_ Yuri Kofner, economist, MIWI Institute. Munich, 21 November 2022.

Executive summary

Although Germany is a leader in Europe in factory automation and the robotics industry and has a promising competitive advantage in the cobot segment, it is increasingly lagging behind the other major robotic nations like the USA, China, Korea and Japan.

Due to relatively high unit labour costs in the M+E sector and an ageing population, Germany is more likely to opt for a robot-intensive development path.

Even with the current potential for automating simple work tasks, robotization could already reduce domestic demand for 1.4 million low-skilled migrant workers.

Increased robotization could support the reshoring of industrial production sites: increasing 1 robot per 10,000 manufacturing workers increases manufacturing reshoring by 35 basis points.

Robots hardly replace jobs, but rather repetitive or dangerous work tasks. Robotization increases labour productivity and GDP per capita, creating over 12 million net new jobs in the EU. In particular, it increases the demand for qualified STEM professionals.

In order to secure Germany’s role as a leading robot nation, the federal government could implement the following measures:

- Increase of government R&D funding in robotics to 30 euros per 1,000 euros of GDP and aggregate R&D spending to 4 percent of GDP.

- Creation of special economic zones with tax incentives, regulatory sandboxes, reshoring funding, improved research, education and digital infrastructure.

- Non-introduction of a robot tax, but improvement the Research Allowance Act (FZulG).

- Safeguarding og national security interests through standardization of AI, IoT and robotization as well as M&A screening in strategic high-tech sectors.

- Implementation of a national STEM education agenda.

Competitiveness of the German robot industry

In 2021, the global turnover of the robotics industry reached 25.78 billion euros (7.36 billion euros in industrial robots and 18.57 billion euros in service robots). By 2025, sales are expected to increase by a third to 34.2 billion euros (8.46 billion euros for industrial robots and 25.74 billion euros for service robots).

In Germany, industry sales amounted to 2.44 billion euros and are expected to increase by 12 percent to 2.74 billion euros in 2025.[1]

However, due to increasing industrial dirigisme, corona restrictions, global trade wars, the annual sales growth of the German robotics industry fell from 33 percent in 2018 to -19.5 percent in 2022.

With over 105,000 robots installed in 2021, Germany is the leader in the EU (31 percent), but is well behind its competitors China (848,000) and the USA (460,000), but also Korea (155,000) and Japan (117 thousand).

As expected, the largest sales markets for robots in 2021 were Asia (8.86 billion euros), half of which is in China, and the USA (5.2 billion euros). But with 7.26 billion euros in sales, the EU is also a high-capacity market. By 2025, the market shares are expected to grow in relatively equal proportions.

Between 2019 and 2022, the relative number of newly installed robots increased the most in Japan – by 39 percent (38,000), followed by China – 31 percent (229,000), then Korea – 25 percent (36,000), Germany at 23 percent (21,000) and finally the US – 18 percent (75,000).

In 2020, Germany had one of the highest robot densities in the world at 371 robots per 10,000 workers, behind Japan (390), Singapore (605) and Korea (932), but ahead of the US (255), China (246) and other European nations.[2]

In Germany, almost half of the industrial robots are used in the automotive industry (49.9 percent), another third in mechanical engineering, plastics production and electronics.[3]

The new segment of collaborative robots (cobots) is considered a market with high growth potential: its global turnover is expected to quadruple from 500 million euros in 2021 to almost 2 billion euros in 2025, and then quadruple again – to 8 billion euros by 2030.[4]

Germany has a competitive advantage in cobots, which accounted for 9.1 percent of the total installed robots in 2022, higher than other leading robot-producing nations.

In 2019, three of the twenty largest cobot manufacturers in terms of market share were located in Germany: KUKA (based in Bavaria, but majority owned by the Chinese Midea group), Franka Emika (Bavaria) and Robert Bosch (Baden-Württemberg).

At the same time, Germany had the highest price per newly installed robot (23 thousand euros) compared to e.g. EU average (21.4 thousand euros), Japan (16.2 thousand euros), USA (11.3 thousand euros), Korea (6.7 thousand euros) and China (4.6 thousand euros).

