_ Elena Durante, Financial Stability Analyst, ECB; Annalisa Ferrando, Senior Lead Economist, ECB; Philip Vermeulen, Senior Lecturer, Auckland University of Technology. 30 November 2020.

Monetary policy affects firms’ investment behavior through an interest rate channel and a balance sheet channel. This article uses investment data from over one million firms in Germany, Spain, France, and Italy to analyze the transmission of monetary policy shocks. It finds heterogeneity in the effects depending on firm size and industry – young firms and those producing durable goods react more strongly than the average firm. Embedding these findings into macroeconomic models used in policymaking would enhance the information available to decision-makers.

A key issue for central banks is understanding exactly how their monetary policy works. Monetary policy affects firms’ investment through both an interest rate channel and a balance sheet channel. First, through the interest rate channel, monetary policy can affect firms’ demand for capital as an input into the production process. This is because interest rates affect decisions on saving or investing and can boost aggregate demand. Second, through the balance sheet channel, monetary policy can make it less expensive for firms to borrow externally and reduce the firm-specific user cost of capital, allowing them to invest more. The ‘external finance premium’ is the difference between the cost of borrowing funds externally and generating them internally. Lower interest rates can reduce this premium because they increase asset values, increasing the value of firms’ balance sheets and thus their net worth.

Monetary policy affects firms differently. Not all spending is equally sensitive to interest rates. Therefore, the fluctuations in demand generated by the monetary policy will vary across firms. Spending on durable goods, such as cars or household furniture, is often financed by credit and provides a stream of services over time; such spending is therefore more sensitive to the interest rate. There is ample evidence that the output of industries that produce durable goods reacts more to monetary policy shocks (Ganley and Salmon 1996, Dedola and Lippi 2005, Peersman and Smets 2005). If the effect of monetary policy on the demand for durable goods is relatively strong, it follows that the investment demand of the firms producing these goods should also react more strongly to monetary policy shocks. Another reason why the impact on firms’ investment varies is the size of the external finance premium they face. Firms with less access to finance should face both higher and more volatile external finance premia. Unfortunately, we cannot measure firms’ external finance premia. However, a good proxy for access to finance is the age of the firm. Younger firms generally have less access to credit, are smaller, and have lower earnings. Recent evidence for the US and the UK has already shown that younger firms react more strongly to monetary policy shocks (Cloyne et al. 2018).

This column explains how we analyze these two channels of monetary policy transmission in the euro area, by documenting the heterogeneous reaction of firms’ investment to monetary policy shocks (Durante et al. 2020).

Data and estimation method

We use firm-level data from the four largest economies in the euro area (Germany, Spain, France, and Italy) to construct a large and rich dataset covering more than one million firms throughout 2000-2016. This provides us with around nine million observations of firm-level investment.

As a proxy for the euro area policy rate we use the high-frequency monetary policy shock series from Jarociński and Karadi (2020). The shocks are surprise movements in the three-month Euro Overnight Index Average (EONIA) swap rate around policy announcements.

Since firm-level investment data are annual, we construct an annual monetary policy shock data series by aggregating the monthly shocks into 12-month totals. The reaction of firm investment to those shocks is then estimated using local projections (Jordà 2005).

The next step is to identify the different channels through which monetary policy operates. We split the firms into different groups, based on what we already know about firms being affected differently by different transmission channels. In particular, we first separate financially constrained firms from unconstrained ones, in order to understand the impact of monetary policy on the external finance premium. In other words, we examine how well the balance sheet channel works. In line with the recent literature (Cloyne et al. 2018), we use age as a proxy for more financially constrained firms, defining ‘young’ firms as those less than ten years old. Younger firms have shorter credit histories and should therefore be more vulnerable than older ones to any tightening of credit conditions.

Second, we look for evidence of the interest rate channel of monetary policy at work by breaking our sample down into different sectors such as manufacturing, construction, and services. The granularity of our firm-level dataset allows us to further disaggregate the manufacturing sector into 24 two-digit NACE code industries and the services sector into six two-digit NACE code industries.

