_ Yuri Kofner, junior economist, MIWI Institute for Market Integration and Economic Policy. Munich, 7 May 2021.*

Introduction

In the Alternative for Germany (AfD) party’s 2019 election program for the European Parliament, DEXIT, i.e., Germany leaving the European Union in its current format, was named as a means of last resort if the EU could not be reformed.[1]

The AfD and its proponents are of the opinion that the federalist approach has gained the upper hand in European integration. In their opinion, the principle of subsidiarity is no longer being respected in the EU.[2]

According to the subsidiarity principal, policy areas are only to be transferred to a higher supranational level if they can be implemented much more effectively there, thanks to economies of scale, than at the national level or based on intergovernmental cooperation. The added value of the competencies transfer to a higher level must thus exceed the disadvantages of the Oates effect, i.e., when the supply of certain policies at supranational level does not (completely) correspond to the economic interests of the individual member states.[3] The net welfare effect must also be greater than the democratic insufficiencies in the EU’s decision-making mechanism.[4]

Examples of these disadvantages, which are also criticized by the AfD, include, but are not limited to:

- The inhumane and fiscally damaging refugee policy (dangerous long-distance migration is tolerated instead of trying to create better long-term living conditions locally).[5]

- The planned-economy intervention in the free market under the guise of the “Green Deal”.[6]

- The ultra-loose monetary policy that potentially zombifies the corporate landscape and increases the risk of post-crisis hyperinflation.[7]

Especially under the pretext of the Corona crisis of 2020, we see that the transformation of the EU towards a transfer, fiscal and debt union is actively being pushed forward[8], e.g., with the creation of the Corona reconstruction fund (NGEU). Only a little over 6 percent of the funds made available in the NGEU can actually be spent on improving the healthcare systems.[9]

Having seen that the desired reform of the EU will not take place, the AfD decided at its April 2021 federal party conference in Dresden to officially include the demand for a DEXIT in its federal election program.[10]

The DEXIT-idea is criticized by many leading economic researchers, for example by Gabriel Felbermayr, since, in their opinion, Germany leaving the EU would lead to significant welfare costs for the country.[11]

Thus, on this occasion, the aim of this policy note is to create a cost-benefit calculation of two potential (post-)DEXIT scenarios.

DEXIT means Deutschmark and European Economic Community 2.0

However, before doing that, the potential misunderstanding of the AfD being eurosceptic in its outlook and allegedly even wishing to damage Europe with the DEXIT should first be addressed and corrected. Of course, this accusation is not true.

As already said at the beginning of this analytical note, the aim of the AfD was, and actually still is, a reform of the policy powers in the EU towards an intergovernmental economic and interest community based on the principle of subsidiarity.[12],[13] Such a “Europe of the Fatherlands” corresponds to the concept of “integration of different speeds” and of a “Europe of concentric rings”.[14]

This renewed European Economic Community (EEC), which would most likely be the envisaged goal, would therefore include the following redistribution of competencies:

- A single market for goods, services, and capital.

- A customs union and a common foreign trade policy

- The joint promotion of research and development as a net positive public good.[15]

- The free movement of people, but only according to intergovernmental agreements.

- No common currency and no monetary union.

- No cohesion policy, i.e., no transfer payments.

- No fiscal union and no debt union.

- No supranational industrial policy, not even under the pretext of decarbonization.

Unfortunately, DEXIT is becoming a necessity not only because the EU is moving further and further away from the desired format of a renewed European Economic Community, but also because of the current European treaties and decision-making mechanism.[16] These only make an institutional reform possible if all member states agree by consensus. However, since there are clear net welfare beneficiaries of the current EU transfer structure, such as Greece and Poland[17], such a radical reform would unfortunately be highly unlikely, if not impossible.

For this reason, DEXIT needs to be understood as an unfortunate but necessary means to an end, either to compel a reform of the EU with the possibility of DEXIT, or to renegotiate a new European Economic Community for immediately after the exit.

