designed to remove the incentives in the existing system to push for monetary easing instead of tackling structural and institutional reforms. In the following we therefore set 𝑧𝑡−1 ≡ 𝑖𝑡−1.

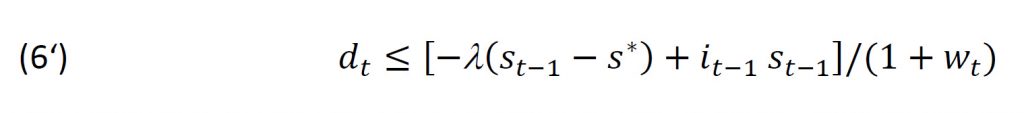

The fiscal rule (6) requires neither estimates nor forecasts, its application for the current year (t) only uses statistical data of the previous year (t-1). This makes it easy to apply, transparent and easy to control. It replaces the rigid 3 percent deficit quota with the flexible limit

The implied limit of the primary deficit ratio becomes:

With debt interest of i = 2 percent, w = 3 percent, = 0.05 and a national debt ratio of [70; 80; 90; 100] percent, the upper limit for the deficit ratio according to (6‘) is [0.9; 0.6; 0.3; 0.0] percent of GDP. The implied upper limit for the primary deficit ratio is independent of the level of debt interest and amounts to [-0.5; -1.0; -1.5; -1.9] percent, of GDP; i.e., surpluses in the primary household are required. In any case, a forward-looking budget policy should not make full use of the upper deficit limit, but should maintain a safety margin in order to be able to better cushion unexpected burdens.

If the new deficit rule is adhered to, the debt ratio will decrease, provided that the following applies to the IGD:

![]()

Since for HIC the lagged debt ratio is greater than the debt limit, the right-hand side of (8) is positive. This means that the debt ratio falls if the IGD is negative, i.e. if the snowball effect works. However, it will also be reduced in case of a moderately reverse snowball effect. E.g., for = 0.05 and st-1 = 80 percent, the debt ratio decreases as long as 𝑖𝑡−1 − 𝑤𝑡 < +1.25 percent.

In order for a budget rule to be credible, compliance with it should be strictly monitored and any excesses of the deficit ceiling (6) should be punished with binding sanctions. The amount of budgetary overspending

![]()

must be deposited with the monitoring institution without interest. In case of recurrence it is to be transferred to the monitoring institution.

