_ Yuri Kofner, economist, MIWI-Institute for Market Integration and Economic Policy. Munich, 30 January 2024.

Summary

- German net payments account for 51 per cent of net transfers to the EU budget.

- The EU costs Germany up to 206 billion euros gross every year. By 2030, it will cost the German economy up to 670 billion euros gross per year.

- The direct and indirect costs of the EU cancel out the economic benefits of the European Union for Germany. With the implementation of the Green Deal by 2030, membership of the EU will cost the German economy a net 12 per cent of GDP.

- The AfD wants to initiate a referendum on Dexit.

- Dexit means that the AfD wants to retain the best core elements of European integration such as the single market, the customs union, research cooperation, etc., but wants to get rid of all harmful aspects such as the euro, over-centralisation, interventionism, fiscal and debt union, bureaucratic monsters, etc.

- Dexit can therefore be understood as replacing the EU with a more liberal “European Prosperity and Interest Community” (EPIC). According to the motto: “Doing less, more efficiently”.

- The net economic benefit of Dexit for Germany would amount to at least 4.6 per cent of GDP, on average more likely 5.8 per cent. Dexit, understood as the replacement of the EU by the EPIC, would make every German 2,700 euros wealthier.

- After Brexit, the British economy performed better than Germany in key areas such as economic growth, capital flows and trade.

False claims by the political caste

Regarding the AfD’s call for a “Dexit”, the politicians of the cartel parties, the system media and the court economists keep repeating the same fake narratives: [1]

False claim 1: By calling for a “Dexit”, the AfD wants to leave the EU completely and the AfD has no concept for an alternative version of the European community of states.

False claim 2: The EU only has advantages for the German economy, or the economic advantages of the EU for Germany far outweigh its disadvantages.

False claim 3: “Dexit” would have serious detrimental effects on the German economy.

False claim 4: “Brexit” has only harmed the British economy.

These false claims can be refuted with the following three arguments:

Fact 1: Dexit means replacing the EU with the European Prosperity and Interest Grouping (EPIG)

The AfD wants to hold a national referendum on leaving the EU. An AfD federal government would only enter into further negotiations in the event of a positive popular majority in favour of Dexit [2].

Germany accounts for 51 percent of net contributions to the EU budget (2022) and 20 percent of EU customs revenues. If Germany were to withdraw completely, the financing of the EU would collapse. Dexit must therefore be seen as the ultimate leverage for an AfD federal government [3].

The AfD’s real goal is to replace the patronising European Union with a more liberal European Prosperity and Interest Community (EPIC)[4].

***

The EPIC will keep the positive core elements of European integration:

- Common internal market for goods

- Customs union for goods

- Existing free trade agreements for goods with third parties

- Cooperation in research and development

***

The EPIC will largely retain certain aspects of European integration, but will reform them to better reflect (German) national interests:

- Protection of external borders

- Common internal market for services

- Common internal market for banks and capital

- Common internal market for internal labour migration

- Regulation of national tenders

- Existing deep and comprehensive free trade agreements with third parties (in relation to services, capital, labour; e.g. with Canada and the Eastern Partnership countries)

A subsequent deepening of cooperation in these areas is possible between economically similarly developed member states (e.g. Germany, France, the Netherlands) if they are willing to do so and fulfil the necessary economic requirements. This corresponds to the model of European integration of “different speeds”, “concentric rings” and “country clubs”[5].

***

The EPIC will abolish the negative aspects of supranational EU centralisation and return them to the national level:

- Euro and single monetary policy

- All net transfers (fiscal union) except for research cooperation

- Common agricultural policy

- Joint debt

- Common social policy (e.g. common unemployment insurance)

- Common industrial policy (e.g. ban on the internal combustion engine)

- Common energy and climate policy (e.g. common heating and insulation regulations)

- Common sanctions policy

In this sense, the AfD’s “Dexit” demand aims to achieve nothing other than the implementation of scenario Four “Doing less, more efficiently” from the European Commission’s 2017 White Paper on the future of the European Union[6].

