_ Matthias Kullas, Dr. Sc., Head of Division, Centrum für Europäische Politik (cep); Karen Rudolph, Policy Analyst, cep; Muhammed Elemenler, Policy Analyst, cep. Freiburg, December 2019.

Impact of transfers from EU budget, financial assistance institutions and the European Investment Bank.

Redistribution between the Member States of the European Union

The study calculates redistribution between the EU countries, between 2008 and 2017¹ through the EU budget, financial assistance institutions and the European Investment Bank (EIB).² The figures illustrate the advantages and disadvantages of EU membership in just one area. Thus, the fact that a country is a net contributor to the EU budget, or is liable by way of financial assistance for the debts of other Member States, does not mean that EU membership or the introduction of the euro is disadvantageous for the Member State in question. The absolute figures for the ten-year period as well as the annual average per capita results are indicated for every Member State. The annual average per capita results significantly relativize the absolute figures.

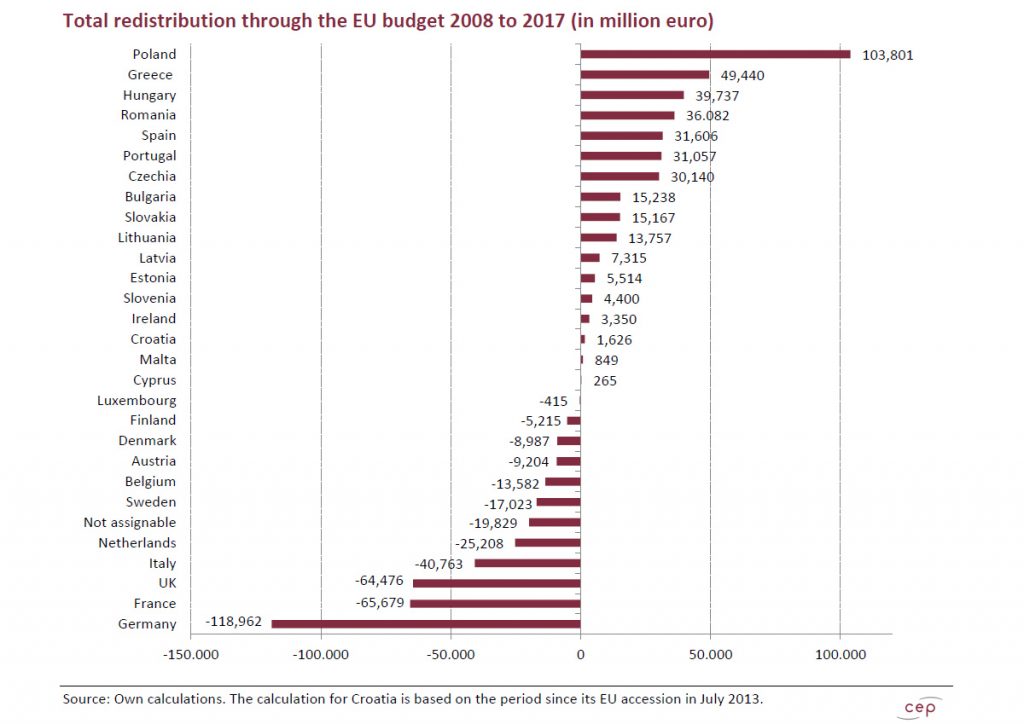

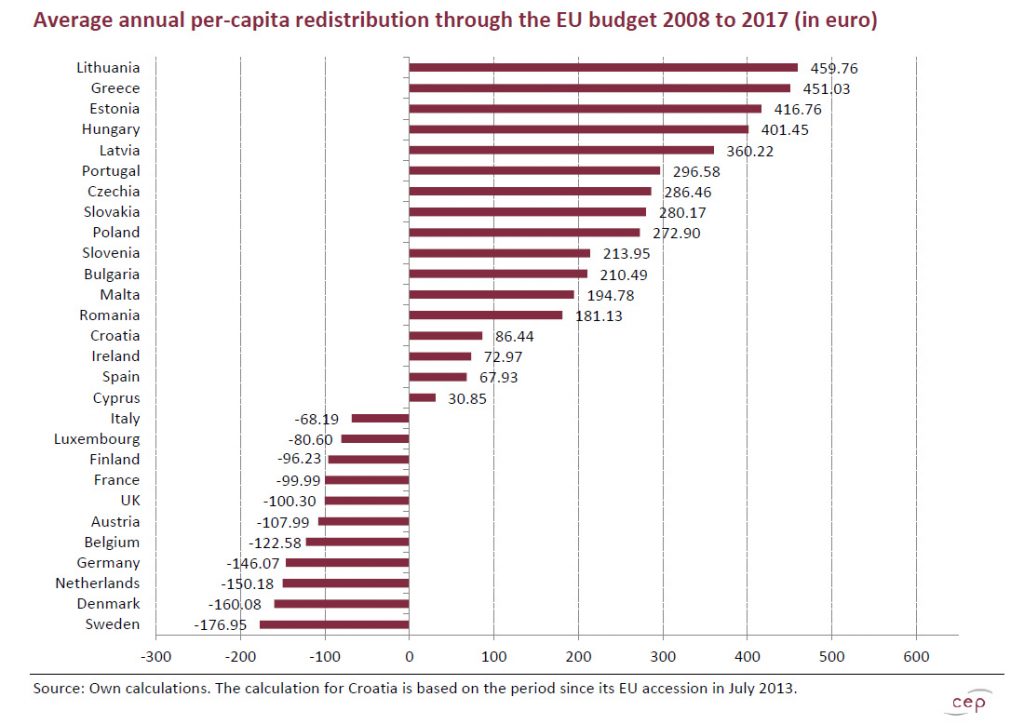

Redistribution through the EU budget

The EU budget is largely financed by contributions from the Member States out of national budgets. These represent a financial burden for the Member States. Funds from the EU budget for measures in the Member States, on the other hand, relieves the burden on national budgets assuming that the Member States are saved from the corresponding amount of national expenditure. Redistribution takes place where, on balance, a Member State receives more or less funds from the EU budget than it contributes to the EU budget.

