_ James Cloyne. visiting scholar, Federal Reserve Bank Of San Francisco; Patrick Hürtgen, research economist, Deutsche Bundesbank; Alan M. Taylor, chair in international economics, University of California. CEPR-VoxEU, 6 May 2023.

There is a lively debate about the international transmission of monetary policy, the role of the exchange rate regime, and the role of different central banks for the global cycle. This policy note sheds new light on these issues, focusing on the European Monetary System between 1979 to 1998. It shows that Bundesbank policy spillovers were much stronger in major economies in the European Monetary System with Deutschmark pegs than in economies outside the system with floating exchange rates. Furthermore, compared to monetary spillovers from the US, German spillovers were comparable or even larger in magnitude for both pegs and floats.

How does monetary policy affect the economy at home and spillover abroad? Do spillovers depend on the exchange rate regime? Which countries, as Keynes put it, get to be a “conductor of the international orchestra”? These have long been important questions in international macroeconomics (Eichengreen 1985, Obstfeld et al. 2005), but they gained new salience amid rising concerns that US spillovers may play an outsized role in global monetary and financial outcomes in all economies, advanced and emerging, fixed and floating (Rey 2013, Kalemli-Özcan 2020, Miranda-Agrippino and Rey 2020, Strasser et al. 2021). We contribute to this debate by showing that, in the late 20th century, the ‘international orchestra’ may have had more than one conductor. Germany, as much as the US, shaped economic outcomes for a range of major economies, and with spillover effects aligned with the broad predictions of the trilemma, that is, stronger in pegs than in floats.

In our study (Cloyne et al. 2022), we examine how German and US monetary policies were transmitted to European countries with and without fixed exchange rates to the Deutschmark. According to the ‘international trilemma’, it is impossible to guarantee a fixed exchange rate, free capital movement, and an independent monetary policy at the same time. As a result, Bundesbank’s monetary policy may have a greater impact on countries with fixed exchange rates than those with floating exchange rates. We examine whether this was indeed the case. To do this, one of our novel contributions is to create a new time series of monetary policy shocks for Germany in the spirt of Romer and Romer (2004) for the US. We can then compare the relative importance of German and US monetary policies for these economies over this period.

A new time series of monetary policy shocks from the Bundesbank

One challenge when identifying monetary policy effects is the fact that there is mutual interaction between central bank policy rates and the state of the economy. To unravel this interdependency, following Romer and Romer (2004) for the US, we construct a series of ‘exogenous’ monetary policy surprises by stripping out the predictable systematic component of interest rate changes around policy meetings. A key part of the approach is to try and measure the information set on which policy decisions were made in real time, and then use a first stage regression to remove the systematic component of each policy change. In this context, it is important to bear in mind that interest rate decisions are made on the basis of real-time data that can be revised at later points in time. The information available retrospectively thus differs from the information available at the times when the central bank was required to make its decisions. To accurately measure the information set of Bundesbank policymakers in real time, we examined historical sources from the Bundesbank archive. Specifically, we analysed the minutes for each of the 580 meetings of the Central Bank Council between 1974 and 1998 as well as comprehensive statistical overviews containing real-time data. The component of the key interest rate that is not explained by these real-time data represents our new measure of the monetary policy shock, which we use to investigate the effects of monetary policy in Germany and abroad. In line with other studies (e.g. Romer and Romer 2004), we assume, for simplicity, that the Bundesbank’s reaction function to real-time data is stable throughout the entire period.