***

Argument 2: The EU is very costly for Germany, a Dexit would boost the German economy

Advantages of the current EU for Germany

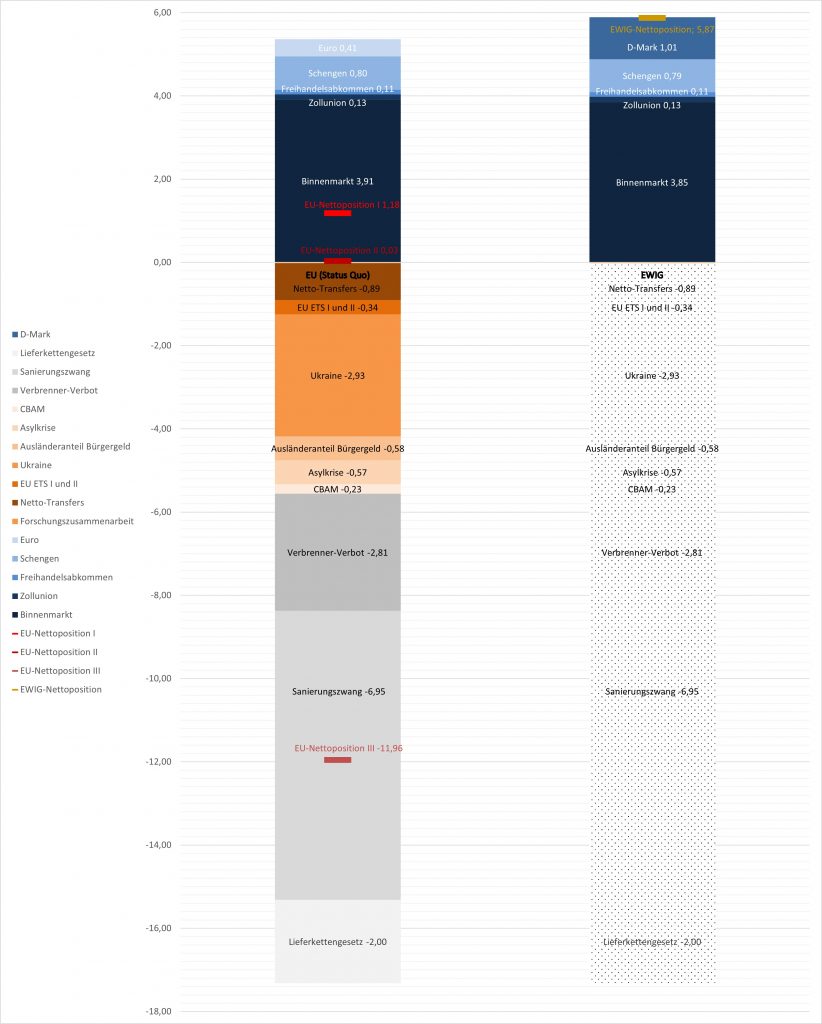

The positive aspects of the European Union contribute 5.36 percent to Germany’s GDP, [7] but the core elements of European integration – the single market (3.91 percent) and the customs union (0.13 percent) – which the AfD wants to retain anyway, make up the largest part of this contribution: 4.04 percent of GDP.

Aspects of European integration that should be largely retained but reformed, such as the free trade agreements with third countries (0.11 percent) and the Schengen area (0.80 percent), only contribute 0.91 percent to German GDP.

The single currency, the euro, which the AfD wants to leave, is good for German trade within the eurozone due to the lack of transaction costs. Nevertheless, the euro only has a small positive gross effect of 0.40 percent on German GDP.

Disadvantages of the current EU for Germany

In reality, the costs of the EU’s over-centralisation and supranationalisation for Germany are immense.

German net transfers to the EU budget and German net liabilities for the NGEU “Corona” fund cost 0.89 per cent of German GDP [8].

A Germany governed by an AfD federal government in the national interest would not have to bear many of the costs incurred by EU regulations in areas such as “green transformation”, mass immigration and sanctions. Depending on the extent to which the problems in various policy areas are attributed to EU regulations, the greater the total costs of the EU for the German economy can be estimated.

