_ Yuri C. Kofner, junior economist, MIWI Institute for Market Integration and Economic Policy. Munich, 1 September 2020.

Summary

The Eurasian Economic Union needs to finance R&D activities as a supranational public good. In this regard, the author proposes to establish a “Eurasian Venture Fund” (EVF) under the management of the Eurasian Development Bank, which will provide grants for fundamental science and venture capital for innovative start-ups. If the fund would be established in 2021, then by 2026 the gross amount of grants could be over USD 70 million, and the current portfolio of venture capital investments – almost USD 1 billion. To finance the fund, it would be necessary to deduct only 1 percent of the total amount of import customs duties collected annually by the EAEU. The fund’s country-specific grants and investments could increase the average R&D spending in Russia by 1.8 percent, in Belarus by 20 percent, in Kazakhstan by 40 percent, double it in Armenia, and three times in Kyrgyzstan. As a result, thanks to the activities of the proposed Eurasian Venture Fund, the GDP growth rate of the Russian Federation in 2023 could be 0.2 to 0.7 percent higher, that of Belarus – by 2-8 percent, Kazakhstan‘s – by 4-16 percent, Armenia’s – by 10-40 percent, Kyrgyzstan’s – between 30 and 120 percent.

The Eurasian Union should offer public goods

The Eurasian Economic Union (EAEU) is primarily a customs union and a common market for the free movement of goods, services, capital, and labor. The main task of the EAEU is the so-called “negative integration”, i.e. completing the construction of the common market by gradually eliminating interstate trade barriers.

While virtually all member states benefit from the single economic space, which adds 1.1 to almost 12 percent to their national income,[1] the economic benefits of the EAEU are not obvious to many.

This may be since eliminating trade barriers is a complex and slow process. Ever new and not yet removed market barriers are more visible to the media, entrepreneurs, and citizens than the quiet successes of the Eurasian Economic Commission (EEC) in removing them.

In this regard, for the benefits of Eurasian integration to become more visible, the EAEU should add “positive integration” to its agenda, i.e. offering supranational public goods.

The supply of public goods is a key task for nation-states. However, subject to the principle of subsidiarity, the costs of providing a public good at a higher supranational level may be lower and the welfare effects higher. This is due to economies of scale and the very nature of public goods as being non-exclusive and non-rivalry. The same is also true for “club goods”, though non-rivalry in consumption may not be perfect due to congestion effects and for which exclusion is possible, but where the joint provision is still more efficient.[2]

Debates on this topic have recently intensified in Europe, and leading economists such as Gabriel Felmbermayr, president, IfW Kiel,[3] Clemens Fuest, president, ifo Institute,[4] and Mario Holzner, executive director, wiiw,[5] advocate that the EU should purposefully offer more public or club goods. Examples of such goods already offered by Brussels, are the euro, the Schengen area, the farmer subsidy program (CAP), the structural cohesion funds, and the science grant program “Horizon 2020”.

Among the new public or club goods that, according to economists, the European Union should offer at the supranational level, the most prominent are: military procurement and defense; migration policy and redistribution of migrants; climate change mitigation; cybersecurity and setting standards for the global digital economy; pan-European infrastructure projects in transportation, electricity transfer and communications; research and development in large and risky projects.

The Eurasian Union should support innovation through joint venture funding

For the citizens, the business community, and the media to become more aware of the value of Eurasian economic integration, the EAEU should supply public goods. As such, the author argues, it should provide supranational financial support for science, research and development (R&D). This would be advisable for several reasons.

In the 21st century, the world is moving towards the knowledge-based economy, i.e. most empirical studies show that R&D, as well as the introduction of information technologies, are becoming the main factors determining productivity growth.[6]

Knowledge is an ideal public good. Governments need to provide education services, fundamental science, as well as R&D, since, otherwise, the private sector would under-provide them. Research and knowledge generation benefits substantially from economies of scale, especially from cross-border scientific collaboration and co-financing, which makes the scientific process more efficient for less money. Knowledge consumption, especially if distributed digitally and freely, is non-rival, non-exclusive, and benefits the whole economy by increasing its productivity and international competitiveness.

Unfortunately, the post-Soviet economies, including the EAEU member states, lag behind the developed and other emerging economies in the field of innovation and science, especially in their commercialization.

