_ Leandro Prados de la Escosura, emeritus professor, Universidad Carlos III De Madrid; research associate, CAGE University Of Warwick. VoxEU – CEPR. 7 July 2023.*

Economic liberty implies the absence of coercion and interference in the actions of economic agents. The evolution of economic freedom and its dimensions have only occasionally been explored. This analytical note offers new estimates spanning 1850–2020 for 21 OECD countries, revising previous estimates. Long-run gains in economic freedom over the last 170 years were interrupted by the two World Wars. Economic freedom peaked by 2000 and has declined in the early 21st century. International openness has been the main driver of economic freedom over time, especially from 1950 onwards.

***

Economic liberty is a negative freedom that implies the absence of coercion and interference in the actions of economic agents. The connections between different facets of economic freedom, such as property rights, international liberalisation, and regulation, on the one hand, and innovation, growth, inequality, and institutional change, on the other, have often been addressed in the economic literature (Vannoni and Morelli 2021, Moxnes et al. 2016, Gancia and Epifani 2008, Coricelli and Campos 2009, Senik and Grosjean 2007). However, only occasionally have the long-run impact of economic freedom and its dimensions been addressed.

The lack of quantitative estimates of economic freedom helps explain this. The Fraser Institute (2023) and the Heritage Foundation (2023) provide indices of economic freedom from 1970 and 1995, respectively, but the long view has been lacking. A few years ago, I constructed a retrospective index of economic freedom for a group of present-day advanced countries inspired by the Fraser index (Prados de la Escosura, 2014, 2015, 2016).

In a recent paper (Prados de la Escosura 2023), I offer new estimates of economic freedom, spanning 1850–2020 for the same sample of 21 countries, that result from a thorough revision of my previous estimates. Given the large share of world economic activity represented by the country sample, this historical retrospect captures the evolution of economic freedom well beyond the OECD club.

Assessing economic liberty and its dimensions is hampered by unavoidable discretional decisions in the choice and transformation of variables (de Haan 2003). A widely shared view is that the more a society relies on the market and the less on government intervention, the larger its economic freedom. However, freedom of economic activity implies “freedom under the law, not the absence of all government action” (Hayek 1960: 193). In fact, the government, as a provider of protection to the individual from coercion, is essential for economic liberty (Friedman 1962). It is the nature of government action, rather than how active the government is, that is at stake. Hence, the size of government should not be considered a dimension of economic freedom.

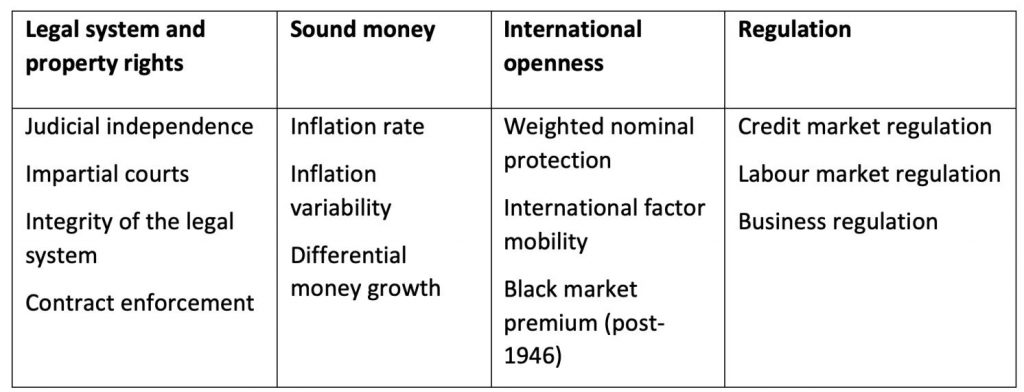

Table 1. Dimensions of the Historical Index of Economic Liberty and their components

The Historical Index of Economic Liberty follows the Fraser index and considers the legal system and property rights, sound money, international openness, and regulation as its dimensions, but not the size of government. The reduced forms chosen for each dimension are consistent over space and time. Table 1 presents the Historical Index’s dimensions and their components that are combined into an aggregate index as an unweighted average.