These range from problems that are directly and immediately related to EU regulation, such as: ETS I, i.e. EU certificate trading and ETS II, the CO2 levy (0.34 per cent of GDP), [9] as well as sanction costs, financial aid and increased energy costs due to obligations to Ukraine and the United States (2.93 per cent) [10].

Furthermore, they include current problems that would not have the scale they currently have without joint commitments and state failure at EU level. This applies above all to the migration and asylum crisis, which represent an immense burden on the domestic economy in the form of exploding expenditure on foreigners receiving citizens’ benefits, so-called “Bürgergeld” (0.58 per cent of GDP) [11] and expenditure on asylum benefits (0.57 per cent)[12], among other things.

Ultimately, this also includes the enormous costs that Germany is likely to incur in the coming years as a result of European Commission policy requirements, such as: the CBAM, i.e. the CO2 border adjustment (0.23 per cent), [13] the EU ban on the combustion engine (2.93 per cent), [14] the EU obligation to renovate buildings and the EU ban on fossil heating systems (6.95 per cent), [15] and the EU supply chain regulation (2 per cent of GDP) [16].

In its current form, the EU costs the German economy between 4.18 and 5.33 per cent of GDP in gross terms and up to 17.32 per cent in the near future! If all these costs are deducted from the aforementioned benefits, the net gain to the German economy from EU membership is not 5.36 per cent of GDP, but only 1.18 per cent, if only the direct and immediate costs are taken into account. The net EU benefit for Berlin is zero (0.03 per cent) if the costs of the migration crisis exacerbated by EU policy are included. If the costs of the upcoming EU sustainability regulation are added, the EU actually costs the German economy a whopping 12 per cent of GDP per year in net terms!

Economic benefits of Dexit: reform of the EU into an EMIG

Under the fixed exchange rate system in the eurozone, German exports are undervalued and imports to Germany are overvalued. Leaving the euro in favour of the Deutschmark would make German exports relatively more expensive, but imports to Germany cheaper. Ultimately, the second effect will be greater, which will make imports of raw materials and intermediate products significantly cheaper for German industry. This will lead to re-industrialisation and increase German GDP by 1.01 percent [17]

Stopping Germany’s net contributions to the EU budget would mean an end to EU subsidies for the recipient states (known as EU cohesion policy). However, this in turn would only slightly reduce demand from other EU member states for German exports. As a result, the above-mentioned benefit of the common internal market would be reduced only slightly to 3.85 per cent of GDP (a decrease of only 0.06 percentage points), while the benefit of the Schengen area would decrease by a negligible 0.01 percentage points. [18]

The cost of joint European research projects, an area of cooperation that the AfD would maintain, currently amounts to only 0.02 per cent of GDP. [19]

***

The reform of the European Union towards the EPIC called for by the AfD would mean eliminating all negative aspects of the current EU – supranationalist centralisation, monetary policy manipulation by the ECB, massive fiscal transfers and joint debt at the expense of German taxpayers, crippling overregulation and (industrial) policy interventionism, etc. – while retaining the key positive elements of European integration: the single market, the customs union, free trade agreements with third parties and research cooperation.

As a result, particularly due to the above-mentioned exchange rate effect of returning to a national currency, the net benefit of Dexit in terms of replacing the EU with the European Prosperity and Interest Community (EPIC) would amount to 5.87 per cent of GDP for the German economy – an increase of between 4.69 and 17.83 percentage points compared to the current status quo! In other words, a Dexit in the direction of the EPIG would make every German citizen between 2,150 and 8,200 euros wealthier each year (Diagram 1).

Other disadvantages of the EU that are difficult to quantify

It should also be noted that there are many negative aspects of the current EU integration, but their impact on the German economy is much more difficult to quantify.