The EAEU ranks 50th place in the Global Innovation Index from 2019, which corresponds to the level of Romania, one of the EU’s least innovative countries. The leader of the rating is Switzerland, the USA occupies the 3rd position, Germany – the 9th place. The highest position among the EAEU member states is held by the Russian Federation (46), followed by Armenia (64), Belarus (72), Kazakhstan (79), the Kyrgyz Republic (90).[7] Also, in the monitor Russia ranks 23rd in terms of human capital and research.

According to the OECD, annual average gross expenditure on research and development (GERD) for 2014 – 2018 made up only 1 percent of the EAEU’s GDP. In comparison, for the same period average GERD in the EU was relative to 2 percent of GDP (3 percent in Germany), in China – 2,1 percent, in the USA – 2,8 percent, and in South Korea it was relative to 4,4 percent of the country’s gross domestic product. Moreover, there is an even greater asymmetry in this indicator within the EAEU. Thus, Russia’s average GERD for the study period was 1.1 percent of its GDP, Belarus – 0.5 percent, Armenia – 0.2 percent, Kazakhstan and Kyrgyzstan – only 0.1 percent each.[8]

In 2018, the Russian Federation ranked 8th place by the total number of patent applications with the world’s top 20 patent offices (almost 38 thousand). In this regard, the country filed almost 5 times fewer patent applications than the European Union (174 thousand), almost 16 times fewer than the United States (almost 600 thousand) and over 40 times fewer applications than China (1.5 million).[9]

The same gap is true for industrial designs, where, in 2018, Russia filed almost 9 thousand applications, which was 5 times fewer than in the USA (47 thousand), 12 times fewer than in the EU (108 thousand) and almost 80 times fewer than in China (709 thousand).[10]

Russia is especially less successful in the commercial application of new technologies. Even if the Russian government expands funding for basic research, the problem remains that it rarely leads to commercially successful new products.

In Russia, business-financed GERD accounted only for 0.3 percent GDP on average annually between 2015 and 2018, whereas it made up 1.2 percent in the European Union, almost 1.6 percent in China and almost 1.8 percent in the United States.

According to the World Bank, high-technology exports made up 15.3 percent of the EAEU’s manufactured exports on average annually during 2015-2018, whereas the indicator was 16.7 percent for the EU, 20.9 percent for the USA and 30.8 percent for China. High-technology exports made up 29.2 percent of Kazakhstan’s manufactured exports, 14.5 percent of Kyrgyzstan’s, 14 percent of Russia’s, 6.6 percent of Armenia’s, and 4.4 percent of Belarus’.[11]

Following the thought pattern of the Kiel Institute for the World Economy,[12] one of the main reasons why Russia and the Eurasian Economic Union lag behind in R&D in general and in the commercial application of new technologies, in particular, is the underdevelopment and the small size of the (common) venture capital market.

A KPMG monitoring showed that on average for 2015-2018, over 50 percent of investments into venture-capital-backed companies were distributed in Northern America, 27 percent in Europe (including Russia and Belarus), and 21percent in Asia.[13] In Russia, the average total sum of capital investments in start-ups for 2017-2018 was USD 338.7 mln, [14] whereas it was USD 24.4 bln in Europe.[15] During the study period, Russia took the 7th place (3.8 percent) in the share of total early-stage venture funding in Europe, Belarus – only the 27th (only 0.08 percent).[16]

Last, but not least, the Eurasian Economic Union should support innovation and scientific research as a supranational public good, not only because it is important, efficient, and necessary, but also because it is one of the main demands set by the member states for the integration project.

According to Article 4 of the EAEU Treaty, one of the three main objectives of the Eurasian Economic Union is the “comprehensive modernization, cooperation, and competitiveness of the national economies within the global economy”. And paragraph 4.7 of Article 92 reads that “the member states, to achieve the goals of industrial policy implementation within the framework of the EAEU, can carry out joint research and development works with the goals of promoting high-tech production”.[17]

The Commission is currently working on the “EAEU Development Strategy until 2025”. The basis for this strategy is the joint “Declaration on the Further Development of the EAEU until 2025” adopted in December 2018 by the heads of the member states. One of the main sections of this document calls for “Shaping “a territory of innovations” and stimulating scientific and technical breakthroughs by creating and developing high-performance, in particular, export-oriented economy sectors, promptly introducing innovations and digital technologies, primarily in industry and agriculture; […] joining efforts of the member states to encourage collaborative research and development activities; […] joining efforts of the member states to encourage collaborative research and development activities; […] implementation by the EAEU member states of joint large-scale high-tech projects able to become symbols of the Eurasian integration; implementation by the EAEU member states of (cooperative) projects with an integration component, […]”.[18]

The Eurasian Union should create a joint Eurasian Venture Fund

In connection with the above, the author proposes that the EAEU member states should jointly establish a “Eurasian Venture Fund” (EVF), which will support fundamental science and, on a venture basis, invest in promising Eurasian start-ups, which are engaged in commercializing new research and development results.