5. Debt reduction with rule (6) in comparison to the Maastricht 3 percent-rule

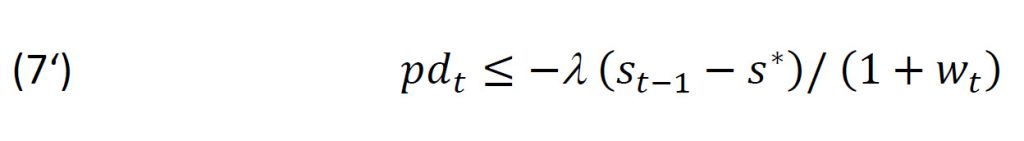

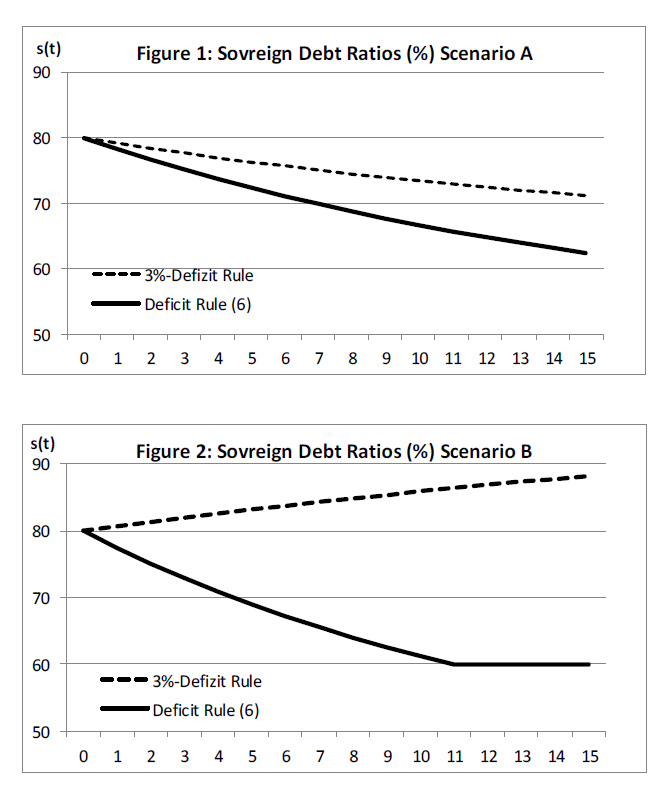

We illustrate the differences between the 3 percent deficit rule for the euro countries and the new deficit rule (6) using two scenarios. The calculations refer to a HIC with an initial debt ratio of 80 percent over a period of 15 years, with = 5 percent. Both rules are strictly followed as long as the debt ratio exceeds 60 percent. As soon as the debt falls below the ceiling, the debt ratio is kept constant at this level.

Scenario A is based on ideals that may have formed the basis of the Maastricht Treaty. The economy grows at the constant nominal rate of wt = 5 percent p.a. A constant rate of it = 4 percent is assumed for the average interest on debt. In the more realistic scenario B, both growth and debt interest rates are lower: wt = 3 percent and it = 1 percent. However, the prerequisites for deleveraging are favorable, in both scenarios, the snowball is effective. In scenario A the IGD is -1 percent. In scenario B the IGD is even lower at -2 percent.

Figures 1 and 2 show the development of debt ratios over 15 years. In scenario A the debt ratio falls under both deficit rules. With the 3 percent rule, however, the process of deleveraging is extremely slow. The debt ratio is still above 70 percent of GDP after 15 years, while under the new rule it falls to almost 60 percent.

In scenario B, despite an IGD of -2 percent, the 3 percent rule fails to reduce the debt overhang. The debt ratio in scenario B rises to almost 90 percent of GDP despite strict adherence to the 3 percent rule. In contrast, under the new rule (6) it falls below the 60 percent limit after 12 years.

In both scenarios, the new deficit rule (6) thus shows better results in terms of a sustainable budget policy: Although the conditions for debt reduction are favorable in both scenarios, debt reduction with the 3 percent rule either takes an extremely long time or does not come about at all. In contrast, with our new rule the debt ratio is reduced to the 60 percent limit within a reasonable period of time in both scenarios, which, of course, requires greater efforts in the primary budget.

In scenario A, the 3 percent rule requires a balanced primary budget over the whole period. If the new rule is applied, a primary surplus of around 1 percent is required initially, but it tends to zero over time. In scenario B, the 3 percent rule’s allowable primary deficit ratio is slightly more than 2 percent of GDP, but this is associated with a rising debt ratio. The new rule requires a small and declining primary surplus until the 60 percent debt limit is reached.

6. Beyond Corona: Empirical application to EMU 2022-2026

The favorable financing conditions in the last decade with low and negative interest rates for new loans have led to a drastic fall in the interest burden on public budgets, and that “despite the sometimes sharp rise in debt ratios” (Deutsche Bundesbank 2017b, p. 54). Since 2008, the euro countries have saved interest expenditure of about € 1,700 billion, which is around 15 percent of GDP in the euro area. The ultra-expansionary monetary policy of the ECB may have ‘bought time‘ for the HIC, but it was not used to reduce debt; to the contrary.