For example, comprehensive studies would have to be carried out on the possible effects of leaving the euro in favour of a new Deutschmark. On the one hand, there is controversy among economists as to what impact the TARGET-II claims totalling 1.2 trillion euros in 2022 would have on the domestic banking sector in the event of an exit from the euro.[20] On the other hand, regaining national sovereignty in monetary policy would have a significant positive impact on the banking sector: In 2022, German savers lost almost 400 billion euros due to the negative real interest rate (7.9 per cent inflation rate vs. 0.6 per cent averaged ECB key interest rate). [21] An independent Bundesbank would have set a significantly higher key interest rate and thus prevented German savings from losing interest value in real terms.

And then there are the countless and ever-increasing bureaucratic monsters that the EU is imposing on Germany, whose enormous economic costs are obvious but not so easy to calculate. Examples of this include the sustainability taxonomy, the Corporate Sustainability Reporting Directive (CSRD Directive), the stricter Verification Law, the Eco-Design Directive, the stricter Whistleblower Protection Law and so on.

Argument 3: The British economy performed better after Brexit than before and better compared to Germany

Critics of the AfD are trying to talk down Dexit by comparing it to Brexit and arguing that leaving the EU was supposedly bad for the British economy. However, the opposite is the case.

Although the Brexit referendum was in 2016, the actual exit from the EU did not take place until four years later, in January 2021. Since then, British economic indicators have been better – both compared to the years before Brexit and compared to those of Germany, which remained in the EU.

Despite leaving the European customs union, average yearl trade volumes between the UK and the EU was 13 per cent higher in the period 2021-2023 than in 2016-2020, and even exports from the island to the mainland were 12 per cent higher than before Brexit. [22]

In the three years after Brexit, net capital flows from both Germany and the UK were negative, i.e. both countries appear to be deindustrialising, although average quarterly net capital outflows from Germany were 12 percent higher than those from the UK.[23]

In the decade before Brexit, the GDP growth rates of both countries were roughly the same. However, the UK’s annual GDP growth rate after Brexit (2021-2023) was on average 2.6 percentage points higher than that of Germany – the sick man of Europe. The IMF expects the UK economy to grow by 1.9 per cent each year between 2024 and 2028, while the German economy is only expected to grow by 1.5 per cent.[24]

Looking at just these three key indicators, we can see that, contrary to publicised opinion, the UK has performed better economically post-Brexit and certainly better than Germany, which is still part of the EU.

Diagram 1: Welfare effect of Dexit for Germany: EU vs. EPIC

Source: Own calculations. Benefits, costs and net positions in relation to German GDP. All data from 2022.

Sources

[1] Z.B. Tutt C. (2024). Schlechte Idee von rechts: Warum ein EU-Austritt Deutschland schaden würde. WiWo. URL: https://shorturl.at/osz28

[2] Zeise S. (2024). Alice Weidel fordert Referendum über EU-Austritt. Berliner Zeitung. URL: https://shorturl.at/gmBO6

[3] SZ (2024). AfD-Vorsitzende Weidel sieht „Dexit“-Referendum als Plan B. URL: https://shorturl.at/HQ047

[4] Auf Englisch: European Prosperity and Interest Community (EPIC). Mögliche Wahlkampfslogans: “Let’s make Europe EPIC again!” und “Eure EU hat fertig. Unser Europa ist EWIG.“

[5] Stehn J. (2017). Das Kern-Problem der EU. IfW Kiel. URL: http://tinyurl.com/ycxtn24c

[6] European Commission (2017). White Paper on the Future of Europe. URL: https://shorturl.at/rLSZ1

[7] Felbermayr G. et al. (2019). Die (Handels-)Kosten einer Nicht-EU. IfW Kiel. URL: https://shorturl.at/eBSVW

[8] Busch B. et al. (2023). Wohin fließt das Geld aus dem EU-Haushalt? Nettozahler und Nettoempfänger in der EU. IW Köln. URL: https://shorturl.at/wDH35

[9] Umweltbundesamt (2023). Rekordeinnahmen im Emissionshandel: Über 13 Milliarden Euro für den Klimaschutz. URL: https://shorturl.at/erGO3