The European Union has its own and rather large budget, which averaged USD 173.4 billion annually in 2015-2018, or about 1 percent of the EU’s gross domestic product. The European budget has three main sources of income: the member states’ share contributions based on their GNI (about two-thirds), import duties and sugar levies (ca. 15 percent), and deductions from VAT (ca. 11 percent). The EU budget is mainly spent on structural cohesion programs to support economic convergence between the member states and their regions, state aid to European agriculture and fishing, environmental protection, but also on foreign aid, combating terrorism, organized crime, and illegal immigration, as well as on administrative expenses.[19]

Unlike the European Union, the Eurasian Economic Union has only one expenditure side, one revenue side, and only two redistributive spheres. The only expenses of the EAEU budget are the administrative expenses of the Eurasian Economic Commission and the EAEU Court. On average annually for the period 2015-2020, they amounted to USD 110.5 million (USD 105.5 mln for the EEC and USD 5 mln for the Court). They are financed on the revenue side of the EAEU budget through shared contributions by the EAEU member states in the following ratio:

- Armenia – 1.220 percent;

- Belarus – 4.560 percent;

- Kazakhstan – 7.055 percent;

- Kyrgyzstan – 1,900 percent;

- Russia – 85.265 percent.[20]

In addition to the revenue side of the Eurasian budget, where the Russian Federation bills the largest share, the only other area where the EAEU has the legal power to redistribute financial resources between its member states is the redistribution of aggregate revenues from import customs duties of the union. In the latest edition, this distribution quota was as follows:

- Armenia – 1.220 percent;

- Belarus – 4.860 percent;

- Kazakhstan – 6.955 percent;

- Kyrgyzstan – 1,900 percent;

- Russia – 85.065 percent.[21]

In this regard, the proposed Eurasian Venture Fund can be financed either directly through further contributions by the EAEU member states, or as a deduction from the total amount of import customs duties collected by the EAEU.

The author proposes to finance the Eurasian Venture Fund by deducting 1 percent of the annual total amount of import customs duties of the EAEU. On average, the EAEU collected a total of USD 12.4 bln per annum between 2015 and 2019.[22] Consequently, the EAEU could potentially allocate USD 123.7 million on average annually for the needs of this fund. Of this 1 percent, the author proposes to deduct a fixed amount of USD 100 million (or at least 75 percent) every year against the authorized capital of the Eurasian Venture Fund. The remaining amount over USD 100 million (or at least 25 percent) is proposed to be spent on basic research in the form of annual grants to be given on a competitive basis.

Since this 1 percent would be deducted before the redistribution of aggregate customs revenues to the member states, each of them would bear the cost of maintaining the fund equally in the form of deducting only 1 percent from the amount of the customs revenues it receives.

If the EVF would have been established in 2015, then according to the above-described logic, its financing mechanism for 2015-2019 could have looked like in (Tab 1.).

Tab 1. Hypothetical financing mechanism of the Eurasian Venture Fund (2015-2022*, in USD mln)

| EAEU total import customs revenues | 1 percent deduction to the EVF, of which… | … to the EVF’s authorized capital | …on basic research grants by the EVF | |

| 2015 | 10023.0 | 100.2 | 100.0 | 0.2 |

| 2016 | 9050.1 | 90.5 | 67.9 | 22.6 |

| 2017 | 10118.8 | 101.2 | 100.0 | 1.2 |

| 2018 | 20665.1 | 206.7 | 100.0 | 106.7 |

| 2019 | 11973.5 | 119.7 | 100.0 | 19.7 |

| 2020* | 6842.0 | 68.4 | 51.3 | 17.1 |

| 2021* | 16611.8 | 166.1 | 100.0 | 66.1 |

| 2022* | 16877.0 | 168.8 | 100.0 | 68.8 |

Source: EEC Statistics Department and author’s calculations.*Forecast.