The monetary policy effects of the Bundesbank on the German economy

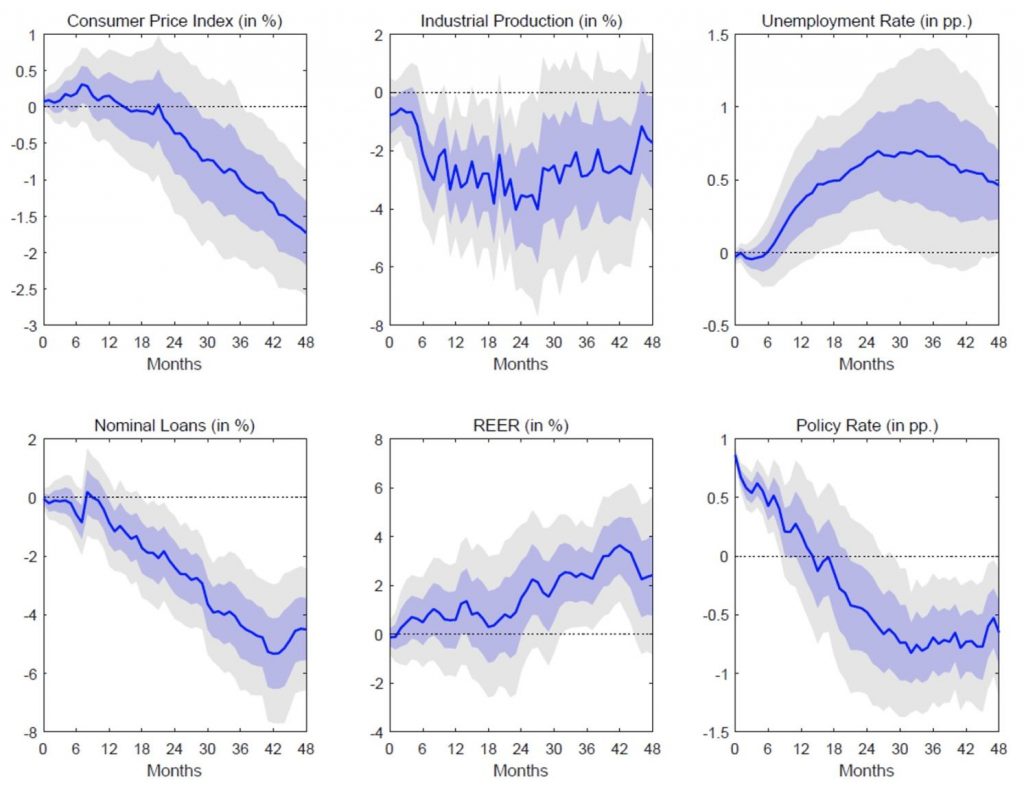

Following an increase in interest rates – an unexpected tightening of the Bundesbank’s monetary policy by 100 basis points – inflation in Germany falls with a lag of a few months. In addition, output declines, unemployment rises, lending decreases, and the Deutschmark appreciates in both nominal and real terms (see Figure 1). Reassuringly, the monetary policy effects in Germany are comparable to those for the US, the UK (Cloyne and Hürtgen 2014), Canada (Champagne and Sekkel 2018), and Norway (Holm et al. 2021). Our new results therefore not only illustrate the monetary policy effects in Germany, but also complement the sparse set of results using the Romer and Romer (2004) approach for other countries.

Figure 1. The macroeconomic effects of a policy rate increase in Germany

Notes: This figure shows the impulse response functions (IRFs) following a 100 basis points rise in the policy rate on a number of key variables for Germany. A rise in the exchange rate means an appreciation. Shaded areas are 95% and 68% confidence intervals.

The spillover effects on European countries depend on their exchange rate regimes

In a second step, we examine the effects of German and US monetary policy on 15 European countries. We separate the countries into those with fixed exchange rates to the Deutschmark and those with floating exchange rates to the Deutschmark, based on a classification that is common in the literature (Ilzetzki et al. 2019). For example, Switzerland and Norway are countries with floating exchange rates, while the currencies of France and the Netherlands were pegged to the Deutschmark. The analysis begins in April 1979, one month after the establishment of the European Monetary System, and ends in December 1998, which is when the Eurosystem began.

