On March 23-24, 2023, the Deutsche Bundesbank held a workshop for budget and finance advisors from the parliamentary groups on current monetary policy issues in Frankfurt am Main. The seminar was attended by MIWI economist Yuri Kofner.

In eight lectures, leading economists spoke on topics such as economic and price developments, EU banking union, the role of the Bundesbank in the Eurosystem, the future of cash, plans to introduce a digital euro and the distribution of wealth in private households in Germany.

The following statements are based on the discussions during the workshop, but reflect the author’s personal assessment and not the official position of the Bundesbank.

From crisis to crisis

The economic data bear witness to clear signs of several problems in the economy. Not only is a decline in international demand for German industrial products recognizable. An unusually high number of sick leave also depressed economic development in 2022… Probably as a result of a weakened collective immune system due to the vaccination campaign or the obligation to wear masks.

The Federal Republic is currently experiencing the sharpest increase in construction costs since 1950 and the willingness to borrow has fallen more sharply than during the 2008 financial crisis. In Germany, around 80 percent of corporate financing is still provided through bank loans. Overall, the GDP will shrink by 0.5 percent in the current year.

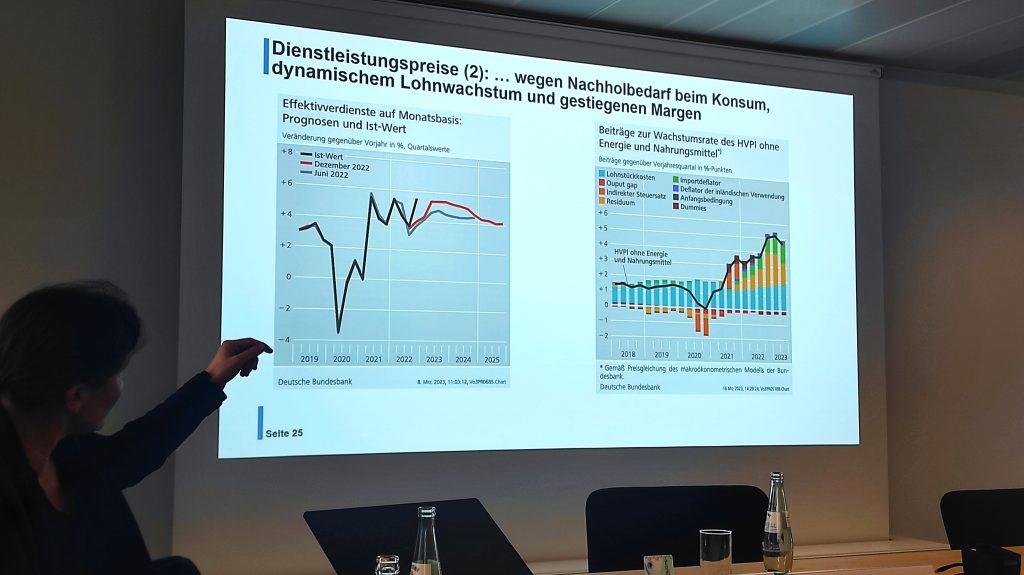

Although unemployment is at an all-time low and the shortage of skilled workers is at an all-time high, the volume of working hours is still significantly lower than before the Corona crisis. This could be explained by an increase in undeclared work or by an unbalanced social and tax system that puts less strain on part-time work than full-time jobs. Unit labour costs rose at an unprecedented rate of 5.7 percent year-on-year in December 2022. The wage-price spiral will account for over a third of an expected inflation rate of 7.3 percent in 2023.

“Woke Capitalism” instead of financial stability?

In a discussion on the current tensions in the banking market and the activation of capital buffers, the central bankers estimated the current Common Equity Tier 1 capital in relation to the risk-weighted assets of systemically important institutions in Germany at 5 percent and for non-systemically important banks at 9 percent. The EU taxonomy poses a threat to financial stability, as some risk-weighted assets will be rated better if and because they are labelled as “green” and “sustainable”.

Cash – coined freedom!

