_ Friedrich Heinemann, Head, Research Department, “Corporate Taxation and Public Finance”, Centre for European Economic Research (ZEW); et al. Published by Bertelsmann Stiftung. July 2017. Gütersloh. Republished from the original research report.

Optimising the division of competences among the EU and its member states.

Key findings

This study was written in the context of Europe’s multiple crises. In the eyes of many voters, the performance of the EU has been disappointing in the aftermath of the economic and euro area debt crisis. The decision of the United Kingdom to leave the Union drastically demonstrates this dissatisfaction. Against this background, this study aims to provide guidance for a better-performing EU through an improved allocation of competences between the European Union and its member states.

The study analyses eight specific policies with respect to their preferable assignment. These eight specific policies cover a wide range of policy fields. The study applies a unified quantified approach. Moreover, it is precise in the definition of ‘counterfactuals’. These counterfactuals are understood as conceptual alternatives to the allocation of competences under the status quo. As such, they either relate to a new European competence (if the policy is currently a national responsibility) or a new national competence (if the policy is currently assigned to the EU). Thus, the study’s design excludes any prior judgment regarding the desirable allocation.

The testing applies the following criteria to judge the appropriate assignment: free riding of member states on public goods provided by others, economies of scale through European provision, preference heterogeneity of voters across member states, the merits of intra-jurisdictional competition, and the interplay of competence allocation with the functioning of the European internal market. The wealth of detailed analyses along these criteria is transparently condensed by using a weighted scoring method.

For Common Agricultural Policy (CAP), we concentrate on direct payments to farmers. We compare the current EU responsibility with a national counterfactual in which income support is the responsibility of the national welfare system. Our results point to significant free riding under the current European arrangement and massively excessive costs resulting from ill-targeted income support. According to our results, income protection through CAP exceeds the level defined by national minimum income support in 21 member states. Overall, we find that having national responsibility is clearly preferable to the current assignment.

For asylum and refugee policy, the status quo entails de jure a mixed division of responsibilities. De facto, however, member states largely decide their own policies. We compare this arrangement to a counterfactual featuring a truly European provision of harmonised asylum services. Our analysis concludes that European responsibility would be clearly superior, as it would reduce massive free riding on the reception efforts of other member states. In addition, annual cost savings of between €5 billion and €12 billion (given refugee numbers like those experienced in 2015) appear realistic as a result of economies of scale.

Since Europe largely lacks responsibilities for direct taxation, the study focuses on corporate taxation for that policy field. The specific counterfactual scenario involves both a harmonised corporate tax base definition and an apportionment of corporate profits among member states according to a How Europe can deliver | Optimising the division of competences among the EU and its member states 11 formula. The competence of tax-rate setting would remain at the national level. Taken together, the criteria indicate that there are disadvantages to having this remain a national prerogative. In addition to reducing inefficiencies in tax base competition, the European counterfactual would enable substantial cost savings in tax compliance. For example, tax compliance costs for a company with up to five foreign affiliates are currently 2.5 times larger than those of a purely domestic company. A uniform tax base could cut back this costs disadvantage.

For defence policy, the study lends support to current political initiatives for more Europe in defence. Our counterfactual is a fully integrated European army with unified decision-making and a centralised provision of military equipment financed from the EU budget. The analysis finds a large number of indications that the current fragmentation results in significant diseconomies of scale. For example, the armies of the EU member states currently deploy 89 different major weapon systems, while US forces utilise just 27. Moreover, the quantitative analysis of benefit- and burden-sharing shows the superiority of a European competence, as it would much better align benefits and costs for member states and thereby decrease the extent of free riding. Furthermore, a European army would also give a boost to the internal market for defence goods.

Development policies are currently a shared responsibility. We contrast this situation with a far-reaching European counterfactual in which development aid is fully financed and managed by the EU. As with defence and asylum policies, having development aid financed from the EU budget would reduce free riding on the efforts of other member states. Substantive economies of scale can be achieved by cutting back high administrative costs and reducing other inefficiencies associated with the current aid fragmentation. Moreover, voter preferences appear to be particularly homogeneous across member states.

The results of our study indicate that it would be more advantageous to have responsibility for higher education remain at the national level. The European counterfactual to the current national responsibility is a model of EU financing that is decentrally implemented by autonomous universities (‘money follows students’). There is no evidence of European economies of scale. Free riding would increase compared to the status quo, under which national costs and benefits are largely aligned. Overall, the current approach of having the EU concentrate on mutual recognition of qualifications and fostering student mobility appears to be appropriate.

Results for railway freight transport are indeterminate. The study compares the current shared competences with a European counterfactual of a single EU-financed railway system without technical or operational barriers. Three criteria – economies of scale, preference heterogeneity and internal market consistency – weakly point to the advantages of a more European approach. However, European financing schemes would loosen the link between national costs and benefits, thereby increasing problems of free riding.

For stabilisation policies in the European Monetary Union, we screen the potential merits of a European unemployment insurance scheme. Here, instead of considering a counterfactual in which the competence of this policy field is relocated, we consider a new European scheme that complements existing national unemployment protection in the euro area countries. The current protection may cause free riding by other countries, which also benefit from the general stabilisation effects of such national insurances. The results confirm that this problem, which may lead to under-provisions of unemployment insurances, could be resolved within a European scheme. Furthermore, the current unemployment insurance schemes are similar across countries with regard to basic design issues. Thus, no major preference asymmetry would preclude a partial Europeanisation.

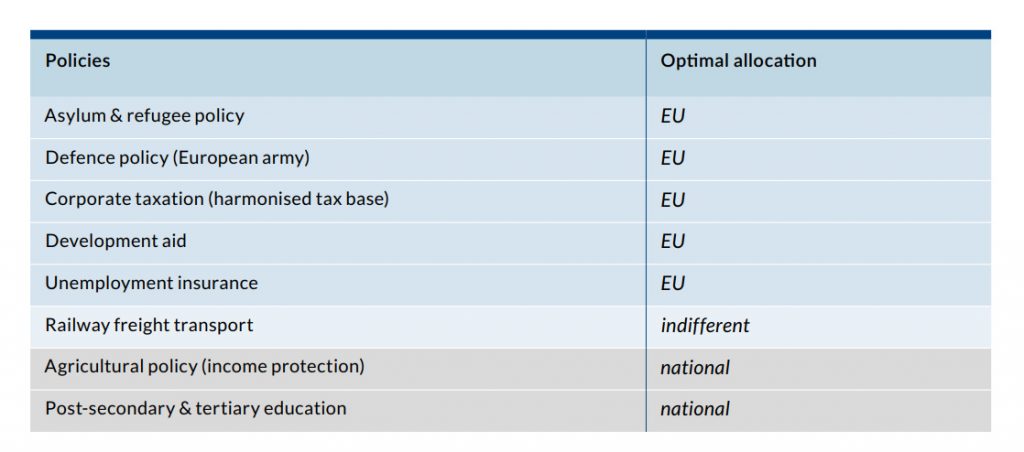

Overall, we conclude (see table below) that our comprehensive, quantification based assessment points to a desirable shift of competences to the EU level in five out of the eight policies covered by the study. While our findings are ambiguous for one policy (railway freight transport), we see better potentials for education and agriculture policy with a national responsibility