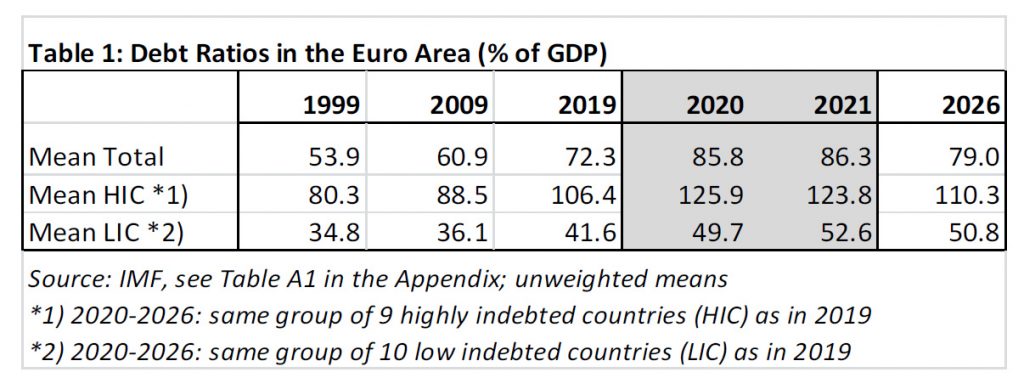

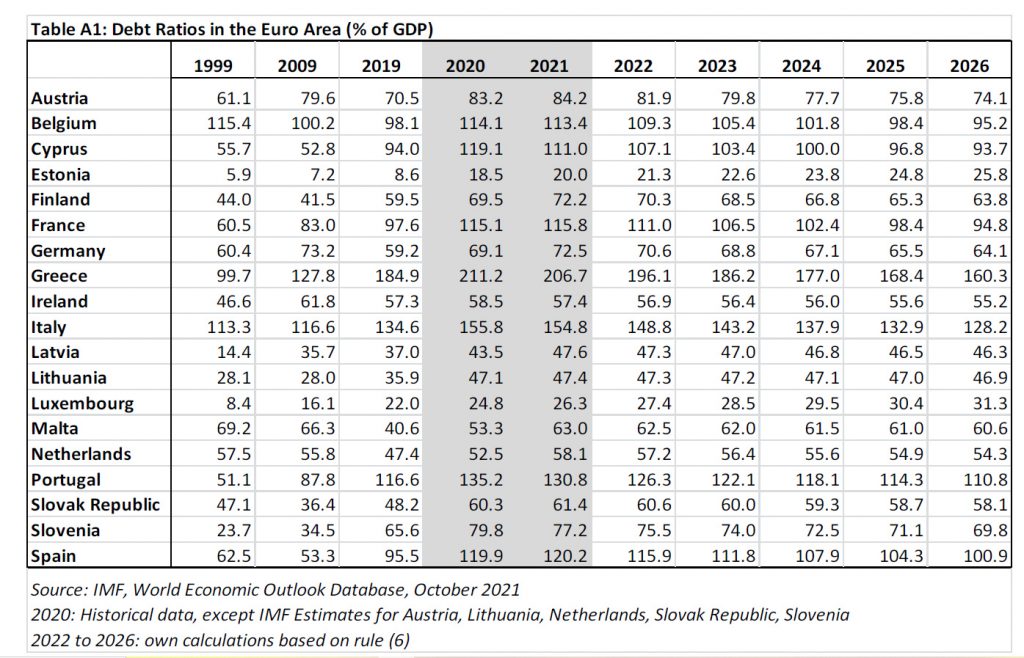

As Table 1 shows, the debt ratio of the 19 countries that are now part of EMU rose on an unweighted average from 54 percent in 1999 to 61 percent in 2009 and then to 72 percent in 2019. That is an increase of almost 20 percentage points within two decades. The debt ratio of the group of HIC increased even more, it rose by 26 percentage points (from 80 to 106 percent). In contrast, the debt ratio of the low indebted countries (LIC) increased by moderate 7 percentage points (from 35 to 42 percent).

Table A1 in the appendix shows that the debt ratios of all EMU countries (except Ireland) in the two pandemic years 2020/21 rose sharply compared to 2019 due to state corona aid and spending programs. On average they increased by 14 percentage points, from 72 percent to 86 percent. The largest increases of more than 20 percentage points were recorded by Spain, Greece, and Italy.

In the years 2020/21, the number of HICs rose from 9 to 13 (and that of LICs fell from 10 to 6). The countries belonging to the LIC group whose debt ratios crossed the 60 percent limit during the pandemic are Finland, Germany, Malta and the Slovak Republic [FI-GE-MA-SR].

