_ Yuri Kofner, economist, MIWI Institute. Zug – Munich, August 15, 2022.

In October 2021, 136 countries (now there are 137) agreed on a fundamental reform of global corporate taxation. The new regulation, which is to come into force from 2023, provides for two fundamental changes (pillars): on the one hand, the profit taxation of global mega-corporations according to the market country principle (pillar I), and on the other hand, the introduction of a global minimum tax of 15 percent for large corporations (pillar II).[1]

In the following analysis, both approaches and the concept of corporate taxation are evaluated from a German ordoliberal-conservative perspective.

Corporate taxation

Criticism of corporate and profit taxes is extremely unpopular, and those calling for their reduction are often seen as corporate lobbyists allegedly arguing “against the interests of the common worker.”

Hidden taxation of workers and consumers

However, instead of moderating the incomes of CEOs and big capitalists, corporate taxes actually are hidden income taxes and sales taxes that hurt workers, consumers and small businesses the most.

Studies by the ifo Institute [2] and NBER [3] show that 31 percent of the corporate tax burden is passed on to consumers in the form of higher prices, 38 percent to workers in the form of lower wages and only 31 percent to shareholders. Higher corporate taxes reduce the wages of the low-skilled, women and young workers the most, as well as hitting SME workers the hardest.

A 1 percentage point increase in the corporate tax rate increases retail prices by 0.17 percent, with low-priced goods bought by low-income households reacting nearly twice as much as luxury goods prices. This was also recently confirmed by a study by the ECB.[4]

On the other hand, corporate taxation favours large corporations due to economies of scale and more heavily indebted companies due to the preference for debt financing in tax law.

Innovation-inhibiting

The corporate tax also reduces the research and innovation activities of companies. Empirical research is unequivocal in this regard. A current paper by the ifo Institute gives a good overview of this: the higher the corporate tax, the lower the R&D expenditure, the number and quality of patents, citations, and the number of researchers employed. And vice versa: the lower the corporate tax rate, the more intensively a company researches, ceteris paribus.[5]

Growth retardant

Corporate taxes hamper economic growth and lowering them would boost the economy. A study by the IMF shows that a reduction in the corporate tax rate in Germany by 10 percentage points would increase national welfare by 0.2 percent and German GDP by 0.9 percent.[6]

The American research institute “Tax Foundation” estimates the significantly positive economic and social effects of the decision by liberal-conservative president Trump to lower the corporate tax rate from 35 percent to 21 percent as follows: an increase in GDP of 1.7 percent by 2027, Capital stock up 4.8 percent, the labor share up 1.5 percent, and nearly 340,000 new US jobs.[7]

In contrast, an analysis by the Heritage Foundation shows that left-progressive president Biden’s proposal to fund massive government spending by raising the US corporate tax rate from 21 percent to 28 percent would reduce the GDP of the American economy by nearly 1 percent. [8th]

Further studies from the USA and Great Britain support the findings made above.[9]

Policy recommendations

It is therefore obvious that corporate taxes themselves should be lowered as they stifle innovation and economic growth and impose a hidden tax on workers and consumers.

- The federal government should lower the combined corporate tax rate to 15 percent. This would increase German GDP by around 1.3 percent and automatically lead to higher government revenues from wage taxation, value added tax and capital gains tax. German family businesses, medium-sized companies and the “somewheres”[10] would also benefit to a much greater extent from a general reduction in corporate tax than large domestic and foreign corporations.

Global minimum tax

The second pillar of the OECD tax reform is the more far-reaching. It sets a global minimum tax with an effective minimum tax rate of 15 percent and affects large companies with annual sales of over 750 billion euros. Foreign profits of multinational companies can be subsequently taxed domestically, as can profit transfers from subsidiaries to foreign groups if they are taxed below 15 percent abroad.