In 2021, over a quarter of a million people were employed in the German automation industry, interestingly this number has not changed for over the past decade.[5]

In 2020, more than half of the industrial robots in German manufacturing will be installed in large companies, but only in 9 percent of SMEs.[6]

From the point of view of the Bavarian State Bank, there is great potential for German manufacturers of cobots in small and medium-sized companies, since cobots usually pay for themselves within a year and robotics specialists are often not required for implementation. In 2021, however, cobots were installed in just 3-5 percent of SMEs in the manufacturing sector in Germany.

Robotization as a response to demographic change

Although conservatives have criticized technology’s alienation of human relationships, given a shrinking domestic labour pool, robotization is seen as a potential means of reducing the need for low-wage immigration. The technology-savvy nation-state of Japan, which Western right-wing conservative circles see as a role model when it comes to migration and identity politics, has set itself the goal of replacing 2.4 million jobs with robots by 2030.[7]

Countries with older populations are also better suited for robotization: For example, researchers at Boston University (2018) found a slightly positive correlation between robot adoption and a higher proportion of middle-aged workers, as they tend to have higher wages, making robot adoption more cost-effective.[8]

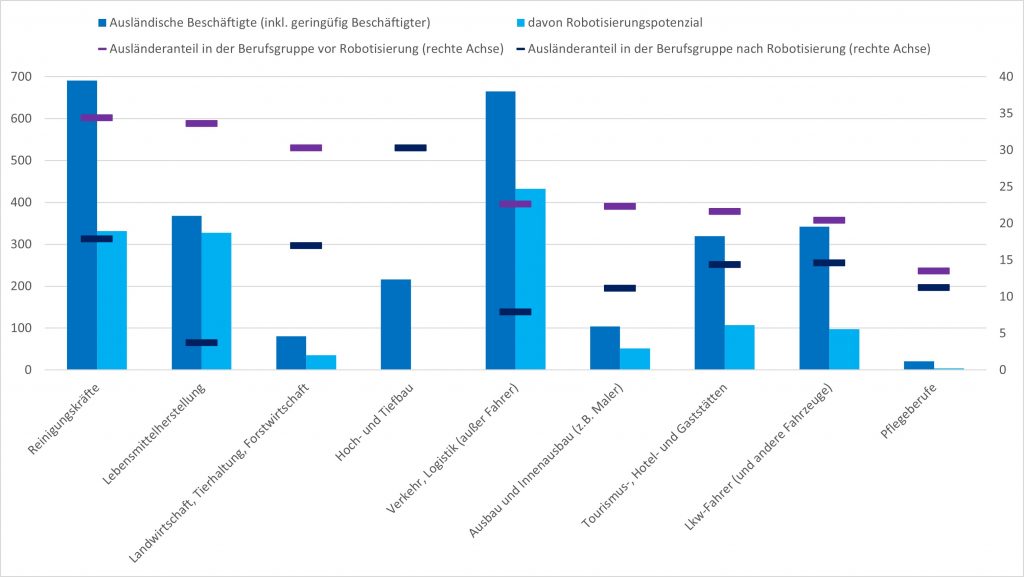

Even with the current level of robotic technology, it would be possible to reduce a need for around 1.4 million foreigners currently employed in the various immigration-intensive occupations in Germany such as cleaning, farm labour, food production, warehouse logistics, etc. (Chart 1). [9]

Diagram 1. Robotization potential of immigration-intensive professional groups in Germany (2021)

Note: In 1,000 employees (left axis), in percent (right axis). Source: Federal Employment Agency, IAB, Federal Government (care professions).[10]

Robots help with reshoring

Conservatives and right-wing populists view the dark side of the globalized division of labour with cautious scepticism: the impairment of national (economic) sovereignty through increased dependence on foreign exporters (e.g. microchips from Taiwan) and technologies (e.g. 5G from China), wage competition and potential sectoral job loss due to offshoring.

In the long run, however, protectionist measures such as technical trade barriers only damage the international competitiveness of the nation state.

Here, on the other hand, robotization can be seen not only as a means of reducing the pull factors for low-skilled labour immigration, but also as a right-wing conservative development path to reduce offshoring pressures by increasing domestic labour productivity.