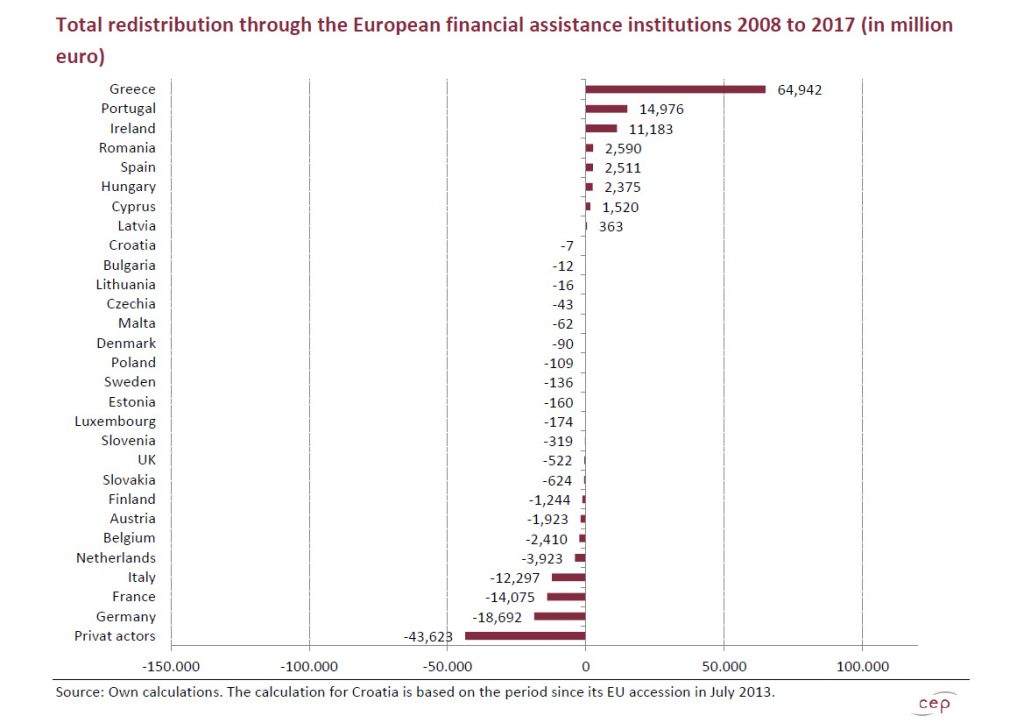

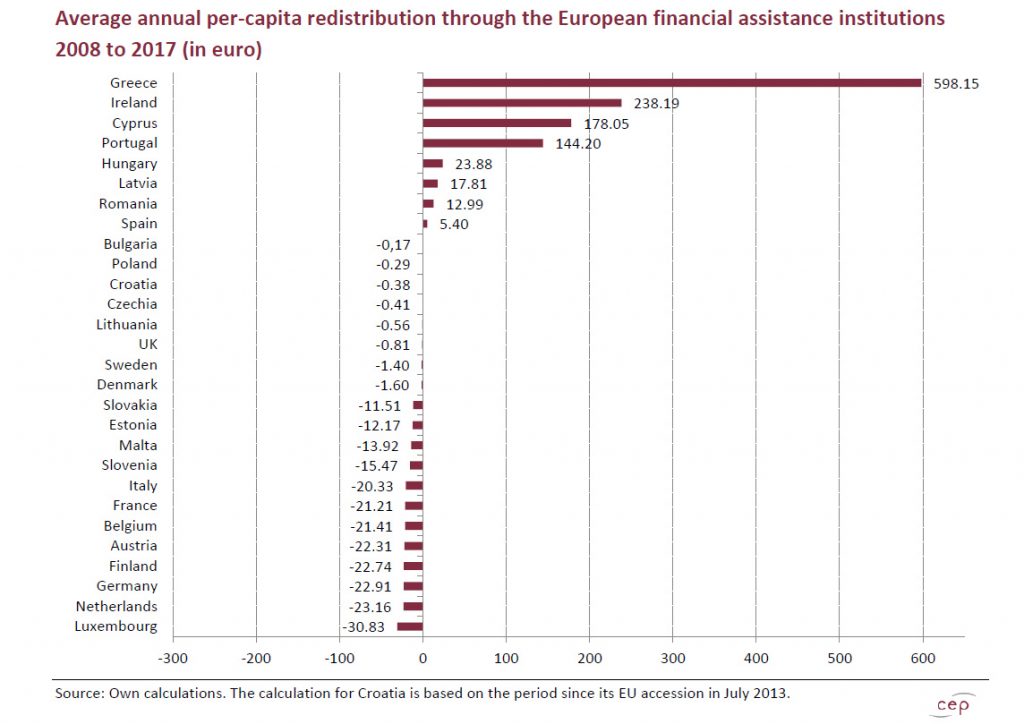

Redistribution through the European financial assistance institutions

Financial assistance, for Member States that are at risk of insolvency, has so far been paid to non-euro countries via the “balance of payments facility” (Art. 143 TFEU) and to eurozone countries by way of bilateral loans, the European Financial Stabilisation Mechanism (EFSM), the European Financial Stability Facility (EFSF) and the European Stability Mechanism (ESM). Redistribution in favour of the recipient country arises where the actual interest rate is below the market interest rate. Conversely, the Member States that guarantee the financial assistance are burdened because the actual interest rates do not adequately cover the default risk. In pricing the default risk, we took account of the fact that, de jure or at least de facto, financial assistance institutions – with the exception of EFSF – are preferred creditors.