Findings

Figure 1 shows how the average firm’s investment reacts over the four years following a ten basis-point upward surprise in the short-term interest rate, i.e. how firms’ investment reacts to a tightening of monetary policy. The investment rate of the average firm does not react initially but drops by 3.4 percentage points in the year following the monetary policy shock. In the second year after the shock, the investment rate remains at this lower level. It then returns to its initial level in the third year.

Figure 1 Average investment reaction to a monetary policy shock

Notes: The horizontal axis shows the years following the shock; the vertical axis is the change in percentage points from the baseline investment rate following a ten basis-point upward surprise. The shaded areas represent 90%, confidence bands.

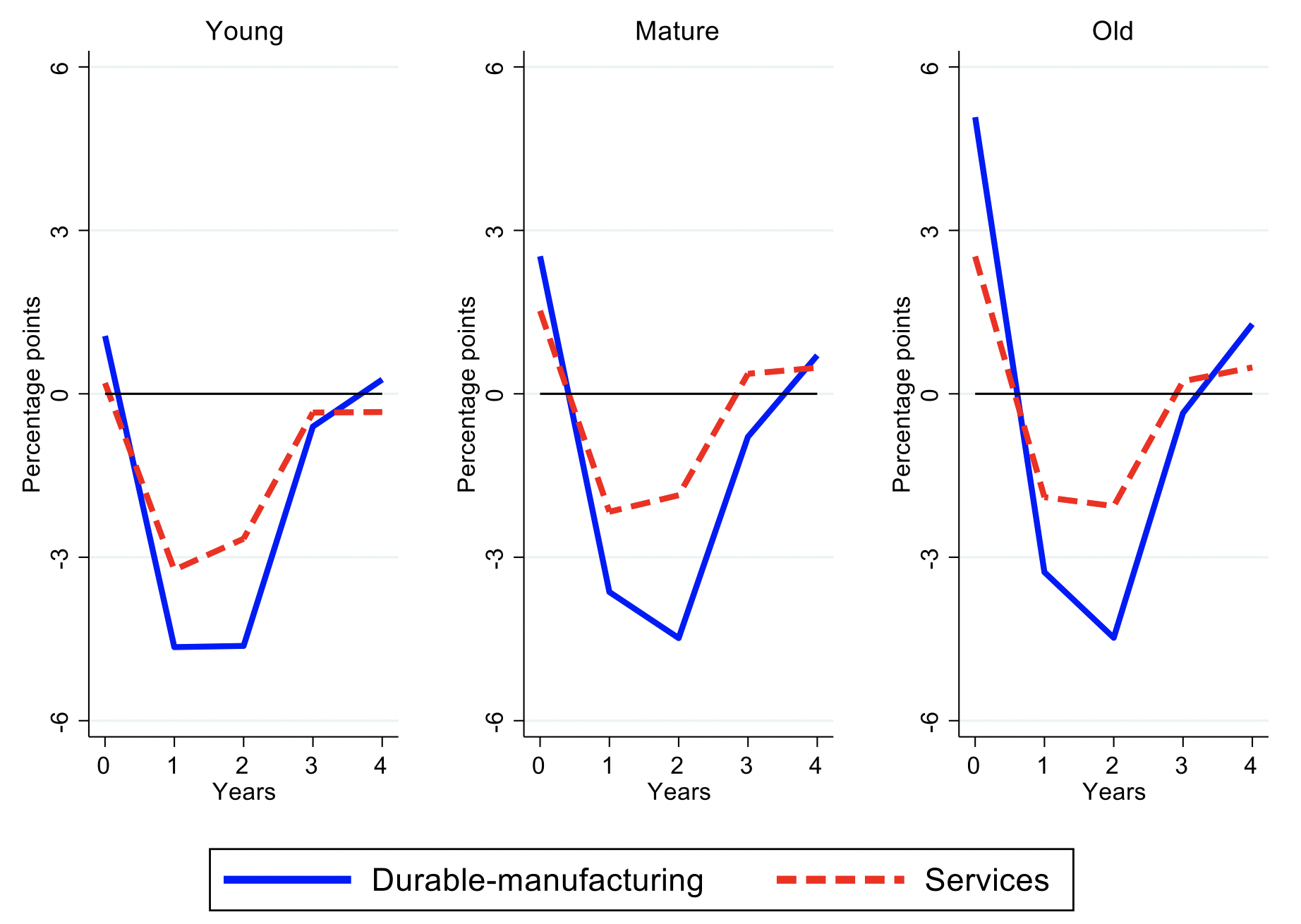

Young firms, i.e. firms below ten years of age, react more strongly to a surprise than the average firm. Similarly, firms that produce durables react more strongly than firms providing services. Figure 2 illustrates that a combination of these characteristics leads to substantial differences in firms’ reactions to monetary policy. One year after the surprise, the investment rate of young firms in the durables sector drops by 5.0 percentage points. This compares with a drop of only 2.7 percentage points for ‘old’ firms, defined as over 20 years of age, that provide services.2 ‘Mature’ firms, between ten and 20 years of age, exhibit a reaction within those two extremes (4.4 percentage points for mature firms producing durables and 2.9 percentage points for mature firms providing services). We also run a series of statistical tests on the equality of the effect of the shock between the two sectors and in most cases the tests reject the equality. For all firms, the investment rate remains depressed for two years following a monetary policy surprise, returning to its original level only in the third year.2

Figure 2 Investment reaction by age of firm and durability of output

Notes: The horizontal axis shows the years following the shock; the vertical axis shows the change in percentage points from the baseline investment rate following a ten basis-point upward surprise.

Conclusions

The differences in the way firms’ investment reacts can be used to gauge the importance of the two different channels of monetary policy involved here. In the aftermath of a monetary policy shock, firms that produce durables cut back their investment more than firms providing services. This reflects the interest rate channel at work. Young firms also react more, indicating that the balance sheet channel of monetary policy is having an impact.