According to the IMF, the debt ratios of these four countries rose, resp. will rise, from [59, 59, 41, 48] percent in 1999 to [72, 73, 63, 61] percent at the end of 2021. Such a change between the two groups of countries leads c.p. to an increase of the debt ratio of all countries, while both, the debt ratios of the HIC and that of the LIC, decrease. In order to avoid a statistical bias due to the group change, these four countries are still assigned to the LIC group. This means that the group-mean values for subsequent years remain comparable with those of 2019.

As Table 1 shows, the debt ratios of the HIC (excluding FI-GE-MA-SR) increase from 106 percent to 124 percent in the pandemic years. That is a huge increase by 18 percentage points. For the LIC (including FI-GE-MA-SR) the pandemic-related increase amounts to 11 percentage points, from 42 percent to 53 percent.

How will public debt ratios develop in the euro area “after corona”? The last column of Table 1 provides IMF forecasts for the year 2026. According to the IMF, the debt ratio of the HIC will decline from 124 to 110 percent within the next five years. However, this would still be above the pre-corona value of 106 percent in 2019. For the LIC group, the IMF estimates a moderate decline from 53 percent to 51 percent, which is well above the pre-corona value of 42 percent.

In the following, we examine how the debt ratios would behave in the next five years (2022 to 2026) if the EMU countries strictly apply the deficit rule (6). Under this rule, the debt ratio develops according to:

![]()

The first term on the r.h.s. of (10) shows that the snowball is just as effective as in (1’). The second term gives the additional debt reduction that results from rule (6), reinforcing the snowball effect for HIC. The parameter determines how much an exceedance of the debt limit in the last year needs to be reduced in the current year. As a comparison with (1′) shows, the second term on the r.h.s. of (10) corresponds to the primary deficit (pdt). Its negative sign signals that HICs (st-1 > s*) require a primary surplus.

In the following, the deficit rule (6) is applied to the HIC group and also to the LIC countries. For the LIC (with st-1 – s* < 0) it means that the second term in (10), taken on its own, increases the debt ratio. We use = 0.05 for all countries, which is the agreed rate for debt reduction of the SGP.

The monetary policy of the ECB in recent years has largely aligned the risk premia of the individual EMU countries. Greece, for example, enjoys growing confidence on the financial markets. The country can now borrow money more cheaply than at any time since it joined the eurozone in 2001 (and more cheaply than the U.S. government). In September 2021, rating agencies upgraded the country’s credit rating to BB+, which is only one notch below the coveted investment grade of the league of investment-worthy debtors. This is an astonishing rise for a country that was still on the brink of national bankruptcy in mid-2015 and had to be rescued with loans from its euro partners. Today, Greece’s creditworthiness benefits from this, as around 80 percent of Greek government debt is held by the central bank and public creditors such as the European Stability Mechanism (ESM). The interest rates on these loans are low, and their maturities extend until 2070. The average interest rate actually paid on the national debt in 2020 was 1.70 percent for the HIC group, only slightly above that of the LIC at 1.35 percent.

Based on IMF data for 2021, we apply the deficit rule (6) by using formula (10) to the 5 years from t=2022 to t=2026. However, data for the average interest rates on government debt in the individual countries are only available up to 2020. Therefore, we use these values for 2021 and keep them constant for the following years 2022 to 2026. The application of (10) requires forecasts of nominal GDP growth (wt) of eurozone economies. However, that is beyond the scope of this study. Rather, we base the extrapolation on a constant nominal growth rate of wt = 3 percent for all EMU countries. This assumption is compatible with real growth in the eurozone of 1 percent and an inflation rate of 2 percent, which corresponds to the ECB’s inflation target.[4] Thereby an unchanged monetary policy is assumed for the next five years.