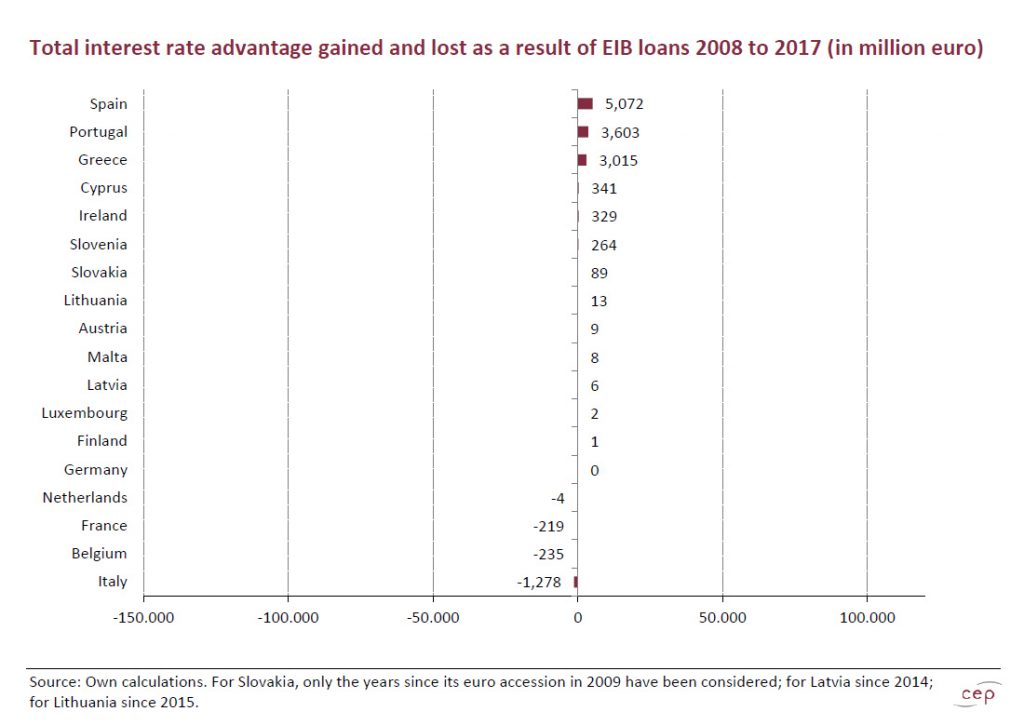

Redistribution through the European Investment Bank

In order to calculate redistribution through the EIB, we first determined the share of EIB loans in each Member State. If the share was higher than the EIB capital share of the respective Member State and EIB loans are cheaper than those of the national development bank, the Member State benefited. Whereas Member States that have received fewer EIB loans than their EIB capital share and EIB loans are cheaper than those of the national development bank, are missing out on the interest rate advantage. Since EIB borrowers are private actors, a redistribution through the EIB does not result directly in an increase or reduction in the burden on the public budget.

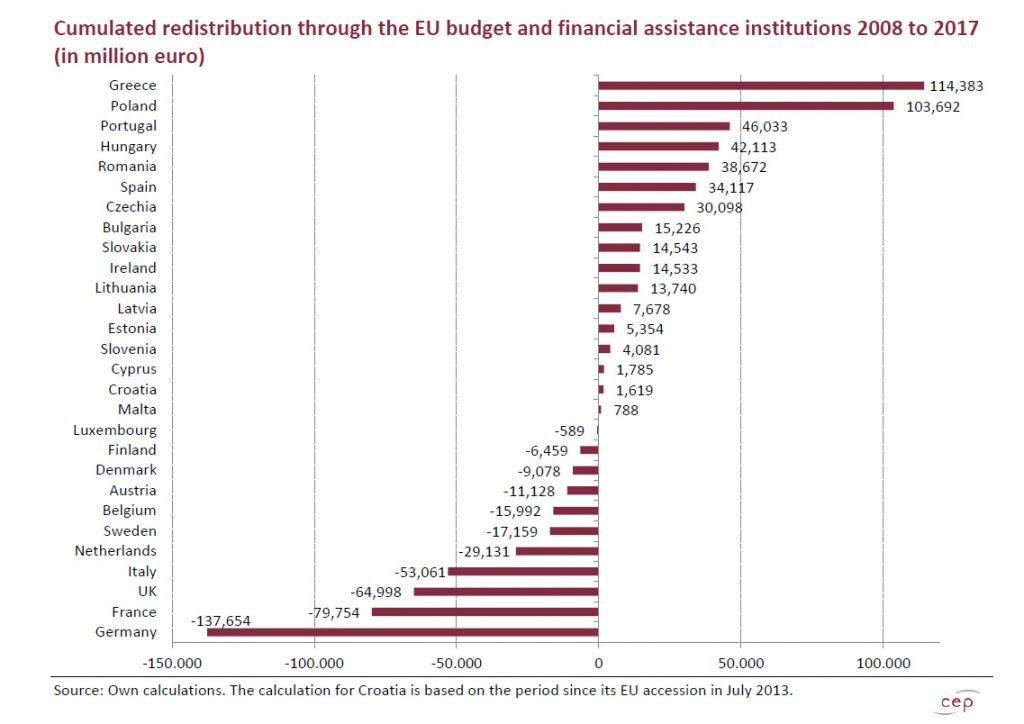

Cumulation of redistribution

Redistribution through the EU budget and the financial assistance institutions have been cumulated. Redistribution through the EIB cannot be included because data is only available for the eurozone countries.

