_ Yuri Kofner, junior economist, MIWI – Institute for Market Integration and Economic Policy. Munich, 28 October 2020.

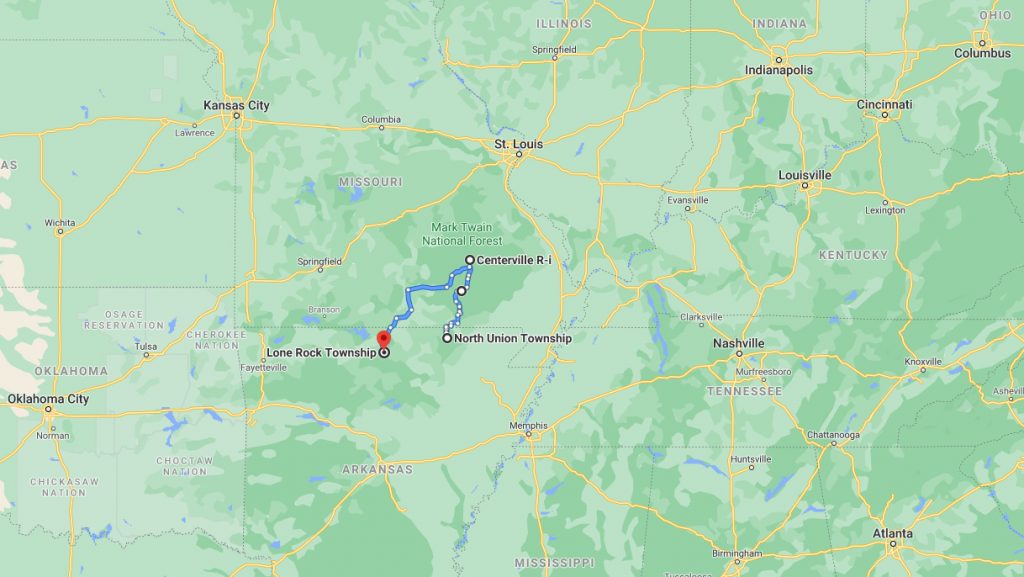

Over the past 20 years, the geographic center of the United States–Mexico–Canada Free Agreement (USMECA, formerly NAFTA)[1] made a “U-turn” to the north-east and back again. USMECA’s economic center moved 93 miles from North Union Township, Arkansas in 2000 to Centerville, Missouri in 2010 and back 143 miles to Lone Rock Township, Arkansas in 2018 (Map 1).

Map 1. The economic center of USMECA/NAFTA (2000, 2010 and 2018)

Source: Google Maps and the author’s estimations.

Methodology and data

These are the results of a study that calculates the economic center of gravity based on the regional (state/provincial) GDP of the United States, Mexico, and Canada weighted by the geographic location of their states and provinces, respectively, according to the following two formulas:

(Formula 1) Latitude = ∑BIP * Latitude / ∑BIP

(Formula 2) Longitude = ∑BIP * longitude * cos (latitude * π / 180) / ∑BIP * cos (latitude * π / 180)

The methodology of this study is taken from (Kauder 2020), who estimated the movement of the economic center of the European Union between 2000 and 2018.

As data input the author used regional GDP indicators of the United States, Mexico and Canada provided by the (OECD 2020), based on SNA classification in USD million in constant prices, constant PPP on the base year 2015. For the geographical coordinates of the states and provinces, the author used neither the geographic center nor the regional capital, but rather the latitude and longitude coordinates of the largest city in these states and provinces, respectively. This was done to represent the economic center of each region more accurately, which is especially important in the case of large provinces like Ontario, Canada.

The study identified and documented the movement of the USMECA’s (formerly NAFTA) economic center during 2000, 2010, and 2018.

Interpretation

Over the entire study period, USMECA’s economic center was located in the south-eastern central part of the United States at the Missouri-Arkansas border about 530 miles south-east to the geographic center of the United States at the Kansas-Nebraska border).