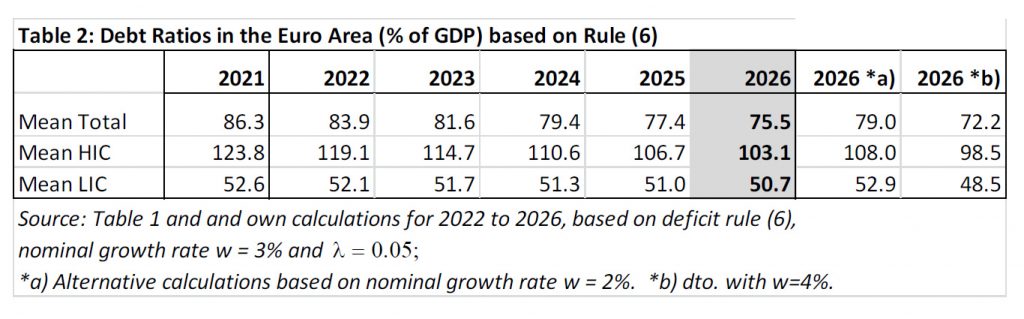

Table 2 shows the development of mean debt ratios for the years 2022 to 2026.[5]

If all EMU countries adhered exactly to the upper deficit limit of rule (6) then their mean debt ratio would decrease from 86 percent in 2021 to 76 percent in 2026. This is still higher than before Corona (72 percent), but lower than in the IMF forecast (79 percent).

The debt ratio of the HIC group falls from 124 percent (2021) to 103 percent (2026), which on average is a decrease of about 4 percentage points per year. For three countries (Belgium, Cyprus, France), the debt ratio falls below 100 percent of GDP. In case of the LIC, the deficit rule (6) also leads to a (moderate) decrease in the debt ratio, falling from 53 percent (2021) to 51 percent (2026). Sensitivity to growth: In order to get an impression of the sensitivity of the results with regard to the 3 percent growth assumption, the debt ratios in Table 2 are also calculated for w = 2 percent and w = 4 percent p.a. With a nominal growth rate of w = 2 percent (4 percent) p.a., as expected, the decline in the debt ratio is smaller (larger), as can be seen in the last two columns of Table 2. For the HIC the debt ratio falls to 108 (99) percent and for the LIC it amounts to 53 (49) percent. Overall, the deficit rule (6) is fairly robust to changes in nominal growth rates. Thus, the new rule is effective, it decouples the consolidation path of HICs from changes in interest rates, and it is not sensitive to nominal growth.

The application of the deficit rule (6) requires from the heavily indebted EMU countries somewhat greater consolidation efforts than implied by the IMF forecasts. The countries whose debt ratio, according to IMF data, will exceed 100 percent of GDP in 2021 are: Greece, Italy, Portugal, Spain, Belgium, France and Cyprus. Debt reduction efforts of these countries must be particularly large. As it depends on the debt overhang, this feature is automatically incorporated into our rule (6). Rule (6), however, is constructed so that further easing of monetary policy and associated interest rate cuts would practically have no impact on the necessary consolidation efforts. This removes incentives for the HIC to exert pressure on the ECB for an expansionary monetary policy and strengthens the independence of the central bank.

Inflation and real interest rates are highly uncertain, but it is “imprudent to assume that things will simply stay the same while they have been constantly changing in the past.” (Issing/Schuknecht 2021). In view of the risks of recurring crises, consistent deleveraging is both, appropriate and necessary. Countries that have used the favorable period between 2014 and 2019 to reduce their debt levels were better able to respond to the challenges of the corona pandemic.

In order to guarantee the deleveraging, however, compliance with the new fiscal rule should be strictly monitored by an independent institution. The current monitoring process is very complicated and subject to a high level of political influence by the Council of Ministers and the EU Commission, which also officially saw itself as a political institution during the term of office of Commission President Juncker. Due to the high number of deficit targets being missed and the lack of sanctions, the fiscal rules are not credible. A newly established independent fiscal authority or an independent ESM should therefore monitor compliance with the fiscal rule (Jost/Seitz 2021). Exceeding the upper deficit limit would have to be subject to binding, effective sanctions. This could be done by a country paying the overdrawn amount into the ESM, as indicated in equation (9). Future aid payments from the ESM for crisis countries and their conditions could also be linked to compliance with the fiscal rules.