Methodology and data

Status quo

To estimate the DEXIT welfare effects of the above envisaged policy power redistribution, the author will use a comparison of the benefits and costs of the European Union for Germany based on a building block approach, as well as a partial equilibrium industry-level trade model[18], to check for exchange rate effects. The author will analyse two potential counterfactual scenarios in relation to the current status quo: 1. a Deutschmark scenario, where Germany leaves the Euro area; and 2. a scenario, where the EU is replaced with the more streamlined European Economic Community 2.0.

Benefits

The advantages of the EU arise mainly thanks to the reduction of trade barriers and transaction costs, as well as thanks to the provision of public goods from a supranational level. According to a trade gravity model conducted by the ifo Institute and the Kiel Institute for the World Economy[19], the European Union is providing Germany with a yearly welfare bonus of 5.4 percent of GDP. The single market (3.9 percent), on which the AfD would like to concentrate back the most, creates the largest share of this benefit.

Costs

The measurable costs of the current EU for Germany consist of the country’s negative net transfers to the EU budget, both directly, and via the European financial aid institutions (EFSM, EFSF, ESM); the newly incepted Corona reconstruction fund (NGEU); and, potentially, the German TARGET II claims. The author has compiled these based on research results from the Centre for European Politics (cep), the ifo Institute, and with data from the Bundesbank.

Germany’s cumulative budgetary net contributions to the EU were determined by the cep for the period from 2008 to 2017 to be as high as 137.7 bln euros.[20] In order to get a more realistic picture of Berlin’s future net payments, the author has factored in BREXIT and thus the discontinuation of the British net contributions, according to which the German net transfer payments must increase by at least 18 percent to make up for the UK. Spread over the years, the annual average German net transfer payments to the EU budget and via the European financial aid institutions amount to 18 billion euros or 0.6 percent of GDP.

The total German net contribution to the NGEU was determined by the ifo Institute to be 2 percent of national GDP.[21] According to the author’s calculations, this amounts to an average of around 62.7 billion euros in total, which is equivalent to 9 bln euros or 0.3 percent of German GDP annually between 2021 and 2027.

Taken together, the annual net costs of the EU’s fiscal redistribution thus amount to 0.9 percent of German GDP.

The unsettled TARGET II claims of the Bundesbank are often seen as proof that Germany itself at least partially finances its export surplus with the southern euro area countries. And these claims are indeed significant: according to data by the Bundesbank,[22] over the study period (2008-2017) they made up a total of 27.1 percent of German GDP. Spread over nine years this was tantamount to 94.5 bln euros or 3.1 percent of GDP per year (if one divides the stock size accordingly into annual theoretical flow sizes). By April 2021 Germany’s TARGET II claims amounted to 1.1 trillion euros.

Whether the TARGET II claims can be viewed as a potential cost for Germany, or if they only represent a “mundane accounting balance”, is disputed among economists.[23] On the one hand, one at least must assume that in the event of an exit from the eurozone, the Bundesbank will have to forfeit these claims, which could lead to a significant capital market crisis.[24] On the other hand, outside of the ECB clearing system it shouldn’t be possible to build up any significant new current account claims.

Since the TARGET II claims remain unsettled in relation to the European partners but are de facto already settled by the Bundesbank regarding the German exporters, the TARGET II balances are recognized by the author in this policy note but are not included in the actual cost-benefit estimation.

At this point, it must be pointed out that this relatively short analysis does not address two others potential effects if Germany were to leave the euro area. Firstly, apart from the TARGET issue, the problem of German foreign assets, the likely (significant) fluctuations in the capital markets overall and all related effects on the real economy[25], are not taken into account in this analysis.

Secondly, the does not consider the possible effects of a stricter monetary policy of a newly independent Bundesbank compared to the current ultra-expansive monetary policy of the ECB. Studies by the European Central Bank itself assume that annual economic growth in the euro area would have been 0.5 percentage points lower without its expansionary monetary policy.[26] However, it is not entirely clear how sustainable such a policy is[27], whether it does not lead to (hyper-) inflation in the event of a loss of control[28] and whether it does not actually lead to a slowdown in economic growth due to a potential zombification of the corporate landscape.