There are two reasons for this. First, the United States is the economic powerhouse of the North American free trade area. Over the past 20 years, the US has accounted for 82.6 percent of the gross domestic product of this regional trade agreement (RTA). Canada and Mexico made up about only 7.2 and 10 percent of the region’s economic structure, respectively.

Secondly, the main manufacturing, financial, and demographic metropolitan areas of the United States is located near its eastern and western coasts. Consequently, in 2018 the economic center of the United States was located in a rural part of Missouri (37°05′72″N, 91°36′57″W) and has moved ca. 82 miles west over the past 20 years due to the booming west coast states. (Ingold et al. 2020) came to similar conclusions.

In 2018, Canada’s economic center was located in Michigan near Lake Superior (41°48′18″N, 89°11′32″W), which is not surprising since most of the country’s population and economic activity is located near the US-Canadian border and along the Quebec City–Windsor Corridor. Mexico’s economic center was located about 56 miles southeast of the city of San Luis Potosi (21°81′52″N, 100°43′51″W).

Interesting is the “U-turn”, which the economic center of USMECA/NAFTA made over the past two decades. In 2001 it was located in North Union Township, Arkansas (36°36′47″N, 91°31′52″W). By 2010 it moved about 93 miles north-east to Centerville, Missouri (37°33′43″N, 90°95′87″W). However, by 2018 it moved back 143 miles south-west to Lone Rock Township, Arkansas (36°18′54″N, 92°29′47″W), even further than where it was in 2010.

This north-south movement may be given the following explanation. While the US and Canada’s GDP grew relatively stable by 17.5 and 18.1 percent in 2000-2010 and by 19.6 and 18.2 percent in 2010-2018, Mexico’s GDP growth rate varied significantly over the decades. While its emerging economy grew rather slowly by only 14.4 percent in 2000-2010, i.e. much slower than in the United States and Canada, it grew much faster than its northern neighbors during 2010-2018 – by 24.1 percent. USMECA’s overall economy grew by 17.3 percent in 2000-2010 and by 20 percent in 2010-2018.

However, although USMECA’s economic center moved somewhat closer to Mexico, the regional trade agreement did not seem to foster macroeconomic convergence. Firstly, as already said, the economic structure of the RTA’s GDP remained relatively unchanged at 82.6 percent USA, 7.2 percent Canada, and 10 percent Mexico.

Secondly, while over the past two decades (2000-2018) the US-American and Canadian GDP per capita by PPP grew from USD 36.3 to 62.8 thousand and from USD 29.3 to 50.1. thousand, respectively, Mexico’s GDP per capita by PPP increased only from USD 11.1 thousand in 2000 to USD 20.4 thousand, which is still three times less than in the US and 2.5 times less than in Canada. In other words, while the US-American and Canadian economies grow with relatively parallel speed to each other, Mexico was not yet able to catch up. The data was taken from the (World Bank 2020).

The USMECA/NAFTA regional trade agreement(s) has boosted intra-regional trade, which during the last decade leveled at about 19-20 percent of the three countries’ total trade.

At the moment, the North American RTS does not yet have any provisions prescribing measures to support macroeconomic convergence, such as the “Maastricht” and “Astana” macroeconomic stability criteria in the EU and the EAEU. Even less does it envisage fiscal transfer mechanisms like the Cohesion Fund and the Recovery Fond of the European Union. However, the 2018 USMECA agreement in Chapter 33 demands the transparency and liberality of the exchange rate policies of the member states, which is being monitored by a specially created joint “Macroeconomic Committee”. It is possible that in the future, with the continuation of North American economic integration, the parties might agree on certain measures to accelerate the economic convergence of Mexico to the common North American level.

Notes:

[1] In the article, the author intentionally prefers to use the unofficial but more pronounceable abbreviation “USMECA” to the official abbreviation “USMCA”.