[10] IfW Kiel (2024). Ukraine Support Tracker. URL: http://tinyurl.com/mr2y3eva | Lauer K. et al. (2023). Ukraine war expected to cost Germany 160 billion euros by year-end. Reuters. URL: http://tinyurl.com/y59jujrm

[11] Bundesagentur für Arbeit (2024). Migrationsmonitor – Deutschland und Länder. URL: https://rb.gy/0m2m36 | Bundesagentur für Arbeit. (2023). Ausgaben für Leistungen nach dem SGB II (Hartz IV) von 2010 bis 2022 (in Milliarden Euro). URL: http://tinyurl.com/4kjsbpwx

[12] Deutscher Bundestag. (2023). Höhe der Kosten des Bundes in Deutschland für Flüchtlinge und Asyl von 2022 bis 2027 (in Milliarden Euro). URL: http://tinyurl.com/3s4j7r99 | Statistisches Bundesamt. (2023). Nettoausgaben für Asylbewerberleistungen in Deutschland nach Bundesländern im Jahr 2022 (in Millionen Euro). URL: http://tinyurl.com/4d4dj464

[13] European Commission (2021). Proposal for a regulation of the European Parliament and of the Council establishing a carbon border adjustment mechanism. URL: http://tinyurl.com/4ym9a6kz

[14] Falck O. et al. (2017). Auswirkungen eines Zulassungsverbots für Personenkraftwagen und leichte Nutzfahrzeuge mit Verbrennungsmoto. ifo Institut. URL: http://tinyurl.com/2pvt4b66

[15] Haufe (2023). EU-Sanierungspflicht: Nur teuer oder auch gewinnbringend? URL: http://tinyurl.com/3z7s3z4w | Schäfer J.W. (2023). Neue Schock-Rechnung zum Heiz-Hammer. Bild. URL: https://www.bild.de/politik/inland/politik-inland/kosten-fuer-mieter-und-eigentuemer-drohen-zu-explodieren-neue-schock-rechnung-zu-83937928.bild.html

[16] Felbermayr G. et al. (2021). Chancen und Risiken eines Sorgfaltspflichtengesetzes. IfW Kiel. URL: http://tinyurl.com/2px38xwp

[17] Kofner J. (2021). Wohlfahrtseffekte des DEXIT: D-Mark und Europäische Wirtschaftsgemeinschaft 2.0. MIWI Institut. URL: http://tinyurl.com/4t4zwk46

[18] Ibid.

[19] Schiermeier Q. (2020). Horizon 2020 by the numbers: how €60 billion was divided up among Europe’s scientists. Nature. URL: http://tinyurl.com/2h7659a4

[20] Deutsche Bundesbank. (2024). Target2-Salden der Deutschen Bundesbank von Dezember 2019 bis Dezember 2023 (in Millionen Euro). URL: http://tinyurl.com/ynbrhcht | Sinn H.W. (2019). Der Streit um die Targetsalden. ifo Institut. URL: http://tinyurl.com/mrxu5j94

[21] Stappel M. (2022). Trotz Zinswende: Hohe Inflation sorgt für 395 Milliarden Euro Kaufkraftverlust beim Geldvermögen. DZ Bank. URL: https://t.ly/v2M8f

[22] Office for National Statistics (UK). (2023). Value of trade in goods with the European Union in the United Kingdom from 1st quarter 1997 to 3rd quarter 2023 (in million GBP). URL: https://shorturl.at/cstW5

[23] OECD (2024). FDI main aggregates, BMD4. URL: https://t.ly/PVhJH

[24] IMF. (2023). Germany: Growth rate of the real gross domestic product (GDP) from 2018 to 2028 (compared to the previous year). URL: https://t.ly/xxfjI | IMF. (2023). United Kingdom: Real gross domestic product (GDP) growth rate from 2018 to 2028 (compared to the previous year). URL: https://t.ly/Iin5q | World Bank (2024). GDP growth (annual %) – United Kingdom, Germany. URL: https://shorturl.at/egkTU

One comment