Net welfare effect

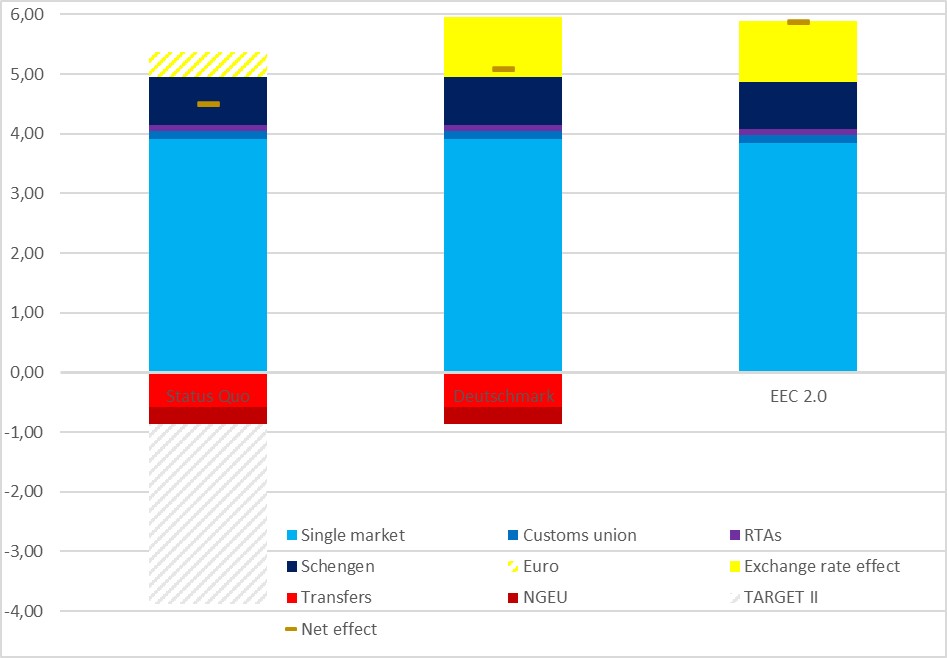

If one calculates the above said costs and benefits against each other, one sees that the EU in its current configuration brings Germany a net added value of 4.5 percent of GDP (Chart 1., Tab. 1). It must therefore be stated that Germany is indeed gaining more than it is losing through its participation in the EU in its current format.

However, nonetheless many of the welfare-reducing policies of the EU mentioned in the introduction of this policy note were not quantified in this simple comparison, e.g.: fiscal and welfare costs from the influx of asylum seekers; the zombification of the economy due to the ECB’s expansive monetary policy; and the industrial policy dirigisme of the Green Deal, – just to name a few.

Two DEXIT scenarios

Deutschmark

Researchers have always been fascinated by the possible economic effects of Germany’s exit from the euro zone.[29]

On the one hand, a redenomination would nullify the transaction cost savings of the single currency. According to the above-mentioned trade gravity model, that would correspond to an annual loss of added value of 0.4 percent of GDP.

Due the fixed exchange rates in the euro monetary union the real exchange rate of the export-led German economic model is undervalued, and the exchange rate of the southern debt-led euro countries is overvalued.[30],[31]

According to macroeconomic projections by the Bertelsmann Stiftung, in the event of a redenomination, the reintroduced Deutschmark would appreciate by approx. 23 percent and the remaining euro would depreciate by approx. 7 percent.[32]

This would mean, ceteris paribus, that German exports abroad would become relatively more expensive, while imports into Germany would become relatively cheaper. For the other euro countries, e.g., Italy, the effect would accordingly be vice-versa.

Whether this will have a positive or negative outcome on the German economy ultimately depends on which effect will be greater: the price rise of German exports, which largely consist of high added value goods, or imports becoming cheaper, mainly intermediate goods and raw materials.