Since, due to the global economic crisis, caused by the COVID-19 pandemic, the EAEU‘s GDP is expected to drop by -3.2 percent in 2020, it would be ideal to complete the procedures for the establishment of the EVF in 2021 when the Eurasian economy is predicted to recover by 2.4 percent and start the fund’s project activities beginning in 2022 based on deductions from the total amount of customs duties collected by the union in 2021.

Using data from the EEC Department of Macroeconomic Policy and the EEC Department of Finances, the author, using an econometric regression, estimated that the gross customs revenue of the EAEU in 2022 and 2023 may amount to USD 16.6 billion and USD 16.9 billion, respectively (Multiple R = 0,8; R2 = 0,6).[23] Consequently, the annual deduction for the needs of the Eurasian Venture Fund could be 166.1 and USD 168.8 million, respectively. Accordingly, USD 66.1 mln could be spent on basic research in 2022 and USD 68.8 mln in 2023. This would be almost three times more than Armenia’s average gross R&D spending and nine times more than Kyrgyzstan’s.

Further, the author proposes that the management of the Eurasian Venture Fund should be entrusted to the Eurasian Development Bank (EDB). There are several good reasons for this. Firstly, the EDB is a recognized international development institution whose main task is to invest in projects with a strong regional integration effect. The bank’s shareholders are all EAEU member states plus Tajikistan. And the EDB officially and closely cooperates with the Eurasian Economic Commission since 2013.[24] Secondly, the EDB already has rich experience in managing stand-alone funds – namely, the Eurasian Fund for Stabilization and Development (EFSD), [25] and, just recently, in July 2020 the EDB’s management decided to establish a “Digital Initiative Fund” (DIF), allocating for its needs an initial contribution of USD 10 million from the bank’s retained earnings of previous years. The DIF’s objective is to assist the EDB member states in creating digital transformation tools and practices by integrating their information resources and participating in the development and financing of projects, including those implemented under the Eurasian Economic Union’s “2025 Digital Agenda”.[26]

Thirdly, in the above-mentioned “Declaration on the Further Development of the EAEU until 2025”, the Commissions and the heads of the member states once again emphasized the desire in “building-up an efficient system of management and financing of joint cooperative projects, in particular, by using the potential of the Eurasian Development Bank, Eurasian Fund for Stabilization and Development and other development institutions that operate in the EAEU as well as “Astana” International Financial Center”.[27]

Fourth, the EDB is a reliable international lending institution, which is confirmed by high ratings from leading rating agencies:

- Moody’s: Baa1 (two notches higher than the sovereign ratings of Kazakhstan and Russia);

- Fitch: BBB+ (one notch higher than the sovereign ratings of Kazakhstan and Russia);

- Standard & Poor’s: BBB (one notch higher than the sovereign ratings of Kazakhstan and Russia); and

- ACRA: A- (one notch higher than the sovereign rating of Kazakhstan and the same as that for Russia).

- Standard & Poor’s: kzAAA (the highest rating on Kazakhstan’s national scale);

- Fitch: AAA(kaz) (the highest rating on Kazakhstan’s national scale); and

- ACRA: AAA(RU) (the highest rating on Russia’s national scale).[28]

The latter aspect would be especially important for the effective functioning of the Eurasian Venture Fund. After all, its reliable credit rating allows the Eurasian Development Bank to borrow a much larger amount of financial leverages (liabilities) on the international financial market than its equity capital, which ultimately allows the bank to provide investments and loans for a much larger amount (assets).

Consequently, with a paid authorized capital of USD 1.5 billion, the Eurasian Development Bank in 2015-2019 managed to have an investment portfolio of almost USD 3 billion on average every year, i.e. almost twice as large (Tab 2).

Tab 2. Volume of the EDB’s current investment portfolio in relation to paid-up authorized capital (2015-2019)

| Volume of the current investment portfolio (in USD mln) | In relation to paid-up authorized capital (in percent) | |

| 2015 | 2200.0 | 145.1 |

| 2016 | 2470.0 | 163.0 |

| 2017 | 2333.8 | 154.0 |

| 2018 | 3441.9 | 227.1 |

| 2019 | 4300.0 | 283.7 |

| Average (2015-2019) | 2949.1 | 194.6 |

Source: Annual reports of the EDB and author’s calculations.[29]