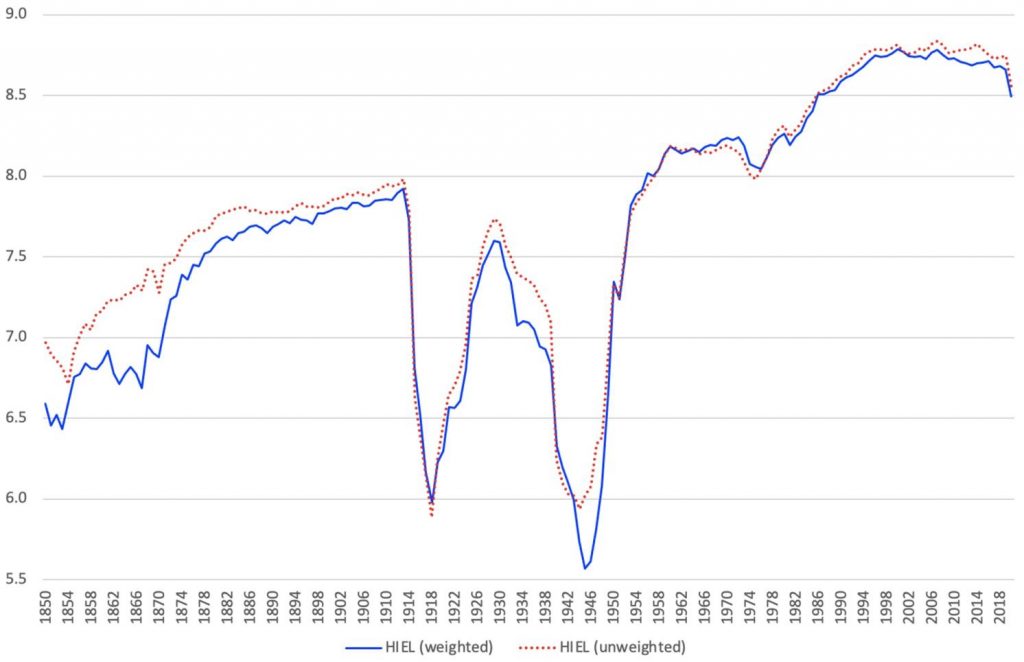

Figure 1. Historical Index of Economic Liberty: Unweighted and weighted average

Source: Espacioinvestiga (2023).

Long-run gains in economic freedom have been achieved over the last 170 years, amounting to three-fifths of the potential maximum, but its progress was far from steady, as the world wars broke the series in distinct phases. Substantial gains took place from 1850 to 1913 and, again, during the second half of the 20th century (39% and 37% of its potential maximum, respectively). Economic freedom peaked by 2000 and stagnated and declined in the early 21st century.

The new aggregate Historical Index confirms the long-run improvement in economic freedom of the old index, although the improvement is now seen to be smaller than was indicated. The new and old indices present, nonetheless, remarkable differences. For example, in the new index, the 1913 peak was reached again in the mid-1950s and economic freedom continued to improve until the end of the 20th century and stagnated thereafter; in the old index, the 1913 peak was not surpassed until the early 1990s. Moreover, the intensity of the shrinking and recovering phases of economic freedom is much milder now.

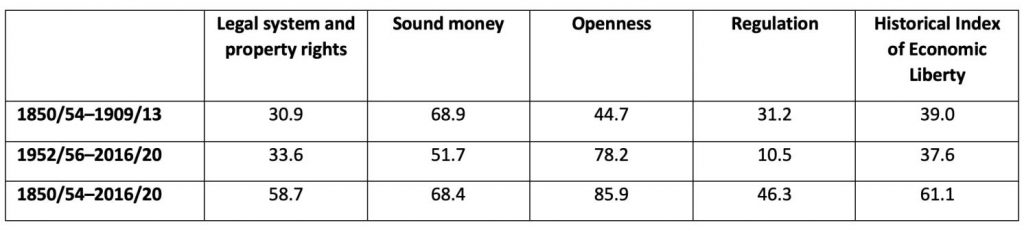

Each dimension of economic freedom exhibits distinctive behaviour, contributing differently to the performance of the Historical Index over time. International openness has been the main driver of economic freedom over time, especially from 1950 onwards, unlike my earlier estimates in which the main contributor was property rights. Sound money was the main dimension 1850–1913 (Table 2).

Table 2. Drivers of economic freedom in the OECD 1850–2020: Shortfall reduction (percent, population-weighted)

But how representative are these results? The fact is that the discrepant behaviour of individual countries from aggregate trends was exceptional. The size of countries’ relative reductions in shortfall is related to their initial levels, so we observe mild long-term β convergence, though mostly concentrated in the post-1950 era. In terms of dispersion, the Historical Index country series present long-run σ convergence, broken by the reversals during the world wars and their aftermath. The stability of the country ranking (Table 3) and the observed degree of β and σ convergence indicate that the distance between countries’ levels of economic freedom narrowed.

Table 3. Ranking of economic freedom in OECD countries

Source: Espacioinvestiga (2023).

Interestingly, these results do not support the widespread view that common-law institutions tend to be more supportive of economic freedom than civil-law institutions. Canada, New Zealand, and the UK, countries of common-law tradition, certainly achieved higher levels of economic freedom than southern European countries, but not higher than those of north-western Europe, and Scandinavia in particular.

References

Coricelli, F, and N Campos (2009), “Financial liberalisation and democracy: The role of reform reversals”, VoxEU.org, 6 August.

Fraser Institute (2023), Economic freedom of the world.

Friedman, M (1962), Capitalism and freedom, Chicago: University of Chicago Press.

Gancia, G, and P Epifani (2008), “Why does trade liberalisation raise wage inequality worldwide?”, VoxEU.org, 7 October.

de Haan, J (2003), “Economic freedom: Editor’s introduction”, European Journal of Political Economy 19: 395–403.

Hayek, F (1960), The constitution of liberty, London: Routledge.

Heritage Foundation (2023), 2023 index of economic freedom.

Moxnes, A, K H Ulltveit-Moe, and F Coelli (2016), “Better, faster, stronger: How trade liberalisation fosters global innovation”, VoxEU.org, 21 November.

Prados de la Escosura, L (2023), “Economic freedom in retrospect”, CEPR Discussion Paper 18187.

Prados de la Escosura, L (2016), “Economic freedom in the long run: Evidence from OECD countries (1850–2007)”, Economic History Review 69(2): 435–68.

Prados de la Escosura, L (2015), “A new historical database on economic freedom in OECD countries”, VoxEU.org, 23 November.

Prados de la Escosura, L (2014), “Economic liberty in the long run: Evidence from OECD countries”, VoxEU.org, 7 April.

Senik, C, and P Grosjean (2007), “Should market liberalisation precede democracy? The citizens’ point of view”, VoxEU.org, 23 August.

Vannoni, M, and M Morelli (2021), “Regulation and economic growth: A ‘contingent’ relationship”, VoxEU.org, 29 March.

* Republished from the original publication on VoxEU in accordance with their copyright rules.