To answer this question, the author used a partial equilibrium model to estimate the trade and welfare effects of the likely exchange rate changes for goods and services trade. The model consisted of four regions: Germany, the rest of the euro zone, the rest of the EU and the rest of the world. The data used came from the WITS-GTAP database[33] for goods and the OECD[34] for services. 2017 was chosen as the reference year.

According to the simulation results, in the Deutschmark scenario, German exports of goods and services would decrease by around 2 percent to the rest of the euro countries, by 35 percent to the non-euro countries of the EU and by up to 40 percent to the rest of the world. At the same time, imports would increase by 3, 30 and 33-37 percent, respectively.

Ultimately, the consumer surplus would exceed the producer loss in the goods and services sector. As a result, the welfare benefit of the exchange rate effect in the Deutschmark scenario would amount to 0.6 percent of GDP in trade in goods and 0.5 percent in the service sector. Cumulatively, German GDP would thus increase by 1 percent from leaving the euro area.

The rest of the structure of German EU membership, including transfer payments, would not change in the Deutschmark scenario.

Ultimately, without taking into account the “TARGET trap”, other capital market shifts and the effects of a probably much stricter national monetary policy, Germany’s exit from the euro and the reintroduction of an independent Deutschmark would make German GDP on average 0.6 percentage points higher than it is currently (Chart 1., Tab. 1). In other words, leaving the euro area would make every German citizen 250 euros richer every year.

European Economic Community 2.0

The EEC 2.0 counterfactual is the same as the Deutschmark scenario, i.e., in that Germany leaves the euro area. Beyond and above that, it is assumed that Berlin will discontinue its annual net transfer payments to the EU, including the NGEU reconstruction fund, but will maintain its net contributions for joint European R&D projects in the usual amount of around 0.5 bln euros per year.[35] Overall, this corresponds to annual savings of 0.85 percent of German GDP.

The European Union would not be possible without Germany. The author assumes that, for economic, demographic, and geographical reasons, Germany has such a strong negotiating position vis-a-vis the other EU member states that, despite Berlin’s discontinuation of transfer payments, the other member states will not be able exclude German participation in the single market, customs union, Schengen area and free trade agreements with third parties within the framework of a renewed European Economic Community, which will replace the EU in this scenario. The cost of excluding Germany from these integration institutions, even in the short run, would be too high for the other EU countries to use credibly as a negotiatory means of pressure against Germany.

Nevertheless, the author expects that due to macroeconomic interdependencies, the almost complete reduction in German net transfer payments to the other EU countries will lead to a certain decline in the positive welfare effects of the European single market, the customs union, and the Schengen area.

Since estimating these feedback effects accurately is rather difficult and would require a very well calibrated multisectoral general equilibrium model, the author has to be excused for using simpler methods and estimates from previous studies.

The German net transfer payments, corrected for a post-Brexit period, make up approx. 38.5 percent of the total net transfer payments into the EU financial framework. Berlin’s net contributions to the Next Generation EU account for around 8.8 percent of all net transfers to the NGEU reconstruction fund.[36] Overall, the German payments make up 18.3 percent of all transfer payments from the net contributors. If Germany were to stop its net transfer payments, EU spending would have to shrink accordingly by this amount and proportion.

According to a comprehensive estimation by the European Central Bank, the average contractive fiscal multiplier in the EU has a factor of 0.5.[37] Accordingly, a decrease in EU spending on structural and cohesion policy by 18.3 percent would only have half the macroeconomic effect on the member states of 9.2 percent. In 2017, Germany accounted for around 22 percent of the intra-EU27 trade in goods and services.[38] Accordingly, a reduction in German net transfer payments would reduce the added value of the European internal market, customs union, and Schengen zone for Germany via these two channels by only 2.1 percent.

Since, on the one hand, the costs for Berlin’s net transfer payments are almost completely slashed, except for German participation in joint R&D projects, and, on the other hand, the added value of the European internal market, customs union and Schengen zone is only slightly diminished, the scenario of a European Economic Community 2.0 will increase Germany’s GDP by 1.4 percent compared to the status quo (Chart 1., Tab. 1). In 2019 prices, such a DEXIT scenario would make every German citizen 570 euros richer per year.