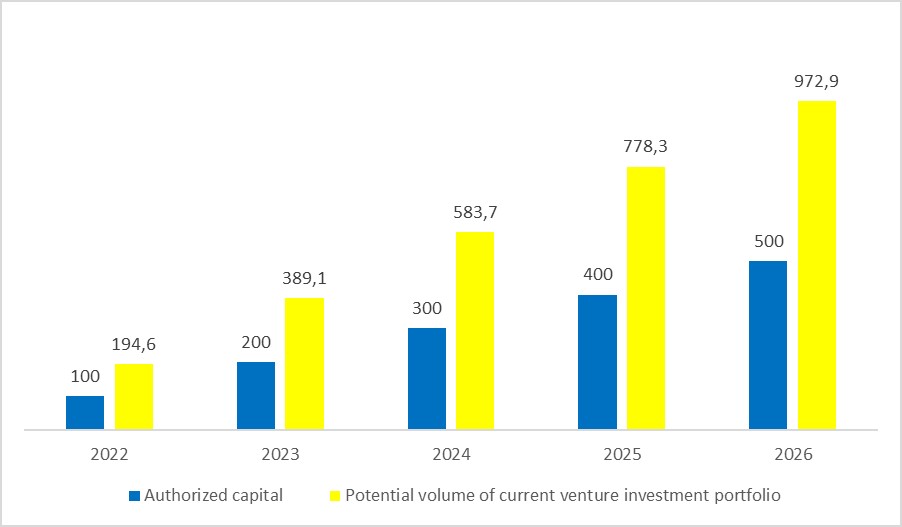

Further, if the EAEU member states will donate USD 100 million each year to the authorized capital of the Eurasian Venture Fund, and if this fund will be managed by the EDB thus having approximately the same leverage conditions on the international financial market, then within five years the EVF could provide early-stage venture investments of almost USD 1 billion (Chart 1).

Chart 1. Potential volume of the EFV’s current venture investment portfolio (2015-2019)

Source: Author’s calculations.

Thus, the total volume of venture investments in innovative companies and grants for fundamental research, which could be potentially provided by the Eurasian Venture Fund in 2023, could amount to USD 457.9 million. This would be almost three times more than the average annual gross R&D expenditure in Belarus, 2.7 times more than in Kazakhstan, almost 20 times more than in Armenia and almost 60 times more than in Kyrgyzstan. The fund‘s potential venture capital investments in 2023 could still be USD 50 mln more than the average total sum of Russian capital investments in start-ups for 2017-2018.

From the point of view of ensuring maximum efficiency, it would be advisable to invest the fund’s venture capital in Eurasian start-ups and innovative companies regardless of their country of origin (within the EAEU, of course), and not to distribute them among the member states according to some kind of quota system. However, knowledge generation is a cross-border public good in terms of its funding rather than its welfare benefits, and it is highly likely that the bulk of the EVF venture capital and grants for basic science will be attracted by Russian applicants.

For this reason, the author proposes the following ratio for spending the fund’s resources between the member states:

- Armenia – 5 percent;

- Belarus – 10 percent;

- Kazakhstan – 15 percent;

- Kyrgyzstan – 5 percent;

- Russia – 65 percent.

According to such a distribution formula, Armenian start-ups in 2023 could attract venture capital as high as USD 19.5 million, Belarusian companies – for almost USD 39 million, Kazakh companies – for USD 58.4 million, Kyrgyz – for USD 19.5 million, and Russian – up to USD 252 million. In the case of Armenia and Kyrgyzstan, this amount would still be either double or two and a half times the country’s average gross R&D spending, respectively. And it would add 17 percent to Belarus’ average GERD, as well as 34 percent to that of Kazakhstan, as well as another two-thirds to Russia’s average 2017-2018 volume of venture capital investment.

As for grants for fundamental science, the author proposes to do without country quotas, and to award them on a competitive basis to any winning applicant regardless of the country of origin (within the EAEU), provided that the research project will involve researchers from three or more EAEU member states. The EEC’s system for the selection of research studies operates on approximately the same basis.

Taken together, the grants and venture capital offered by the fund under the above-said distribution scheme could increase the average R&D spending in Russia in 2023 by 1.8 percent, in Belarus by 20 percent, in Kazakhstan by 40 percent, double it in Armenia, and increase three times in Kyrgyzstan.