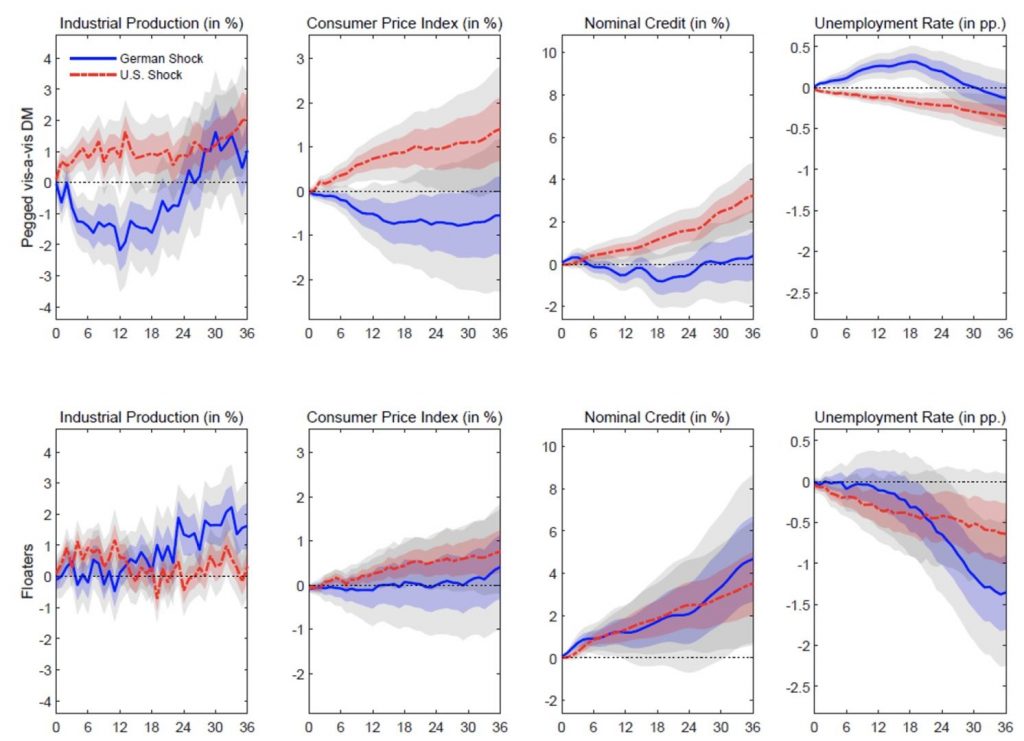

We find that countries with exchange rates fixed to the Deutschmark were influenced by the Bundesbank’s monetary policy to a greater degree than those with floating exchange rates, consistent with the broad predictions of the international trilemma. Figure 2 shows that, as a result of an unexpected tightening of the Bundesbank’s monetary policy, industrial production fell by 2% in countries whose currencies were pegged to the Deutschmark, while those with floating exchange rates did not experience any downturns in their economies (the blue line in the top row compared with the bottom row). Prices and lending likewise fell more sharply in countries whose currencies were pegged to the Deutschmark than in those with flexible exchange rates.

Previous studies, including Miranda-Agrippino and Rey (2020), have examined the role of US monetary policy in the global economic and financial cycle. The Bundesbank also potentially played an important role for a range of large European economies. Because our monetary shocks follow a similar methodology to Romer and Romer (2004) for the US, our analysis allows us to consider the effects of German and US monetary policy jointly for the first time using comparable monetary shock measures. Compared with the spillover effects of a monetary policy shock originating from the US to other countries, the spillover effects from Germany are equally or even more significant (the blue lines compared with the red lines in Figure 2). Thus, the Bundesbank’s monetary policy also played an important role in the international economy during the period under review.

Figure 2 Monetary spillovers to major European economies: Pegs versus floats

Notes: The figure shows the impulse response functions (IRFs) to a 100 basis points rise in the policy rate for the response of key macroeconomic variables depending on whether a country was pegged to the Deutschmark (top row) or whether the exchange rate was floating (bottom row). We show responses to the German policy shock (blue solid lines) and the US policy shock (red dashed line). Shaded areas are 95% and 68% confidence intervals.

Conclusion

In this policy note, we show that the Bundesbank’s monetary policy during the time of the Deutschmark not only had a major impact on the domestic economy, but also had strong spillover effects on neighbouring European countries with fixed exchange rates to the Deutschmark. Our results are thus consistent with the broad predictions of the international trilemma and illustrate that exchange rate regimes play a key role for the spillover effects of monetary policy on other countries.

References

Champagne, J and R Sekkel (2018), “Changes in monetary regimes and the identification of monetary policy shocks: Narrative evidence from Canada”, Journal of Monetary Economics 99: 72–87.

Cloyne, J and P Hürtgen (2014), “Why monetary policy matters: New UK narrative evidence”, VoxEU.org, 15 May.

Cloyne, J, P Hürtgen and A M Taylor (2022), “Global monetary and financial spillovers: Evidence from a new measure of Bundesbank policy shocks”, CEPR Discussion Paper 17587.

Eichengreen, B (1985), The Gold Standard in Theory and History, New York: Methuen.

Holm, M B, P Paul and A Tischbirek (2021), “The Transmission of Monetary Policy under the Microscope”, Journal of Political Economy 129(10): 2861–2904.

Ilzetzki, E, C M Reinhart and K S Rogoff (2019), “Exchange Arrangements Entering the 21st Century: Which Anchor Will Hold?”, Quarterly Journal of Economics 134(2): 599-646.

Kalemli-Özcan, S (2020), “U.S. monetary policy, international risk spillovers and policy options”, VoxEU.org, 16 January.

Miranda-Agrippino, S and H Rey (2020), “U.S. Monetary Policy and the Global Financial Cycle”, The Review of Economic Studies 87(6): 2754-2776.

Obstfeld, M, J C Shambaugh and A M Taylor (2005), “The Trilemma in History: Tradeoffs Among Exchange Rates, Monetary Policies, and Capital Mobility”, Review of Economics and Statistics 87(3): 423–438.

Rey, H (2013), “Dilemma not Trilemma: The global financial cycle and monetary policy independence”, VoxEU.org, 31 March.

Strasser, G, L Stracca, M Jarocinski, G Georgiadis, L Dedola and M Ca’ Zorzi (2021), “Making waves: Fed spillovers are stronger and more encompassing than the ECB’s”, VoxEU.org, 25 May.

Romer, C D and D H Romer (2004), “A New Measure of Monetary Shocks: Derivation and Implications”, American Economic Review 94(4): 1055-1084.

* Republished from the original publication on VoxEU in accordance with their copyright rules.