Conclusion and discussion

The European Union in its current format brings Germany a clear welfare bonus of 4.5 percent of GDP, since the economic benefits of 5.4 percent of GDP exceed the economic costs of 0.9 percent of GDP.

However, this equation omits many difficult to quantify aspects of the ever more intensifying economic centralization tendencies of the EU: potential zombification through the expansionary monetary policy of the ECB, distortions of competition through the interfering industrial policy of the “Green Deal”, and so on.

A potential DEXIT cannot be compared with the historical BREXIT insofar as there can de facto be no functioning European Union without Germany. DEXIT must therefore be understood as a means of exerting political pressure in order to achieve the required reform of the EU towards a “European Economic Community 2.0”.

The only choice is between: a. whether such a new status can be achieved instead of DEXIT – to ward it off, or, b. whether it has to be reached simultaneously with DEXIT, i.e., that on a December 31st the EU will cease to exist and the EEC 2.0 will come into effect on the following January 1st.

The author’s estimations show that Germany would benefit from leaving the euro. Despite higher transaction costs, but thanks to an ultimately positive exchange rate effect on trade in goods and services, national GDP in the Deutschmark scenario would be 0.6 percentage points higher than in the current status quo. It must be noted, however, that these equations do not take into account the situation with the open TARGET II claims, nor any other likely significant capital market shifts in the case of Germany leaving the euro area.

The European Economic Community 2.0 scenario will have an even higher net positive welfare effect on the German economy. Compared to the current status quo, German GDP would be 1.4 percent higher in case of such a policy power realignment. This is because, on the one hand, Germany could almost entirely cut down on its net transfer payments to the other member states, on the other hand, the associated decrease in added value for Germany from participation in the European single market, customs union and Schengen area would turn out to be rather limited.

Over the course of the research for this cost-benefit analysis it became evident that it is essential which aspects of European integration are included in the estimation process. It is also difficult to quantify all aspects accuratly. For example, as already mentioned, the capital market was left out entirely in this analysis.

In order to better assess the potential effects of various DEXIT scenarios, it would be advisable next to apply and compare a large number of different general equilibrium models and comprehensive simulation methods.

Chart 1. Welfare effects of DEXIT: status quo vs. Deutschmark and EEC 2.0 scenario (in percent of GDP)

Source: Estimations by the author based on data by the IfW Kiel, ifo Institute, Centre for European Policy and Deutsche Bundesbank.

Tab 1. Welfare effects of DEXIT: status quo vs. Deutschmark and EEC 2.0 scenario (in percent of GDP)

| Status quo | Deutschmark | EEC 2.0 | |

| Single market | 3,91 | 3,91 | 3,85 |

| Customs union | 0,13 | 0,13 | 0,13 |

| RTAs | 0,11 | 0,11 | 0,11 |

| Schengen | 0,80 | 0,80 | 0,79 |

| Euro | 0,41 | 0,00 | 0,00 |

| Exchange rate effect | 0,00 | 1,01 | 1,01 |

| Transfers | -0,58 | -0,58 | -0,02 |

| NGEU | -0,29 | -0,29 | 0,00 |

| TARGET II | -3,01 | 0,00 | 0,00 |

| Net effect | 4,49 | 5,09 | 5,86 |

Source: Estimations by the author based on data by the IfW Kiel, ifo Institute, Centre for European Policy and Deutsche Bundesbank.

*The author would like to express his gratitude to Rainer Hermes, Parliamentary Consultant for European Affairs at the Bavarian State Parliament.