In fact, reports from the OECD (2018) and CEPR (2021)[11] found that robotics is slowing, and in some cases halting, offshoring and thus a key to sustaining production in developed economies.[12]

In a survey of Citigroup customers, 70 percent of industrial customers believed that automation would encourage companies to consolidate production and move manufacturing closer to their premises.

A research report by the International Federation of Robotics cites Whirlpool, Caterpillar and Ford Motor in the US, and Adidas in Germany as examples of reshoring through robotization.[13]

Krenz et al. (2021) estimated that in manufacturing sectors, an increase of 1 robot per 10,000 workers is associated with a 0.35 percent increase in reshoring activity.[14]

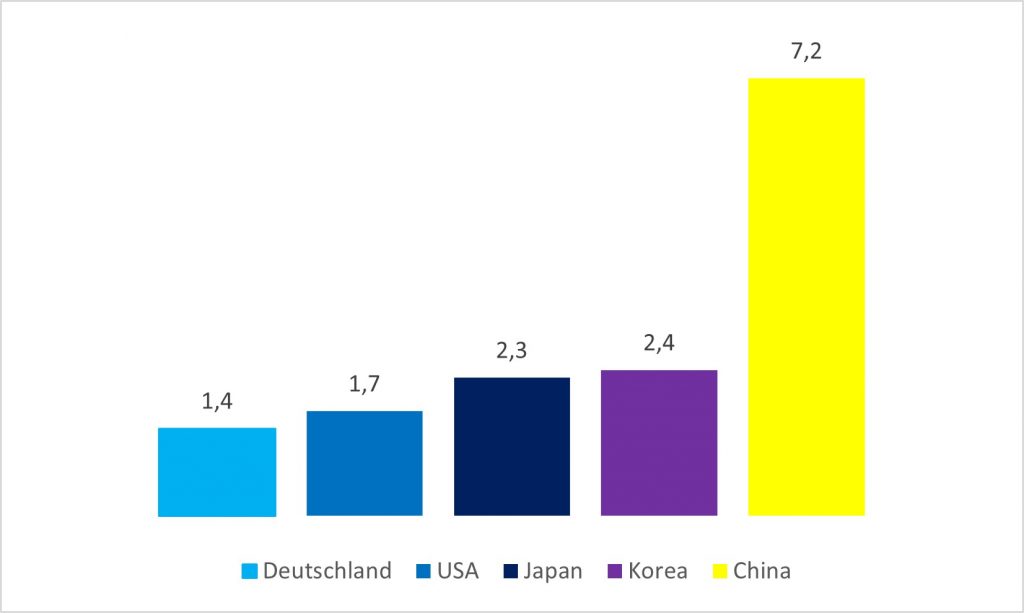

Germany is predestined for reshoring through robotization, as it sometimes has the highest labor costs in M+E manufacturing in the world – almost 45 euros per hour worked in 2018 (37.6 euros in the US, 28.5 euros in Japan, 27 euros in Korea and only 9 euros in China).[15] Assuming the installation of a new robotic system that would replace two shifts of a production worker would cost 250,000 euros, then in Germany it would pay for itself the fastest – within 1.4 years. Breakeven would take 1.7 years in the US, 2.3 years in Japan, 2.4 years in Korea, and 7.2 years in China (Chart 2).[16]

Chart 2. Break-even point for an industrial robotic system replacing two shifts in M+E (2018, years)

Note: Assumed installation costs of 250,000 euros. Source: Röhl K.H. (2019), Atkinson R (2019).

Robots and the labor market

A common fear, often perpetuated by the media, is that robotization would lead to job losses, particularly in manufacturing. However, the empirical literature largely shows that either these fears are exaggerated or that the opposite is actually the case, namely a positive association between automation and net job creation.