For the Eurasian Venture Fund to primarily support innovative projects with a high integration potential, it could offer grants and venture capital investments on more attractive conditions to companies and research centers with a trans- or supranational organizational form. Thus, the activities of the fund could become an important tool for promoting the formation of potential future “Eurasian companies”, – so-called “Societas Eurasicaea”.[30]

In 2016, the EEС and the national governments decided to establish the so-called. “Eurasian Technological Platforms” to promote R&D cooperation and know-how exchange between leading high-tech enterprises, research institutes, and state agencies of the member states in various innovative industries. As of April 2020, such competence centers are already operating in 16 areas, which roughly reflect some of the competitive advantages of the Eurasian economies:

- Medical biotechnology and pharmacy;

- Information and communication technologies;

- LED and photonics;

- Aerospace technology;

- Nuclear and radiation technologies;

- Energy;

- Transportation technologies;

- Metallurgy technologies and new materials;

- Extraction of natural resources and oil and gas processing;

- Chemistry and petrochemistry;

- Electronics and engineering technology;

- Environmental development;

- Industrial technology;

- Agriculture, food industry, biotechnology;

- Electrification;

- Technologies for the maintenance and repair of industrial equipment.[31]

Representatives of these Eurasian technology platforms could form an advisory board to the Eurasian Venture Fund and guide its leadership in the selection of promising applicants for grants and/or venture capital.

To prevent corruption schemes or misuse of the fund’s resources, a supervisory body could be created over it, consisting of authorized representatives of the national governments (e.g. from the industrial ministries). If a corruption case is discovered in one of the fund’s projects, then the applicants of this recipient country (countries) may be excluded from applying for the fund‘s resources for the next year, and all the fund’s freed up resources for this period will be redistributed for applications from the remaining EAEU member states.

A former board member (minister) of the Eurasian Economic Commission could head the EVF.

Potential effects on economic growth

As mentioned above, leading empirical studies agree that increased R&D spending has a positive and significant effect on a country’s economic growth rate. An increase of one percentage point in R&D expenditure in the economy as a whole seems to result in an average increase in GDP growth between 0.1 and 0.4 percent. [32]

Therefore, if by 2023 the Eurasian Venture Fund would operate as described above, then, thanks to its activities, the GDP growth rate of the Russian Federation in 2023 could be 0.2 to 0.7 percent higher, that of Belarus – by 2-8 percent, Kazakhstan‘s – by 4-16 percent, Armenia’s – by 10-40 percent, Kyrgyzstan’s – between 30 and 120 percent.

JEL: F15, F36, G24, O38

Notes:

[1] Kofner Y. (2020). Who wins and who loses from the Eurasian Economic Union? MIWI Institute. URL: https://miwi-institut.de/archives/534

[2] EEAG Report on the European Economy (2018). All Together Now: The European Union and the Country Clubs. CESifo Group. URL: https://www.cesifo.org/DocDL/EEAG-2018.pdf

[3] Felbermayr G. (2020). What the EU should do for its citizens. URL: https://miwi-institut.de/archives/124

[4] Fuest C., Pisani-Ferry J. (2019). A Primer on Developing European Public Good. EconPol. URL: https://www.econpol.eu/publications/policy_report_16

[5] Creel J., Holzner M., et al. (2020). How to Spend it: A Proposal for a European Covid-19 Recovery Programme. wiiw. URL: https://wiiw.ac.at/how-to-spend-it-a-proposal-for-a-european-covid-19-recovery-programme-dlp-5352.pdf

[6] A good summary of research papers is provided by: Jona-Lasinio C., Schiavo S., Weyerstrass K. (2019). How to revive productivity growth? EconPol. URL: https://www.ifo.de/DocDL/EconPol_Policy_Report_13_Productivity_Growth.pdf

[7] Global Innovation Index 2019 (2019). WIPO – World Intellectual Property Organization. URL: https://www.wipo.int/edocs/pubdocs/en/wipo_pub_941_2019.pdf

[8] OECD Data. URL: https://data.oecd.org/rd/gross-domestic-spending-on-r-d.htm

[9] World Intellectual Property Indicators 2019. (2019). WIPO – World Intellectual Property Organization. URL: https://www.wipo.int/edocs/pubdocs/en/wipo_pub_941_2019.pdf

[10] Ibid.