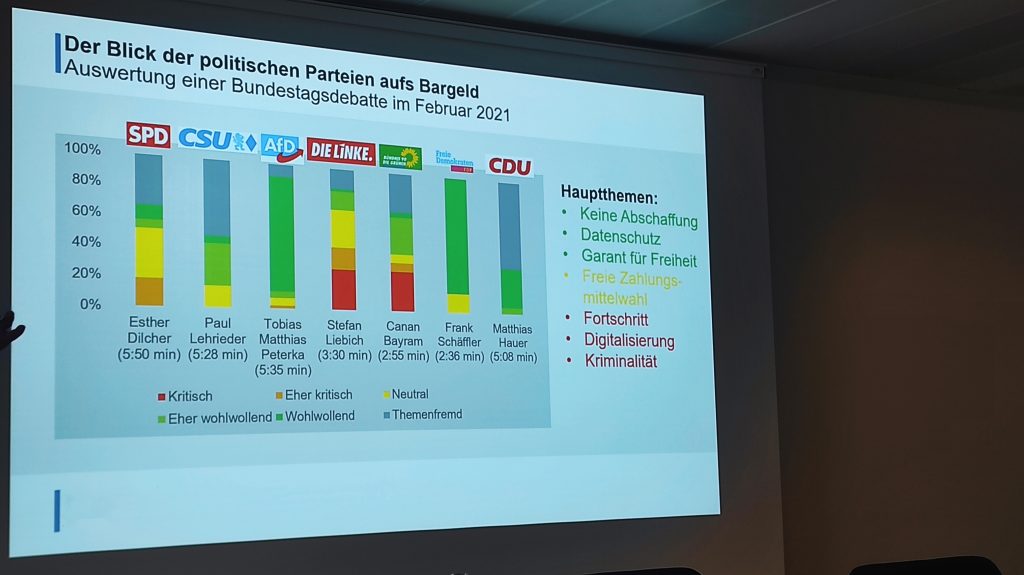

In 2022, the volume of cash in circulation accounted for around 900 billion euros, almost a quarter of German GDP. Almost 60 percent of all transactions in Germany are settled in cash. The vast majority, nearly 70 percent of citizens, support the right to cash; most of them (55 percent) because it “guarantees freedom and anonymity.” In 2021, 7 percent of cash withdrawals were already being made in supermarkets – compared to just 1 percent ten years earlier. Also, Sweden, the frontrunner on issues related to the central bank digital currency (e-krona), recently passed a national law guaranteeing the right to cash. The introduction of upper limits for the use of cash does not reduce the share of the informal economy, as estimates by Professor Friedrich Schneider from the University of Linz show.

Regarding the planned introduction of the digital euro, a Bundesbank economist assured that there were “no plans to control the purchases and deposits of citizens with the e-euro”, but admitted that this was technically possible. Arguments for the digital euro, such as increased “strategic autonomy” of the European monetary system and possible, but not guaranteed, tokenization of payments, did not seem convincing.

Studies from the United States show that a low interest rate policy keeps ineffective companies (zombie companies) in the market longer, and also does not encourage increased investment and innovation through easier access to loans. Instead, the borrowed capital that is acquired is more likely to flow into dividend payments to shareholders.

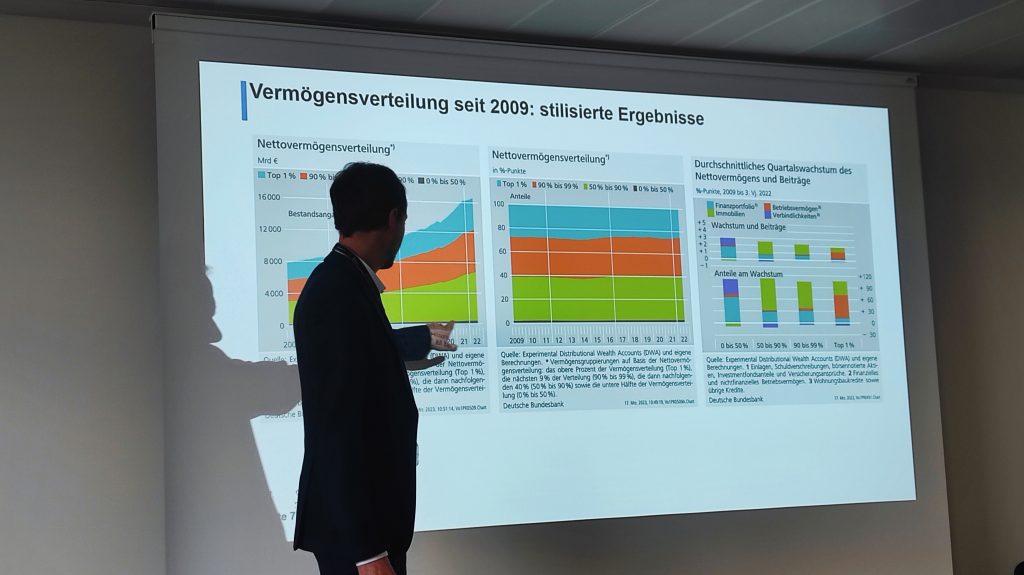

Wealth as working capital in family businesses

In Germany, 50 percent of households own less than a few percent of total assets, four fifths of which only as a financial portfolio, i.e. in savings accounts and deposits. In contrast, the top 1 percent of households own around 30 percent of total wealth. However, a wealth tax would be a bad idea as over a third of that is business wealth, which is vital for economic growth, investment, employment and as a buffer in recessions. Nevertheless, the median wealth of a German household, at 70,800 euros, is lower overall than in other euro countries. This is mainly due to a lower homeownership rate.

Successful exchange, even with the Greens

MIWI researcher Yuri Kofner comments on the importance of the seminar as follows:

“The Bundesbank workshop gave the parliamentary advisors a welcome insight into the latest developments in monetary policy and a wonderful opportunity for scientific exchange with leading economists, for which I would like to thank those responsible. It was also gratifying that a friendly exchange could take place between economic advisors from different parliamentary groups, e.g. AfD, Free Voters, CDU and Greens.”