7. Raising the public debt limit to 100 percent of GDP?

The ESM is the bailout fund of the EU, responsible for providing emergency fiscal support to member states in case of financial distress. Its president, Klaus Regling, warned that the EU’s fiscal framework is too complex and some of the fiscal rules might have become “economically nonsensical”.

In a recent discussion paper, ESM economists propose a higher limit to public debt. The paper by Francová et al. (2021) came out just a week after the Commission relaunched a review of the EU’s fiscal rules (EU Commission 2021). The paper praises the EU’s fiscal framework for contributing to better fiscal coordination and enabling the EU to respond to the economic shock of the pandemic. Nonetheless, the authors believe that the EU’s fiscal rules need to be changed. They claim that a “new economic reality necessitates a fresh look at the European fiscal rules”. These new economic realities are the low borrowing costs for EU member states and the high post-pandemic debt levels.

Under the current fiscal rules, countries with debt levels above 60 percent of GDP need to reduce their debt levels annually by 5 percent of the difference between their current debt levels and the 60 percent threshold. Francová et al. (2021) argue that the public debt limit should be raised from 60 percent to 100 percent of GDP. Moreover, they suggest to keep the current deficit rule that limits the annual deficits at a maximum of 3 percent of GDP. Countries should continue to adhere to the principle of reducing debt levels when they exceed 100 percent of GDP. To do so, they should run primary surpluses in their budgets, even in times of economic downturn. In addition, the authors criticize the current fiscal framework for its complexity, and they suggest replacing the rules on the structural deficit by an expenditure rule. The expenditure rule is intended to prevent government spending from growing faster than the growth trend in these countries.

Ultimately, the ESM proposals amount to the EU Commission setting the long-term path to debt reduction of over-indebted countries as it sees fit.

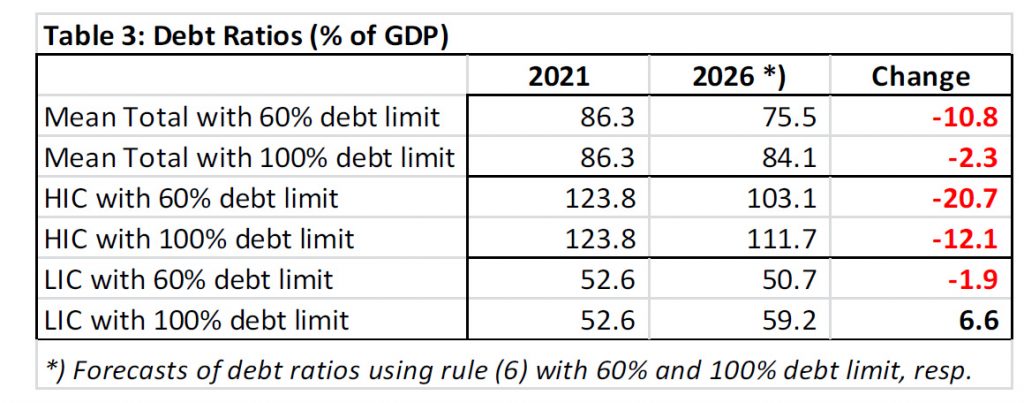

In section 6 we applied the deficit rule (6) to extrapolate the debt ratios of the EMU countries up to 2026 on the basis of the IMF forecasts for 2021. In doing so, we have used the current debt limit s* = 60 percent of GDP. In the following, in accordance with the ESM proposal, we examine how the debt ratios would respond with rule (6) combined with a debt limit of s* = 100 percent of GDP.

Table 3 shows that the fiscal consolidation path in the euro area would be much flatter if a debt limit of 100 percent of GDP were to apply.

While the debt ratio of the HIC countries declines by 21 percentage points when applying the deficit rule (6) with s*= 60 percent, it only falls by 12 percentage points with s*= 100 percent (from 124 percent to 112 percent of GDP). It is also a matter of concern that the debt ratio of the LIC countries even increases by almost 7 percentage points to nearly 60 percent of GDP.