Notes

[1] AfD (2019). Europawahlprogramm. URL: https://www.afd.de/europawahlprogramm/

[2] Boehringer P. (2021). Das Ringen des AfD-Bundesparteitags um den EU-Austritt Deutschlands. URL: https://www.youtube.com/watch?v=hBap1Qkywj8

[3] Stehn J. (2017). Das Kern-Problem der EU. IfW Kiel. URL: https://www.ifw-kiel.de/de/publikationen/kiel-policy-briefs/2017/en/das-kern-problem-der-eu-8613/

[4] Scharpf F.W. (2018). There is an alternative: A two-tier European currency community. Max-Planck-Institut. URL: https://www.mpifg.de/pu/mpifg_dp/2018/dp18-7.pdf

[5] Rothfuß R. (2020). Wege aus der Migrationskrise. Leitlinien für ein exterritoriales Schutz- und Entwicklungskonzept und eine Remigrationsagenda für Europa. ID Fraktion im Europäischen Parlament. URL: https://www.id-afd.eu/wp-content/uploads/2021/02/ROTHFUSS_2020_Wege-aus-der-Migrationskrise.pdf

[6] Sinn H.W. (2020). Wir machen nur unsere Industrien kaputt. Industriemagazin. URL: https://www.hanswernersinn.de/de/wir-machen-nur-unsere-industrien-kaputt-im-28092020

[7] Tofall N.F. (2017). Zombifizierung und Geldpolitik. Flossbach von Storch Research Institute. URL: https://www.flossbachvonstorch-researchinstitute.com/de/studien/zombifizierung-und-geldpolitik/

[8] Kofner Y. (2021). Economic, fiscal and monetary impact of the Corona measures on Bavaria, Germany and Europe. URL: https://miwi-institut.de/archives/842

[9] Opinion by the author based on: CESifo (2021). The EU’s Big Pandemic Deal: Will It Be a Success? URL: https://www.cesifo.org/en/publikationen/2021/journal-complete-issue/cesifo-forum-012021-eus-big-pandemic-deal-will-it-be

[10] Zeit (2021). AfD beschließt Wahlprogramm – klare Absage an EU. URL: https://www.zeit.de/news/2021-04/11/afd-setzt-bundesparteitag-fort-schwere-zeiten-fuer-meuthen

[11] Felbermayr G. et al. (2019). Die (Handels-)Kosten einer Nicht-EU. IfW Kiel. URL: https://www.ifw-kiel.de/de/publikationen/kiel-policy-briefs/2019/die-handels-kosten-einer-nicht-eu-0/

[12] AfD Fraktion im Deutschen Bundestag (2021). Was bringt uns ein Dexit? URL: https://www.youtube.com/watch?v=ksEgaHox3lY

[13] Zurückführung der EU – Austritt aus der EU. WP-33 Sachantrag auf dem 12. Bundesparteitag der AfD. Dresden, 10-11.04.2021.

[14] Schäuble W., Lamers K. (1994). Überlegungen zur europäischen Politik. CDU/CSU. URL: https://www.cducsu.de/upload/schaeublelamers94.pdf

[15] Fuest C., Pisani-Ferry J. (2019). A Primer on Developing European Public Good. EconPol. URL: https://www.econpol.eu/publications/policy_report_16

[16] The Council of the EU (2021). Voting system. Unanimity. URL: https://www.consilium.europa.eu/en/council-eu/voting-system/unanimity/

[17] Kullas M. et al. (2019). 10 Jahre Umverteilung zwischen den EU-Mitgliedstaaten. Centrum für Europäische Politik (cep). URL: https://www.cep.eu/eu-themen/details/cep/10-jahre-umverteilung-zwischen-den-eu-mitgliedstaaten-cepstudie.html

[18] Francois J, Hall K (2002). Francois Global Simulation Analysis of Industry-Level Trade Policy. World Bank. URL: http://wits.worldbank.org/data/public/GSIMMethodology.pdf

[19] Felbermayr G. et al (2018). Undoing Europe in a New Quantitative Trade Model. ifo Institute, IfW Kiel. URL: https://www.ifw-kiel.de/de/experten/ifw/gabriel-felbermayr/undoing-europe-in-a-new-quantitative-trade-model-0/

[20] Kullas M., Rudolph K. (2020). Umverteilung durch die EU und den horizontalen Länderfinanzausgleich in Deutschland. Centrum für Europäische Politik (cep). URL: https://www.cep.eu/eu-themen/details/cep/umverteilung-durch-die-eu-und-den-horizontalen-laenderfinanzausgleich-in-deutschland-cepinput.html