Ultimately, these findings provide a deeper understanding of the transmission of euro area monetary policy to the real economy. They point to important differences across firms – a feature that is not yet routinely embedded in the standard macroeconomic models. As central banks around the world are using such models as one of the inputs that guide their policymaking, embedding our findings into those macroeconomic models would enhance the information available to decisionmakers.

Authors’ Note: This column first appeared as a Research Bulletin of the ECB, and it is based on the ECB Working Paper “Monetary policy, investment and firm heterogeneity” (Durante et al. 2020). The authors gratefully acknowledge the comments of Alberto Martin and Giulio Nicoletti and the excellent research assistance of Valerio Di Tommaso. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank.

References

Cloyne, J, C Ferreira, M Froemel and P Surico (2018), “Monetary policy, corporate finance and investment”, NBER Working Paper, No 25366.

Dedola, L and F Lippi (2005), “The monetary transmission mechanism: evidence from the industries of five OECD countries”, European Economic Review 49(6): 1543-1569.

Durante, E, A Ferrando and P Vermeulen (2020), “Monetary policy, investment and firm heterogeneity”, ECB Working Paper, No. 2390.

Ganley, J and C Salmon (1996), “The industrial impact of monetary policy”, Quarterly Bulletin, Bank of England.

Jarociński, M and P Karadi (2020), “Deconstructing monetary policy surprises: the role of information shocks”, American Economic Journal: Macroeconomics 12(2): 1-43.

Jordà, O (2005), “Estimation and Inference of Impulse Responses by Local Projections”, American Economic Review 95(1): 161-182.

Peersman, G and F Smets (2005), “The industry effects of monetary policy in the euro area”, Economic Journal 115(503): 319-342.

Endnotes

1 These effects are relatively large. Comparisons with the existing literature are difficult to make due to differences in the period of investigation, sample characteristics, time aggregation of investment, and shock definitions. In the most closely related study (Cloyne et al. 2018) the quarterly investment rate of young firms in the US and UK falls by around 1% after a quarterly surprise increase of 25 basis points in the interest rate. The firms in that study, however, are all large and listed companies compared to the mostly smaller, unlisted companies in our study.

2 Figure 2 suggests a slightly stronger effect two years after the shock in the durables sector for mature and old firms. However, the effect after two years is not statistically different from the effect after one year for any group of firms.

Source: https://voxeu.org/