Summary

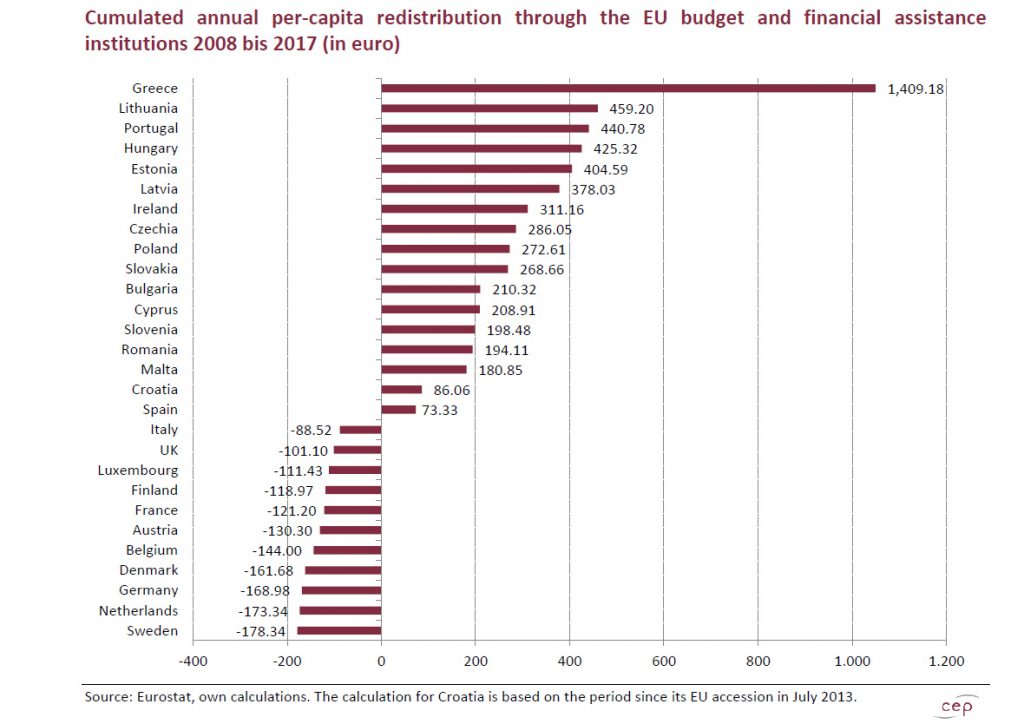

Greece and Poland have profited the most from redistribution by the EU. Between 2008 and 2017, pressure on the Greek budget was relieved by way of a total of € 114.4 billion. This amounts to € 1,049 per capita per year. Greece thus gained twice as much per capita as Lithuania which, with € 459, received the second largest amount of relief. The high level of redistribution in favour of Greece was due, on the one hand, to the fact that the country received more money from the EU budget than it contributed and, on the other hand – and primarily -, that it profited from the favourable interest rate on the financial assistance. Poland too received considerably more money from the EU budget than it paid in. In addition, since the country is outside the eurozone, it only bore a small amount of the financial assistance burden. Overall, between 2008 and 2017, pressure on the Polish budget was relieved by way of a total of € 103.7 billion. This corresponds to € 273 per capita per year. Poland is thus in ninth place in the per capita analysis. The third largest annual per capita gain went to Portugal with € 441. By contrast with Greece, Portugal’s relief came primarily from the EU budget; financial assistance was secondary. Among the large eurozone countries, only Spain gained from the redistributions, specifically by € 73 per capita per year. Firstly, Spain received more money from the EU budget than it paid in and secondly it received ESM financial assistance.

In the ten years from 2008 to 2017, Germany bore by far the greatest burden with and overall amount of € 137.7 billion. This however only corresponds to an annual per capita amount of € 169. Per capita, therefore, Germany finds itself in third place. Sweden and the Netherlands bore a heavier annual per capita burden of € 178 and € 173 respectively. On balance, all three Member States contributed more to the EU budget than they received. Since the Netherlands and Germany are eurozone countries, they also provide substantial backing for the financial assistance.

Apart from Germany, the two other major eurozone countries, France and Italy, were in seventh and eleventh place with an annual per capita burden of € 121 and € 89 respectively. With € 101, the United Kingdom – the third largest net payer into the EU budget – is in tenth place. This burden results almost exclusively from the EU budget. Despite the “British Rebate”, the United Kingdom paid € 6.4 billion per year more into the EU budget than it received. This gap must be closed once the country has left.

In addition, the burden arising from financial assistance appears to be lower than from the EU budget. Because of the preferred creditor status, which the financial assistance institutions, except for the EFSF, have de jure or at least de facto, private bond holders of countries at risk of insolvency shoulder by far the largest default risk. At € 43.6 billion it is more than twice as high as the burden of Germany. This is also the reason why the relief for recipient countries of financial assistance is significantly higher than the burden on guarantor Member States.

The results illustrate the advantages and disadvantages of EU membership in just one area. Thus, the fact that a country is a net contributor to the EU budget, or is liable by way of financial assistance for the debts of other Member States, does not mean that EU membership or the introduction of the euro is disadvantageous for this Member State.

Annex:

Notes:

- Not all values were available for 2018 when the study was prepared.

- Redistribution through the European Central Bank does not fit into the system of classification used by the study because it involves redistribution not between Member States but between creditors (lenders, savers) and debtors (Member States and private borrowers) arising in all eurozone countries.

Source: https://www.cep.eu/

One comment