In an analysis of industrial robots for employment on the German labour market between 1994 and 2014, Dauth et al. (2017) found that the adoption of industrial robots had no impact on overall employment in local labor markets specialized in robot-heavy industries.[17]

The Institute for Labor Economics found that technology-based automation has created 12 million net new jobs in Europe through increased product demand along the value chain.[18]

Digitized companies are not shedding jobs on a large scale. Rather, the opposite is true: from 2015 to 2017, 62 percent of companies in Germany whose businesses are based on the digitalization increased their workforce – only 17 percent reduced their workforce.[19]

This empirical evidence seems to contradict the above argument that robotization can help reduce demand for low-skilled workers. However, this can be easily explained by the fact that although automation takes over individual, especially repetitive, work tasks, it does not replace the jobs themselves. Rather than cutting manufacturing jobs, robotization is increasing productivity per manufacturing worker, as well as the demand for highly skilled workers. According to IW Cologne, Germany will already be short of almost 330,000 STEM workers by 2022.[20]

For the above reasons, the introduction of a robot tax or that robots should pay social security contributions, as recently demanded by the CDU,[21] is not only completely unfounded, but also absolutely contraindicated, as it would create investment barriers, slow down productivity growth, and outsourcing of innovative companies abroad would increase.[22]

Economic growth through robotization

As one would expect, automation and robotization are important drivers of economic growth. A CEBR study shows that investment in robots contributed to 10 percent of per capita GDP growth in OECD countries between 1993 and 2016.[23]

This finding was supported by a study by Graetz and Michaels (2015), who also found that robotic compaction increased annual GDP and labor productivity growth by about 37 to 36 basis points between 1993 and 2007.[24]

A study by the Institute for Labor Market and Vocational Research found that the introduction of robots in Germany from 2004 to 2014 led to GDP growth of 0.5 percent per person and robot over 10 years.[25]

Political recommendations for action

Increase government and general R&D funding

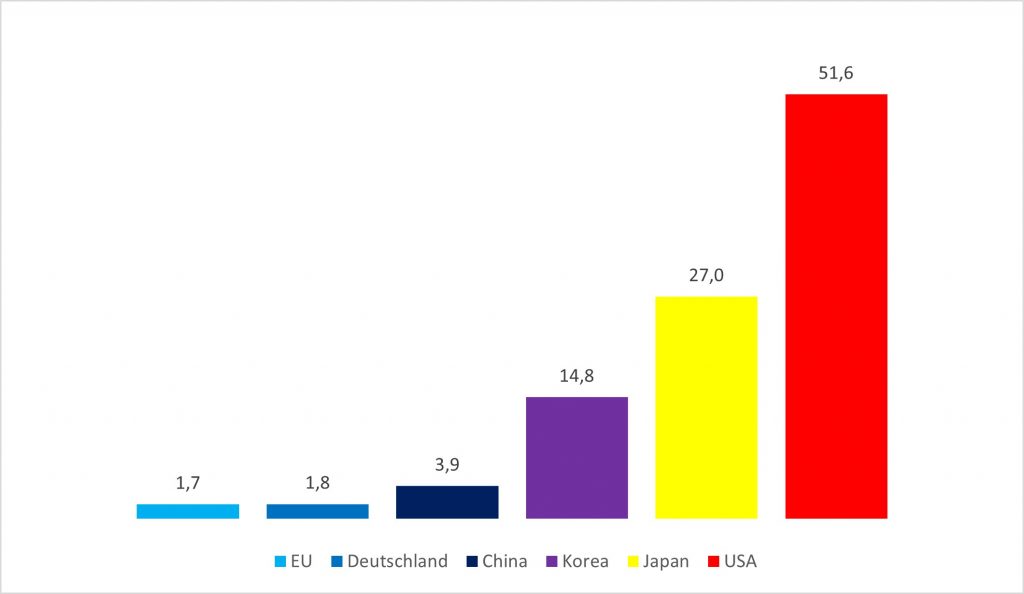

A recent comprehensive overview by the International Federation of Robotics shows that the EU and Germany lag far behind other leading robotic nations in terms of state R&D funding in the field of robotics: In 2020, the EU spent only 1.7 euros per 1,000 euros of GDP (total: 199 million euros), Germany – only 1.8 euros (58.3 million euros), China – 3.9 euros (577 million euros), Korea – 14.8 euros (239 million euros), Japan – 27 euros (1,234 million euros) and the United States – 51.6 euros (an amazing 9,932 million euros).[26]

