_ Dr. Evgeny Vinokurov, chief economist, Eurasian Development Bank and Eurasian Fund for Stabilization and Development. Moscow, 12. January 2023.

A new research paper by Vinokurov E. et al. (2022) aims to scrutinize a wide range of solutions that can theoretically replace and/or supplement reserves in traditional reserve currencies.

The freezing of Russia’s reserves was not the first case of such financial sanctions, but it contributed to the ongoing loss of confidence in traditional reserve currencies. Breaches of trust may eventually lead to significant evolution of the international financial system and pave the way for a new system for managing national reserves. Safety will become a priority, so countries will seek to ensure the utmost control over them.

So far, there is no single straightforward solution or instrument to replace traditional currencies and guarantee the safety of assets. Countries can mitigate reserve loss risks through the maximum diversification of accumulation instruments, the fragmentation of reserve functions among instruments, and multi-operator modes of reserve management. The new reserve management system could end up bringing about increased volatility, complexity in management, and higher costs.

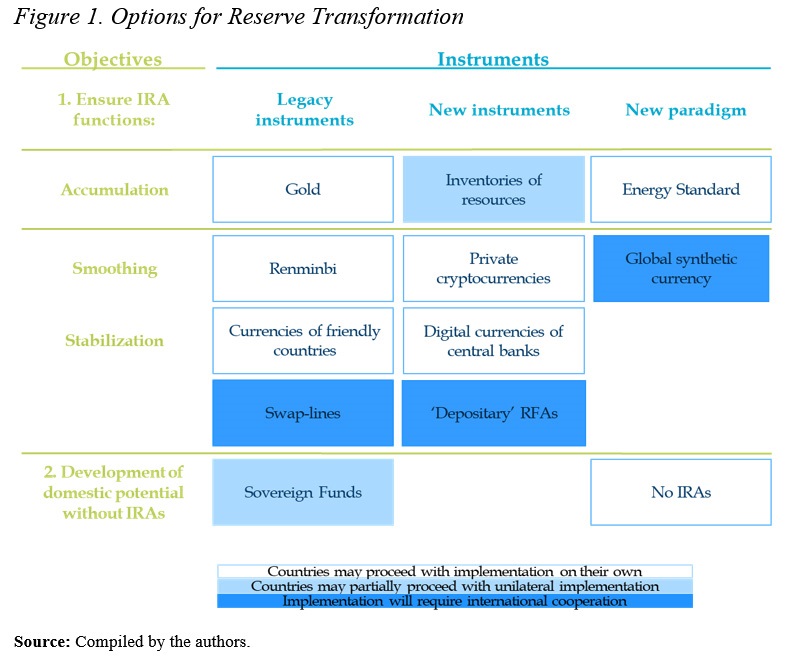

The authors identified 12 available options in total (Figure 1), which can be divided into groups according to their characteristics.

Novelty of instruments: (a) reallocation of funds through investing in other currencies and assets, i.e., in existing instruments; (b) development of new instruments for deploying the funds; (c) a new national and global paradigm of reserve management, changing the nature of reserves instead of the structure.

Functions of IR: (a) accumulation: reserves on the one hand, accrued current account surplus on the other, with their volume inspiring confidence in the solvency of the country and the security of the national currency; (b) smoothing: the liquidity of the reserves has facilitated prompt mitigation of variations in currency supply and demand; (c) stabilization: in crises, reserves were used to cover a balance of payments deficit, external debt repayments, additional capitalization of the banking system, etc.

Number of participating states: (a) some countries may act unilaterally; (b) some groups of countries may coordinate their actions; (c) transformation of the IR management system will go global and involve all countries.

This is the widest set of possibilities, but not all of them will necessarily be put into practice. The specific set of tools can be determined by the country, depending on its objectives.

Overall, the proposed transformation of the reserve management system is likely to advance gradually throughout the 2020s.

The full text of the research paper is available here.