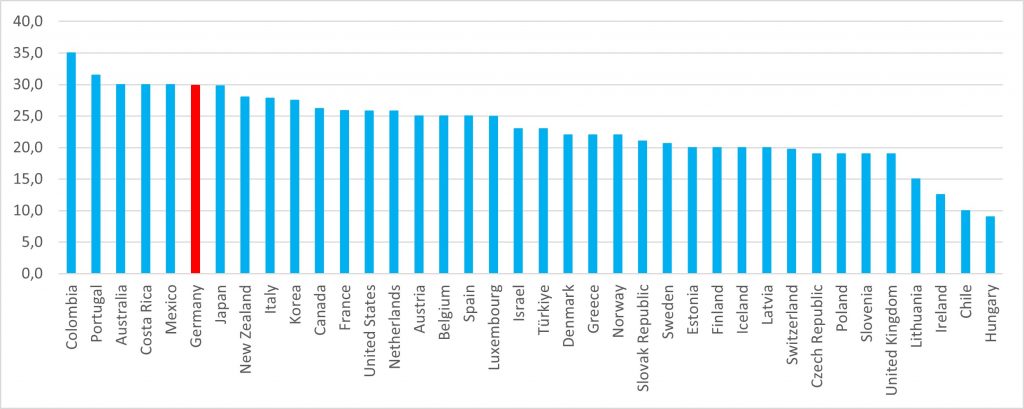

At 29.8 percent, Germany has the third highest combined corporate tax rate in 2022 among the industrialized countries of the OECD and the second highest in Europe (after Portugal and Australia with 31.5 and 30 percent respectively). Countries such as Ireland (12.5 percent), Chile (10.0 percent), Hungary (9.0 percent) and various cantons of Switzerland (8.5 percent) have a consolidated corporate tax rate below 15 percent (Fig. 1.) and are considered tax havens or low-tax countries.[11]

Fig. 1. Combined corporate tax rates in OECD countries (2022)

Source: OECD.

Noticeable additional burden for large German companies

According to simulations by the ifo Institute, the introduction of a global minimum tax would bring in additional tax revenue of 5.1 to 6.7 billion euros per year for the federal government. However, should the low-tax countries increase their tax rate to the stipulated 15 percent, the additional tax burden on the companies concerned that are active on the German market would remain at the above-mentioned 5.1 to 6.7 billion euros, but the additional German government revenue would drop to 2 billion euros per year.[12]

According to Destatis, around 300 large companies with an annual turnover of over 500 million euros would be affected by the global minimum tax regulation in Germany in 2019, but certainly more than 600 corporations with annual sales of over 1 billion euros.[13] The business editors of the newspaper “Welt” assume 827 potentially affected companies in Germany.[14] Although that is only 0.4 percent of all German companies, one has to consider that they account for 40.5 percent of the total turnover of the German corporate landscape. Large companies, which by definition are already considered to be those with a turnover of more than 50 million euros, make up only 1 percent of all companies in Germany, but generate 44 percent of employment, 63 percent of gross direct investments and 71 percent of total business turnover in Germany. [15]

Of course, economists agree, implementing the details of the global minimum tax in the form of the “income inclusion” rule and the “undertaxed payments” rule will create significant administrative burdens for tax offices and corporate compliance departments. The bureaucracy costs have not yet been quantified but will probably be in the hundreds of millions. [16]

Race to the bottom argument

Proponents of the global tax floor justify it with the international tax competition, which allegedly leads to ever lower national tax revenues and is accelerated by the existence of tax havens and low-tax countries. This is the so-called “race to the bottom” argument.

The argument is that companies take advantage of the benefits of the welfare state, such as infrastructure and a well-trained workforce, but do insufficiently to contribute to the common good by avoiding taxes or lobbying to reduce them.