[21] Dorn F., Fuest C. (2021). Next Generation EU: Gibt es eine wirtschaftliche Begründung? ifo Institut. URL: https://www.ifo.de/publikationen/2021/aufsatz-zeitschrift/corona-aufbauplan-bewaehrungsprobe-fuer-den-zusammenhalt-der

[22] Bundesbank (2021). TARGET2 – Balance. URL: https://www.bundesbank.de/en/tasks/payment-systems/target2/target2-balance/target2-balance-626782

[23] Sinn H.W. (2019). Der Streit um die Targetsalden. ifo Institut. URL: https://www.ifo.de/en/publikationen/2019/working-paper/der-streit-um-die-targetsalden-kommentar-zu-martin-hellwigs

[24] Sinn H.W. (2012). TARGET losses in case of a euro breakup. ifo Institute. URL: https://voxeu.org/article/target-losses-case-euro-breakup

[25] Lucke B. (2017). Warum die Auflösung der Eurozone mit dem Austritt Griechenlands beginnen muss. URL: https://bernd-lucke.de/wp-content/uploads/2017/10/2017-10-23-Warum-Deutschland-nicht-aus-dem-Euro-austreten-sollte.pdf

[26] Schnabel I. (2020). Narrative über die Geldpolitik der EZB – Wirklichkeit oder Fiktion. ECB. URL: https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp200211_1_annex~e385ff0f68.de.pdf

[27] AfD (2021). Was bringt uns ein Dexit? URL: https://www.youtube.com/watch?v=ksEgaHox3lY&t=1s

[28] Sinn H.W. (2020). Corona und die wundersame Geldvermehrung in Europa. ifo Institut. URL: https://www.ifo.de/vortrag/2020/weihnachtsvorlesung/corona-und-geldvermehrung

[29] E.g. Nordvig J. (2014). Cost and Benefits of Eurozone Breakup. University of Southern Denmark. URL: https://jensnordvig.com/cost-and-benefits-of-eurozone-breakup-the-role-of-contract-redenomination-and-balance-sheet-effects-in-policy-analysis/

[30] Sinn H.W. (2017). Deutschland – Wirtschaft, Euro, Europa und die Welt. ifo Institut. URL: https://www.hanswernersinn.de/de/ACQ_24052017

[31] Gräbner C., Heimberger P., et al. (2020). Is the Eurozone disintegrating? Macroeconomic divergence, structural polarisation, trade and fragility. Cambridge Journal of Economics. URL: https://academic.oup.com/cje/article/44/3/647/5706035

[32] Petersen T. et al. (2013). How Germany Benefits from the Euro in Economic Terms. Bertelsmann Stiftung. URL: https://www.bertelsmann-stiftung.de/de/publikationen/publikation/did/how-germany-benefits-from-the-euro-in-economic-terms/

[33] World Bank (2021). World Integrated Trade Solution (WITS). URL: https://wits.worldbank.org/

[34] OECD (2021). International Trade in Services Statistics. URL: https://stats.oecd.org/Index.aspx?DataSetCode=TISP_EBOPS2010

[35] Schiermeier Q. (2020). Horizon 2020 by the numbers: how €60 billion was divided up among Europe’s scientists. Nature. URL: https://www.nature.com/articles/d41586-020-03598-2

[36] Estimated by the author based on the results of the above-mentioned cep and ifo studies.

[37] Cugnasca A., Rother P. (2015). Fiscal multipliers during consolidation: evidence from the European Union. ECB. URL: https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1863.en.pdf

[38] Estimated by the author based on data by: European Commission (2018). DG Trade Statistical Guide. URL: https://op.europa.eu/en/publication-detail/-/publication/dc5a2f3e-88a1-11e8-ac6a-01aa75ed71a1/language-en ; and OECD (2021). International Trade in Services Statistics. URL: https://stats.oecd.org/Index.aspx?DataSetCode=TISP_EBOPS2010

11 comments