If you look at the total research expenditure (government, universities, companies) in relation to economic power, the picture does not get any better: in 2020 the EU spent 2.3 percent of its GDP on research and development, China – 2.4 percent, Germany – 3, 1 percent, Japan – 3.3 percent, the United States – 3.5 percent, and Korea – a staggering 4.8 percent (Chart 3).[27]

Chart 3. Government R&D Expenditure on Robotics (2020)

Source: IFR (2021), OECD (2022), World Bank (2022).[28]

It is obvious that in order not to be left behind in global robotics innovations, Germany must ambitiously increase state investments in robot research and development – preferably above the Japanese level, i.e. to at least 30 euros per 1,000 euros GDP, as well as aggregate spending on research and development at 4 percent of GDP. According to the findings of the DIW, the latter step would increase the German gross national product by 40 basis points and make every citizen 176 euros richer.[29]

Creation of special economic zones (“free zones”)

Special economic zones are an effective regional development policy instrument to increase investments in promising innovations, to attract promising start-ups and large international corporations, and to promote the relocation of high-tech manufacturing. Freedom zones are widespread in the EU, e.g. in the Baltic States, Poland and Italy, but Germany has not yet dared to implement this idea, although the federal competition of German local authorities would actually be predestined for this.

To support the federal and state-specific robot industry, the federal and state governments could set up innovation policy freedom zones that could provide for several or all of the following support measures:[30]

- A reduction in the local trade tax multiplier to the minimum rate of 200 percent.

- A tax write-off option for investments in start-ups, which is immediate, uncomplicated and unlimited.

- A tax advantage for capital gains if they are reinvested directly in the start-ups.

- An increase in the allowances for employee financial participation in their start-ups to 3,000 euros or more.

- The extremely high electricity prices of over 40 cents per kWh have a significant impact on the competitiveness of the German location. Within the scope of the SEZ, electricity costs could be reduced through the possibility of writing off the electricity tax and CO2 tax.

- The creation of tax patent boxes and regulatory “sandboxes” for applications in artificial intelligence, quantum computing, blockchain and other potential digital cutting-edge technologies that can be attributed to the robotics cluster. This proposal is endorsed by the Ifo Institute[31] and a new CESifo study has found that the introduction of a patent box increases the average market launch of research applications by business innovators by almost 7 percentage points.[32]

- A targeted expansion of the local digital network infrastructure, in particular of FTTP connections.

- An active involvement of potentially already existing business incubators.

- An active involvement of the relevant university educational institutions and research centers, e.g. by offering relevant courses and further opportunities for cooperation.

- Targeted funding from the European Regional Development Fund (ERDF), “European territorial cooperation” (INTERREG), the joint task “Improvement of the regional economic structure” (GRW), the central innovation program “Mittelstand” (ZIM), the Federal Ministry of Education and Research (BMBF), the program “WIR! – Change through innovation in the region”, the program “Regional Entrepreneurial Alliances for Innovation” (RUBIN), the program “REGION.innovativ”, as well as all relevant regional support programs for the commercial economy at the respective state level.

- Targeted funding with the funds of the federal states concerned, which are earmarked for the funding of start-ups and potential cutting-edge technologies.

- Targeted funding with the funds of potentially existing growth or investment funds of the federal government and the relevant federal states.

Tax incentives for robotics

In addition to the proposals to increase direct state R&D funding and to supplement regional development incentives through special economic zones, nationwide tax incentives to increase robot research should also be implemented. Meta-studies by the ifo Institute show that tax policy measures to increase private R&D activities are much more effective than direct funding.[33]

The introduction of tax incentives for research (Research Allowance Act – FZulG) in Germany in 2020 was a long overdue step in the right direction. Since then, however, many industry associations have come forward with criticism and suggestions for improvement.