[11] World Bank Data. URL: https://data.worldbank.org/indicator/TX.VAL.TECH.MF.ZS?end=2019&start=2014

[12] Dohse D., Felbermayr G. et al. (2019). Zeit für eine neue Industriepolitik? IfW Kiel. URL: https://www.ifw-kiel.de/fileadmin/Dateiverwaltung/IfW-Publications/-ifw/Kiel_Policy_Brief/Kiel_Policy_Brief_122.pdf

[13] Venture Pulse Q4 2019 (2020). KPMG. URL: https://assets.kpmg/content/dam/kpmg/xx/pdf/2020/01/venture-pulse-q4-2019-global.pdf

[14] MoneyTree™: Navigator of Venture Market 2019 (2019). PwC and Russian Venture Company. URL: https://www.pwc.ru/ru/sports/publications/pwc-money-tree-2019.pdf

[15] Annual European Venture Capital Report (2019). Dealroom.co. URL: https://blog.dealroom.co/wp-content/uploads/2019/02/Dealroom-2018-vFINAL.pdf

[16] Early Stage Startups in Europe (2018). Tech.eu. URL: https://tech.eu/product/seed-the-future-early-stage-report/

[17] Treaty on the Eurasian Economic Union. Signend on 29 May 2014 in Astana (now Nursultan). URL: https://www.wto.org/english/thewto_e/acc_e/kaz_e/WTACCKAZ85_LEG_1.pdf

[18] Declaration on Further Development of Integration Processes within the EAEU. Signend on 6 December 2018 in Saint Petersburg. URL: http://www.eurasiancommission.org/en/act/integr_i_makroec/dep_razv_integr/Pages/default.aspx

[19] EU expenditure and revenue 2014-2020. European Commission. URL: https://ec.europa.eu/budget/graphs/revenue_expediture.html

[20] Ministry of Finance of the Republic of Belarus. URL: http://www.minfin.gov.by/upload/ministerstvo/cooperation/eaes.pdf

[21] Protocol of 1 October 2019 amending the Treaty on the Eurasian Economic Union of 29 May 2014, as well as amending and terminating certain international treaties. Eurasian Economic Commission. URL: https://docs.eaeunion.org/docs/ru-ru/01423866/itia_15112019

[22] See note 1.

[23] EEC Statistics Department. Eurasian Economic Commission. URL: http://www.eurasiancommission.org/ru/act/integr_i_makroec/dep_stat/union_stat/Pages/default.aspx

[24] Memorandum of Cooperation between the Eurasian Economic Commission and the Eurasian Development Bank. Signed on 12 December 2013 in Moscow. URL: http://www.eurasiancommission.org/ru/Lists/EECDocs/635199607350014958.pdf

[25] Eurasian Fund For Stabilization and Development. URL: https://efsd.eabr.org/en/about/

[26] The EDB sets up a directorate to implement the activities of the Digital Initiative Fund (2020). Eurasian Development Bank. URL: https://eabr.org/en/press/news/the-edb-sets-up-a-directorate-to-implement-the-activities-of-the-digital-initiative-fund/

[27] See note 18.

[28] https://eabr.org/en/press/news/the-eurasian-development-bank-s-council-establishes-the-digital-initiative-fund-and-discusses-the-ba/

[29] EDB Annual Reports. Eurasian Development Bank. URL: https://eabr.org/en/investors/information-disclosure/annual-report/

[30] Kofner Y. (2019). Societas Eurasicaea and Prospects for Industrial Cooperation in the EAEU. Valdai Discussion Club. URL: https://valdaiclub.com/a/highlights/societas-eurasicaea-and-prospects-for-industrial-c/

[31] Kofner Y. (2020). EAEU industrial cooperation: promising products with intra-union demand. MIWI Institute. URL: https://miwi-institut.de/archives/426

[32] See, for example: Belitz H. et al. (2015). Growth through Research and Development. DIW Berlin. URL: https://www.diw.de/documents/publikationen/73/diw_01.c.512965.de/diw_econ_bull_2015-35.pdf // Ildira M. et al. (2016). The Effect of Research and Development Expenditures on Economic Growth: New Evidences. Çukurova University. URL: http://avekon.org/papers/1776.pdf // Sokolov-Mladenović S. (2016). R&D expenditure and economic growth: EU28 evidence for the period 2002–2012. University of Nis. URL: https://www.tandfonline.com/doi/full/10.1080/1331677X.2016.1211948 // Akcali B. and Sismanoglu E. (2015). Innovation and the Effect of Research and Development (R&D) Expenditure on Growth in Some Developing and Developed Countries. Instanbul University. URL: https://cyberleninka.org/article/n/1516019