As the application of our deficit rule (6) in combination with a 100 percent debt limit suggests, following the ESM proposal would greatly delay the reduction of HIC debt ratios, which strongly increased in the context of the corona pandemic. In the case of the LIC countries, it is likely that raising the debt limit would even lead to an increase in the debt ratios. Thus, our calculations suggest that raising the debt limit to 100 percent of GDP would markedly slow down the necessary reduction in the debt ratios.

Debt limits in the EU are a source of annoyance to advocates of high government spending.

Their arguments are dubious, however. “A relaxation of the budget rules would accommodate those countries that have deliberately not adhered to the previous rules. Why should countries that were successful in ignoring the old rule now at least comply with the new rules? There is no incentive to do so” (Braunberger 2021, our translation).

Raising the debt limit in the Euro area to 100 percent would retrospectively sanction the highly indebted countries for their excessive debt policies in the past. For the low indebted economies it would create incentives to relax their previously rule-compliant debt policies in the future. Overall, an increase in the debt limit as proposed by the ESM economists would further weaken fiscal discipline in the EMU and amplify the risks of excessive government debt ratios. Moreover, it would reduce the ability of highly indebted eurozone member countries to respond to future crises.

8. Conclusions

Fiscal rules are useful instruments to improve fiscal performance. If they are binding and credibly enforced they could also save interest payments on government debt by lowering risk premia (Issing/Schuknecht 2021). Rules can avoid slipping into a sovereign debt crisis, and all the more so as sovereign debt levels have raised to record highs in recent years, due to the costs of the corona pandemic but also following a longer-run trend.

However, the Maastricht rules and the SGP for limiting public debt in the eurozone have failed and need to be reformed. We propose a new deficit rule in the post-corona period:

Reduce at least = 5 percent of the debt overhang from the previous year.

This rule is simple, easy to control, and it reinforces the snowball effect. It is delinked from the political process, since the level of interest rates does not affect the permissible primary debt ratio. It addresses the main problem of excessive government debt ratios and reduces the existing incentives to exert expansionary pressure on monetary policy.

Compared to the Maastricht 3 percent-deficit rule, our rule could reduce sovereign debt levels within a shorter period even if economic growth rates are weak. Applying the new rule, the debt to GDP ratio of heavily indebted eurozone countries could shrink from 124 percent end of 2021 to about 100 percent end of 2026, which is below the recent IMF forecasts. Raising the debt limit to 100 percent of GDP, as proposed by ESM economists, would be counterproductive.

Reducing debt to pre-Corona levels within half a decade is both necessary and feasible to return to a sustainable path for sovereign debt and to create a risk buffer The principle of prudence requires governments taking into account that the next crisis is bound to come.

Literature

Bénassy-Quéré, A., et al. (2018): Reconciling risk sharing with market discipline: a constructive approach to euro area reform, CEPR Policy Insight 91.

Blümel, G. (2021): Stabilitätspakt: Defizit-Sanktionen auch anwenden, Frankfurter Allgemeine Zeitung, 6. November 2021.

Braunberger, G. (2021): Verführerisches Defizit, Frankfurter Allgemeine Zeitung, 31. Oktober 2021.

Caselli, F., Wingender, P. (2018): Bunching at 3 percent: The Maastricht fiscal criterion and government deficits, IMF Working Paper 18/182.

Caselli, F., Reynaud, J. (2019): Do fiscal rules cause better fiscal balances? A new instrumental variable strategy, IMF Working Paper 19/49.

Deutsche Bundesbank (2017a): Zur Ausgestaltung und Umsetzung der europäischen Haushaltsregeln, Monatsbericht Juni 2017, 29-45.

Deutsche Bundesbank (2017b): Zur Entwicklung der staatlichen Zinsausgaben in Deutschland und anderen Ländern des Euroraums, Monatsbericht Juli 2017, 35-70.

Deutsche Bundesbank (2019): Europäischer Stabilitäts- und Wachstumspakt: Zu einzelnen Reformoptionen, Monatsbericht April 2019, 79-93.

Deutsche Bundesbank (2020): The informative value of national fiscal indicators in respect of debt at the European level, Monthly Report, December 2020, 37-47.