Firstly, material costs are regrettably not included in the assessment basis for the research allowance. As a result, companies whose research expenditure consists to a large extent of costs for laboratories, test benches, etc. are disadvantaged. Therefore, these costs should also be included in the research allowance in order to increase the incentive for research and development.[34]

Secondly, a recent DIHK survey has shown that the research allowance is still relatively unknown among small and medium-sized companies and many are put off by the bureaucratic complexity of the application process. The employers’ association therefore proposes, on the one hand, a better application for tax research funding and, on the other hand, a simplification of the application process through fewer statistical data, less obligation to provide evidence, faster processing times in the certification body and in the tax office, as far as a specification of the funding criteria.[35]

As explained above, the introduction of a robot tax in any form should be avoided. This view is shared even by left-wing economists like Südekum.[36]

State funding for reshoring

The federal government could create incentives for German manufacturing companies to relocate their production facilities back to Germany through automation and robotization. The wiiw proposes two political measures to promote relocation of production: On the one hand, relocation costs could be promoted. For example, the Japanese government covers 70 percent of the relocation costs for SMEs if they are manufacturers of strategic goods and relocate their production back to Japan. Secondly, through tax exemptions, e.g. for a certain number of years after the move. Both measures could also be implemented within the freedom zones proposed above.[37]

Protection of national interests

In the field of robotics, Internet of Things and artificial intelligence, the issues of international and technological competitiveness, national security and sovereignty, and ethical concerns are closely intertwined.[38]

The most recent complete takeover of KUKA (over 95 percent), one of the most important German robot manufacturers, by China can be viewed as a prime example. The company is thriving thanks to Chinese investment and better market access to the Far East, but concerns remain about technology transfer and possible job cuts at Germany’s expense.[39]

Establishing harmonized (security) standards, regulations and liability rules is required to maintain technological leadership, reduce dual use capacities of geopolitical competitors and avert potential harm to citizens from AI and autonomous systems. According to IIASA, when defining and harmonizing these standards, it is important to find the right balance between safeguarding national security interests and EU or global market accessibility.[40]

In this context, the tightening of the Foreign Trade Ordinance by the BMWK based on the model of the EU screening mechanism is to be welcomed. With the help of this adjustment, foreign investments in future technologies such as artificial intelligence should be better regulated and potentially prevented as soon as the stake is at least 20 percent in the company. For critical infrastructure and the production of armaments, the limit is 10 percent.[41]

As a further measure, public procurement could be used to promote (domestic) robot manufacturers who commit to national safety standards.

STEM professionals and research clusters

The most important production factor in a resource-poor and demographically shrinking industrial economy like Germany’s is the level of education and the population. Unfortunately, Germany is losing ground in this crucial area. According to the PISA comparison, German students in 2019 were only in the middle when it came to STEM skills[42] and in 2020 the need for STEM specialists in Germany was almost 60 percent higher than the corresponding labor supply.[43]

Here the federal government must step up its efforts to create a leading education and research cluster in the fields of robotics, AI, quantum computing and materials research. First of all, however, basic education in the STEM field must be strengthened again. There is a need to set up a specialized education and research program to network the relevant universities, research centers and companies for the further education and training of the required MINT specialists and for the provision of the latest basic and applied robotic research.

Sources

[1] Statista Research (2022). Robotik. Umsatz. URL: https://de.statista.com/outlook/tmo/robotik/deutschland

[2] IFR (2021). Anzahl der Roboter in der produzierenden Industrie nach ausgewählten Ländern weltweit im Jahr 2020. URL: https://bit.ly/3V7uDDB

[3] Kalb A. (2021). Robotik und Automation: Corona als Katalysator für die Digitalisierung. Bayern LB. URL: https://www.bayernlb.de/internet/media/de/ir/downloads_1/bayernlb_research/megatrend_publikationen/digitalisierung/Robotik_und_Automation-Corona_als_Katalysator_fuer_die_Digitalisierung_20210113.pdf

[4] Janson M. (2021). Umsätze mit Cobots knacken bald Milliardengrenze. Statista Research. URL: https://de.statista.com/infografik/25139/prognose-des-weltweiten-marktvolumens-fuer-kollaborative-roboter/

[5] Statista (2022). Industrielle Automation in Deutschland. Daten von Destatis, VDMA, ZVEI. URL: https://de.statista.com/statistik/studie/id/31557/dokument/industrielle-automation-in-deutschland/

[6] Destatis (2020). Anteil der Unternehmen im Verarbeitenden Gewerbe mit Industrierobotern in Deutschland nach Anzahl der Beschäftigten in den Jahren 2018 und 2020. Statista. URL: https://de.statista.com/statistik/daten/studie/947397/umfrage/nutzung-von-industrierobotern-im-verarbeitenden-gewerbe-in-deutschland/