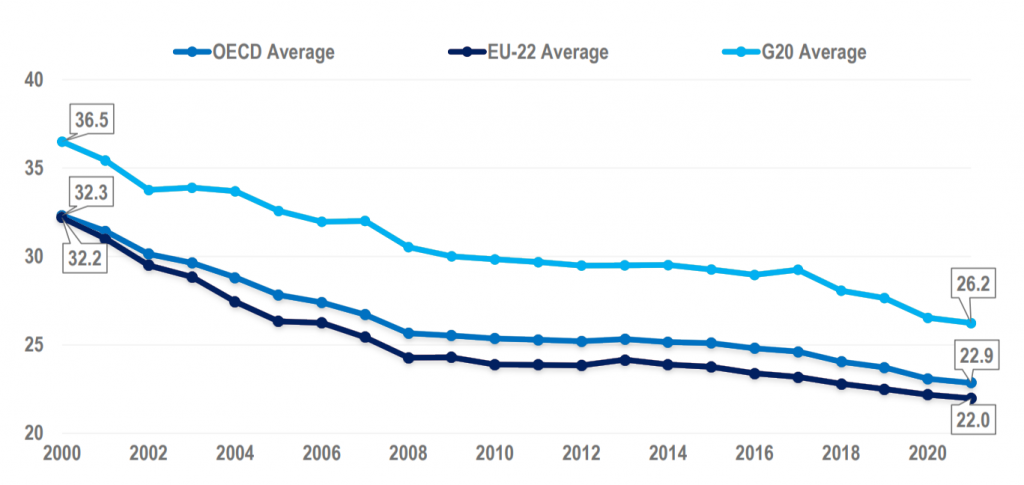

Indeed, the average corporate tax rate in OECD countries has fallen over the past 20 years from 32.3 percent in 2000 to 22.9 percent in 2022. [17] The German corporate tax rate has fallen from 51.6 percent in 2000 to 29.8 percent in 2022, although it was already slightly lower in 2009 at 29.4 percent (Fig. 2.).

Fig. 2. Combined corporate tax rates (2000-2022, OECD, G20, EU-22)

Source: OECD.

The rise of the state

Although corporate tax rates have indeed fallen over the years, the implicit argument that this has meant that government revenues are said to have fallen and that governments have found it increasingly difficult to fund public spending is simply wrong.