European Central Bank (2021): Key Euro Area Indicators, https://www.ecb.europa.eu/stats/ecb_statistics/key_euro_area_indicators/html/index.hu.html

European Commission (2016): European Commission’s forecast accuracy revisited: statistical properties and possible causes of forecast errors, Discussion Paper 027, March 2016.

European Commission (2021): Economic governance review communication, 19th October 2021. https://ec.europa.eu/info/files/economic-governance-review-communication_en.

Europäische Kommission (2017): Vorschlag für eine Richtlinie des Rates zur Festlegung von Bestimmungen zur Stärkung der haushaltspolitischen Verantwortung und der mittelfristigen Ausrichtung der Haushalte in den Mitgliedstaaten, 6. Dezember 2017, COM(2017) 824 final, 2017/0335 (CNS).

European Fiscal Board (2020): Annual Report 2020, https://ec.europa.eu/info/sites/default/files/efb_annual_report_2020_en_1.pdf.

European Fiscal Board (2021), Annual Report 2021, https://ec.europa.eu/info/sites/default/files/annual_report_2021_efb_en_0.pdf.

Francová, O., E. Hitaj, E., Goossen, J., Kraemer, R., Lenarcic, A., Palaiodimos, G. (2021): EU fiscal rules: reform considerations, ESM Discussion Paper 17, October.

Fuest, C., Gros, D. (2019): Applying nominal expenditure rules in the euro area, EconPol Policy Brief 15/2019.

Gaspar, V., Amaglobeli, D. (2019): Fiscal rules, Suerf Policy Note 60, March 2019.

Heinemann, F. et. al. (2018): Do fiscal rules constrain fiscal policy? A meta regression analysis, European Journal of Political Economy 51, January 2018, 69-92.

Heinemann, F., Kemper, J. (2021): The ECB under the threat of fiscal dominance – the individual central banker dimension, Economists voice, forthcoming.

International Monetary Fund (IMF) (2021a): Recovery during a pandemic, World Economic Outlook, October 2021.

International Monetary Fund (IMF) (2021b): Strengthening the credibility of public finances, Fiscal Monitor, October 2021.

Issing, O., Schuknecht, L. (2021): Good debt vs bad debt, The International Economy, Fall 2021, 40-42.

Jost, T., Seitz, F. (2021): Designing a European Monetary Fund: what role for the IMF?, Institute for Monetary and Financial Stability, Goethe University Frankfurt, Working Paper Series, No. 151 (2021).

Jost, T., Tödter, K.-H. (2019): Eine neue Fiskalregel für die Eurozone: einfach, transparent, kontrollierbar, List Forum 45/4, 381-395.

Schuknecht, L. (2021): Public spending and the role of the state – history, performance, risk and remedies, Cambridge University Press, 2021.

Wyplosz, C. (2019): Fiscal discipline in the eurozone: don’t fix it, change it, ifo DICE Report 17, No. 2, 3-6.

Appendix: Debt Ratios in the Euro Area

Table A1 shows the consolidation paths of the debt ratios for the eurozone countries for the years 2022 to 2026 as it results according to deficit rule (6).

Notes

[1] A simpler and better enforceable fiscal rule for the eurozone is also a topic in the recent political debate about reforms of the SGP. See e.g. Blümel (2021) or European Fiscal Board (2021).

[2] Year-ahead forecasts of the EU Commission for GDP growth tended to be slightly over-optimistic across countries (European Commission 2016). Long-run growth perspectives of the EU and the euro area were also often too rosy, see e.g. the Lisbon Strategy of the EU that aimed to make Europe the most competitive region of the world by 2010.

[3] Formally, the rule could be applied to low-debt countries (LIC) as well, “allowing” them to increase their debt ratios.

[4] In the period 2009 to 2019 average annual nominal growth in the eurozone was also close to 3 percent.

[5] For information on the individual countries, see Table A1 in the appendix.

*Republished with kind permission by the authors from the original publication: Jost T., Tödter K.H. (2021). Reducing sovereign debt levels in the post-Covid Eurozone with a simple deficit rule. IMFS. URL: https://www.imfs-frankfurt.de/fileadmin/user_upload/IMFS_WP/IMFS_WP_164.pdf