[7] Moldenhauer J. (2018). Japans Politik der Null-Zuwanderung. IfS. URL: https://renovamen-verlag.de/moldenhauer-japans-politik-der-null-zuwanderung.-vorbild-fuer-deutschland

[8] Acemoglu D., Restrepo (2018) Demographics and Automation. Boston University. URL: https://economics.mit.edu/files/15056

[9] Berechnungen des Autors anhand von: Destatis (2022). Anteil von Deutschen und Ausländern in verschiedenen Berufsgruppen in Deutschland am 30. Juni 2021. Statista. URL: https://de.statista.com/statistik/daten/studie/167622/umfrage/auslaenderanteil-in-verschiedenen-berufsgruppen-in-deutschland/ | IAB (2021). Job Futuromat. URL: https://job-futuromat.iab.de/

[10] Bundesregierung (2021). Antwort auf eine Anfrage der AfD-Fraktion. Drucksache 19/02455. URL: https://dserver.bundestag.de/btd/19/024/1902455.pdf

[11] Bonfiglioli A. et al. (2021). Robots, Offshoring and Welfare. CEPR. URL: https://cepr.org/publications/dp16363

[12] DeStefano T., de Backer K., et al. (2018). Industrial Robotics and the Global Organisation of Production. OECD. URL: https://www.oecd-ilibrary.org/docserver/dd98ff58-en.pdf

[13] IFR (2017). The Impact of Robots on Productivity, Employment and Jobs. URL: https://ifr.org/img/office/IFR_The_Impact_of_Robots_on_Employment.pdf

[14] Krenz A., et al. (2018). Robots, Reshoring, and the Lot of Low-Skilled Workers. University of Sussex. URL: https://www.sciencedirect.com/science/article/abs/pii/S0014292121000970#

[15] Röhl K.H. (2019). Standort Deutschland: Das Kostenproblem wird größer. IW Köln. URL: https://www.iwd.de/artikel/standort-deutschland-das-kostenproblem-wird-groesser-444682/

[16] Atkinson R. (2019). Robotics and the Future of Production and Work. ITIF. URL: https://itif.org/publications/2019/10/15/robotics-and-future-production-and-work/

[17] Dauth W. et al. (2017). The rise of robots in the German labour market. CEPR. URL: https://cepr.org/voxeu/columns/rise-robots-german-labour-market

[18] Gregory T. (2019). Racing With or Against the Machine? Evidence from Europe. IZA. URL: https://docs.iza.org/dp12063.pdf

[19] Stettes O. (2019). Keine Angst vor Robotern – eine Aktualisierung. IW Köln. URL: https://www.iwkoeln.de/studien/oliver-stettes-keine-angst-vor-robotern-eine-aktualisierung.html

[20] Anger C. et al. (2022). MINT-Frühjahrsreport 2022. IW Köln. URL: https://www.iwkoeln.de/studien/christina-anger-enno-kohlisch-oliver-koppel-axel-pluennecke-demografie-dekarbonisierung-und-digitalisierung-erhoehen-mint-bedarf.html

[21] Bild (2022). Forderung der CDU. Roboter sollen in Rentenkasse einzahlen. URL: https://www.bild.de/politik/inland/politik/cdu-fordert-roboter-sollen-unsere-rente-retten-78757866.bild.html

[22] IHK München und Oberbayern (2017). Roboter- oder Maschinensteuer. URL: https://www.ihk-muenchen.de/ihk/17-12-05_Robotersteuer-Pos.pdf

[23] CEBR (2017). The Impact of Automation. URL: https://cebr.com/reports/new-study-shows-u-s-is-world-leader-in-roboticsautomation/impact_of_automation_report_23_01_2017_final

[24] Graetz G., Michaels G. (2015). Robots at Work. Centre for Economic Performance. URL: http://cep.lse.ac.uk/pubs/download/dp1335.pdf

[25] IAB (2017). German Robots. The Impact of Industrial Robots on Workers. URL:

[26] IFR (2021). World Robotics R&D Programs. URL: https://ifr.org/r-and-d

[27] OECD (2022). Gross domestic spending on R&D. URL: https://data.oecd.org/rd/gross-domestic-spending-on-r-d.htm

[28] World Bank (2022). GDP (constant 2015 US$) – China, Germany, Japan, Korea, Rep., United States, European Union. URL: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD?end=2021&locations=CN-DE-JP-KR-US-EU&start=2010

[29] Belitz H. et al. (2015). Wirkung von Forschung und Entwicklung auf das Wirtschaftswachstum. DIW. URL: https://www.diw.de/de/diw_01.c.511167.de/projekte/wirkung_von_forschung_und_entwicklung_auf_das_wirtschaftswachstum.html

[30] Mehr zur Idee der Einführung von Freiheitszonen in Deutschland: Kofner Y. (2021). Special economic zones (SEZ) in Germany: reasons, design and benefits. URL: https://miwi-institut.de/archives/1334

[31] Fuest C. (2018). Steuerpolitik soll Standort stärken und Gewinnverlagerung eindämmen. ifo Institut. URL: https://www.ifo.de/node/43310

[32] Davies R.B. (2020). Patent Boxes and the Success Rate of Applications. CESifo. URL: https://www.cesifo.org/en/publikationen/2020/working-paper/patent-boxes-and-success-rate-applications

[33] Falck O. (2021). Steuern und Innovation. ifo Institut. URL: https://www.ifo.de/publikationen/2021/monographie-autorenschaft/steuern-und-innovation

[34] DIHK (2022). Stellungnahme zur Zukunftsstrategie Forschung und Innovation des BMBF. URL: https://www.bmbf.de/bmbf/de/forschung/zukunftsstrategie/archiv-hts-2025/publikationen/DIHK_stellungnahme_fui.pdf?__blob=publicationFile&v=1

[35] Bimezgane F. (2022). Noch viel Luft nach oben bei der steuerlichen Forschungsförderung. DIHK. URL: https://www.dihk.de/de/themen-und-positionen/wirtschaft-digital/innovation/noch-viel-luft-nach-oben-bei-der-steuerlichen-forschungsfoerderung-77784

[36] Südekum J. (2018). ifo Branchendialog 2018. ifo Institut. URL: https://www.ifo.de/DocDL/sd-2019-01-schricker-ifo-branchen-diaIog-2018-01-10.pdf

[37] Reiter O., Stehrer R. (2021). Learning from Tumultuous Times: An Analysis of Vulnerable Sectors in International Trade in the Context of the Corona Health Crisis. wiiw. URL: https://wiiw.ac.at/learning-from-tumultuous-times-an-analysis-of-vulnerable-sectors-in-international-trade-in-the-context-of-the-corona-health-crisis-p-5882.html

[38] Hollas B. (2021). Artificial intelligence: opportunities and challenges for the German economy. MIWI Institute. URL: https://miwi-institut.de/archives/1056

[39] Pösl T. (2022). Roboterbauer wird komplett chinesisch. Tagesschau. URL: https://www.tagesschau.de/wirtschaft/unternehmen/kuka-china-roboter-hauptversammlung-101.html

[40] Kofner Y. (2019). Digital transformation: Implications for trade policy and economic integration. IIASA. URL: https://previous.iiasa.ac.at/web/home/research/eurasian/11_Digital_transformation_workshop_report.pdf

[41] Rusche C. (2022). Chinesische Beteiligungen und Übernahmen 2021 in Deutschland. IW Köln. URL: https://www.iwkoeln.de/studien/christian-rusche-chinesische-beteiligungen-und-uebernahmen-2021-in-deutschland.html

[42] BMBF (2019). PISA-Studie zeigt: Maßnahmen zur digitalen und zur MINT-Bildung müssen gestärkt werden. URL: https://www.komm-mach-mint.de/news/pisa-studie-2019-mint-bildung

[43] Anger C. et al. (2021). MINT-Frühjahrsreport 2021. IW Köln. URL: https://www.iwkoeln.de/fileadmin/user_upload/Studien/Gutachten/PDF/2021/MINT-Fr%C3%BChjahrsreport_2021_finale_Fassung_27_05_2021.pdf