_ Pablo Duarte, Senior Research Analyst, Flossbach von Storch Institute. 4 September 2020, Cologne.

Economic divergence in the Eurozone rose to its highest level and fiscal transfers are being used to keep the euro area countries together. The strategy can backfire as money transfers can fuel conflicts by increasing citizens’ dissatisfaction with domestic and EU policies.

The European Monetary Union (EMU) has experienced diverging economic developments at least since the great financial crisis of 2007/08. As Gehringer (2020) shows, the disintegration is particularly pronounced for the dynamics of real GDP, productivity, and unemployment as well as government finances. The COVID-19 pandemic has aggravated this tendency. Without the possibility of allowing adjustment via exchange rate changes, massive monetary and fiscal policy measures have been taken to contain divergence at politically tolerable levels. However, creating a “transfer union” creates new risks. In particular, money transfers across the euro area may increase people’s perception of being treated unfairly through the EU policies and hence achieve the opposite of what they were intended for.

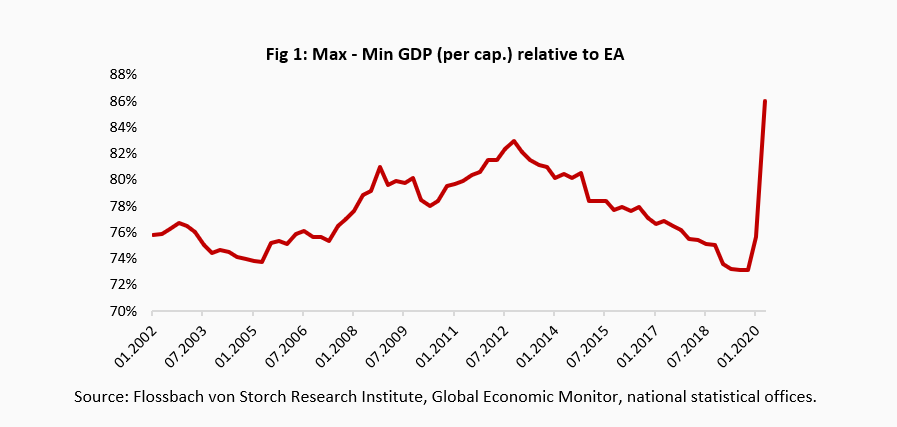

Owing to the corona crisis, the spread of real GDP per capita within the euro area has reached its highest level since 2002. Figure 1 shows the difference between the maximum and the minimum gap between each country’s per capita GDP and the Eurozone’s average for the initial Eurozone countries.1 In 2002, the Netherlands and Portugal recorded the largest gaps with real GDP per capita, with the former 44% above and the latter -30% below the euro area average. In 2020-Q2 the countries with the largest positive and negative gaps were the same as in 2002, but the gaps have widened to 46% for the Netherlands and -36% for Portugal.

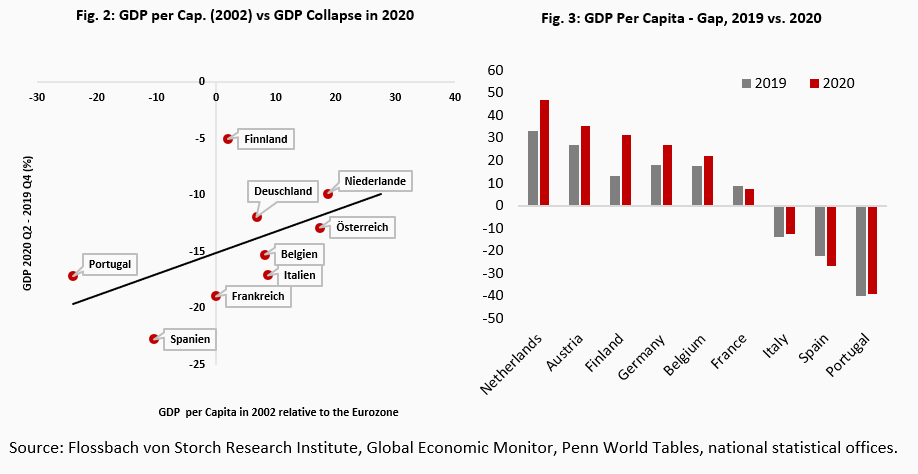

A closer look reveals a north-south split. Figure 2 shows that the lower the per capita GDP in 2002 (relative to the Eurozone average), the stronger the drop in GDP during the first half of 2020. The hardest-hit countries in 2020 have been the southern countries Spain, Portugal, Italy, and – as a newcomer to this group – France. A north-south divide was already visible in 2019; it deepened during the COVID-19 pandemic due to the differences in the severity of the health crisis and the vulnerability of the economy to the measures of social distancing taken to contain the spread of the virus. Figure 3 shows that the positive gap in the Netherlands, Austria, Finland, Germany, and Belgium increased in 2020-Q2, while the negative gaps of Portugal, Spain, and Italy either widened as well or remained roughly unchanged (France).

The recession and widening divergence in the first half of 2020 led to a political struggle for financial assistance for the southern-European countries, especially for Italy and Spain. As Gehringer (2020) explains, the political strategies to prevent economic divergence from unleashing political forces that could tear the EMU apart include, apart from the European Central Bank becoming a lender of last resort not only to banks but also governments, a (step-by-step) creation of a “fiscal union” with debt mutualization. Thus, the ECB announced a 750€ billion heavy Pandemic Emergency Purchase Programme (PEPP) and the EU governments agreed on a 750€ billion pandemic recovery package of financial aid in form of loans and grants, partly financed by debt issuance of the European Union.

The transfers organized through the European institutions, however, weaken taxpayers’ democratic control over government spending in the paying countries and may well increase the perception of unfair treatment in the receiving countries. For instance, agreement to the participation of Germany in the EU pandemic recovery program was quickly pushed through parliament without a thorough discussion of the merits and costs of the transfers. EU bureaucrats who are not responsible to the taxpayers will distribute the money, probably in fairly opaque ways. If divergence is not reduced – which on the past record of similar schemes seems likely – taxpayers will perceive that their money was wasted.

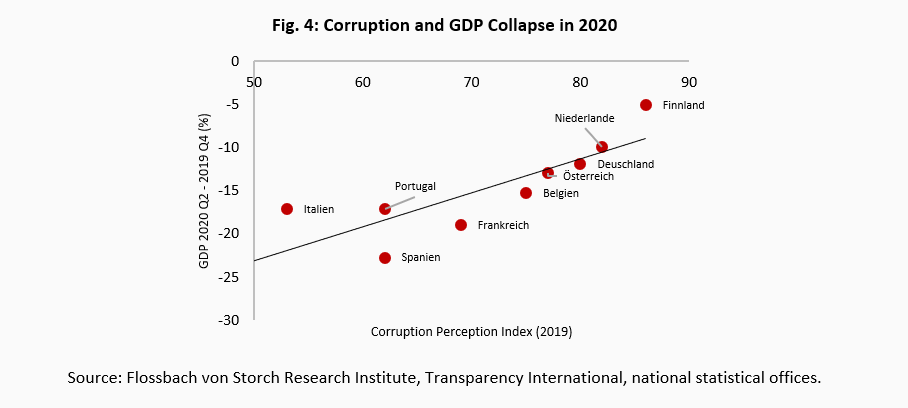

At the receiving end, government spending alleviates some of the most urgent needs. With weak structures of public governance in many receiving countries, however, transfers will most likely be rather spent to the benefit of politicians and their clientele as opposed to the improvement of productivity and economic growth. As Figure 4 shows, the southern European countries rank low in the Corruption Perception Index, which is strongly correlated with the drop in GDP in 2020. The worst-hit countries in need of the most financial support, are also the ones with the governments most likely to waste the money they receive.

As opposed to an exchange rate depreciation, which would affect all economic agents, transfers will benefit only a minority, most likely selected under political considerations. When political patronage strengthens, people’s perception of the fairness of the economic order worsens.2 Thus, instead of promoting political cohesion in the euro area, transfers may fuel disintegration. Populist politicians will likely blame “the EU” for putting their potential voters at a disadvantage and may whip up the desire to leave the EMU as a remedy. Voters in the paying countries will not be blind to these developments and blame their political leaders for having wasted their tax money. In this way, EMU could be torn apart by centrifugal political forces in both the north and the south.

The coronavirus pandemic accelerated the steps towards a fiscal union with debt issuance by the EU and monetary financing of government debt by the ECB. Fiscal transfers are being used in an attempt to restore growth and employment and keep the euro area countries together. But these transfers have the potential of creating conflict by increasing dissatisfaction with domestic and EU policies. To prevent a collapse of the EMU (and the EU) as a result of centrifugal political forces, creative ways of reducing economic divergence are necessary. One way to introduce more flexibility in the EMU and promote economic convergence could be the launch of parallel currencies, either in the southern or in the northern European countries (Schnabl and Mayer, 2020). The straitjacket of the single currency would be loosened, and economic convergence and political cohesion would be promoted in a more effective way than through public transfers.

References

Akbas, M., Ariely, D. and Yuksel, S. (2019). When is inequality fair? An experiment on the effect of procedural justice and agency. Journal of Economic Behavior & Organization, 161, 114-127.

Gehringer, A., 2020. “European (Monetary) Union: Until Death Do us Apart”, Flossbach von Storch Research Institute.

Schnabl, G. and Mayer, T., 2020. “EMU Post-Corona: Economic Distancing via Parallel Currencies”. Flossbach von Storch Research Institute, Comment, available at https://www.flossbachvonstorch-researchinstitute.com/en/comments/emu-post-corona-economic-distancing-via-parallel-currencies/

Starmans, C., Sheskin, M. and Bloom, P. (2017). Why people prefer unequal societies. Nature Human Behaviour, 1 (4), 0082

Notes

1 Greece, Ireland and Luxemburg are not included because the GDP statistics for 2020 Q2 have not been released yet.

2 Studies in empirical social sciences have shown that equal treatment matters for people’s perception of fairness. Akbas et al. (2019) show, for example, that if people are not treated equally in a simple experimental game, their demand for redistribution of the final outcomes drastically increases. See for example Starmans et al. (2017) for a discussion on fairness vs inequality.