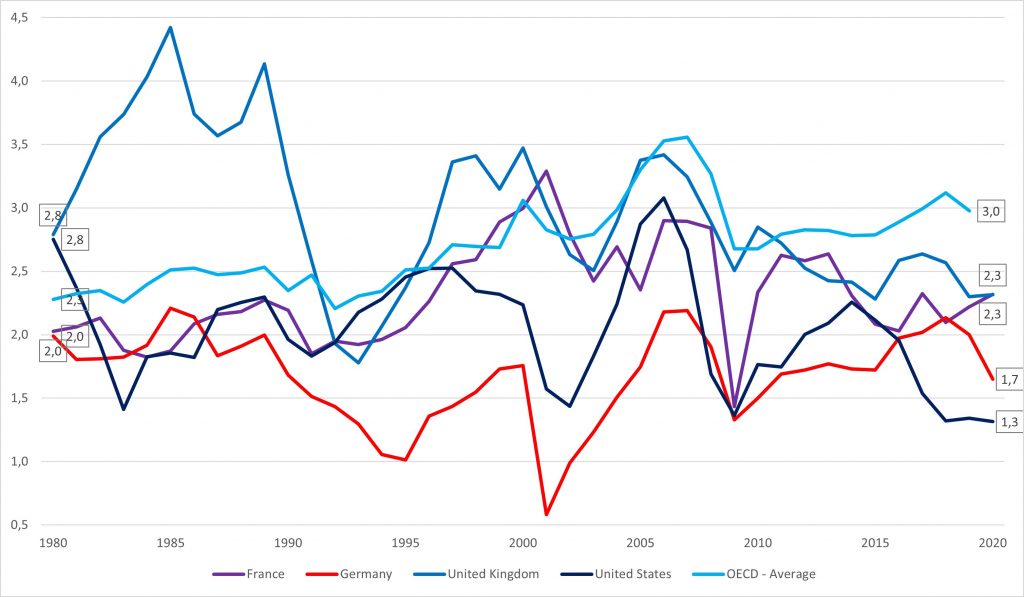

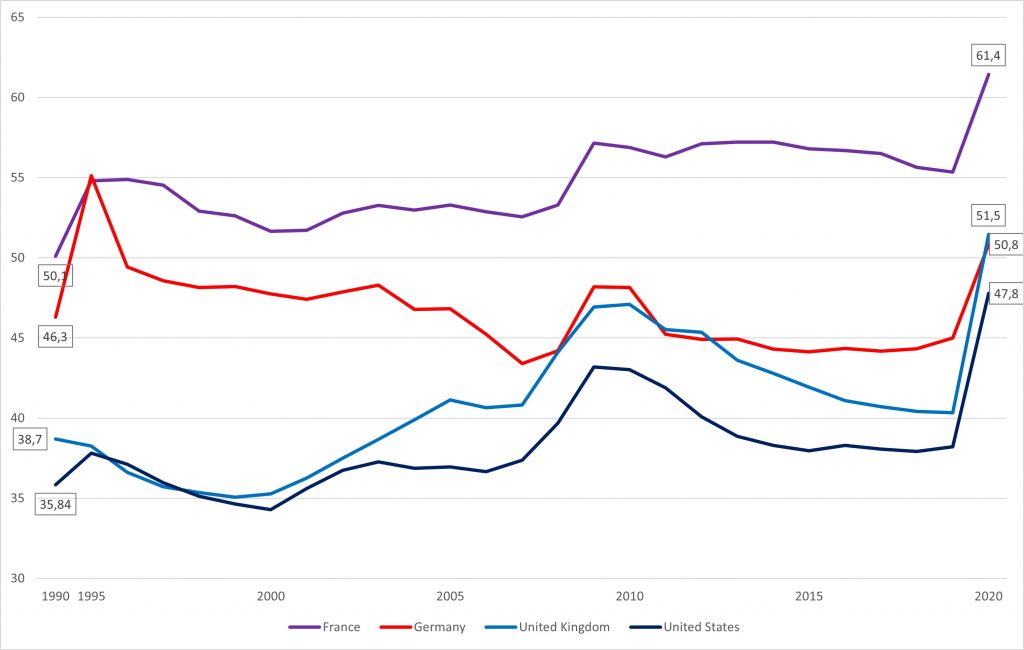

Since 1980, government revenue from corporate taxes has remained more or less stable as a percentage of GDP. On average across OECD countries, they even increased from 2.3 percent of GDP to 3 percent in 2020 (Fig. 3.).[18]

Figure 3. Government corporate tax revenues as a percentage of GDP (1980-2020, France, Germany, US, UK, OECD average)

Source: OECD.

A study by the ifo Institute even shows that between 1997 and 2017 the share of corporate tax revenue in total tax revenue in Germany rose from 16 to 23 percent. In addition, family businesses pay more taxes overall than large corporations: while the implicit tax burden in 2017 for DAX-listed corporations was 24 percent on average, it was 38 percent for medium-sized companies and family businesses.[19]

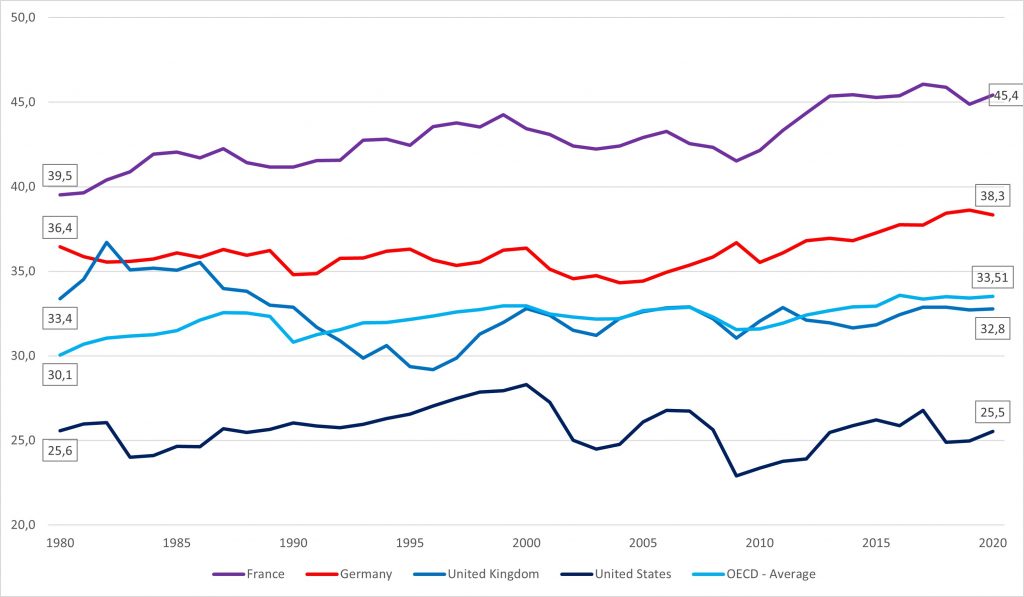

Overall, government revenue has risen in relation to economic output over the past 40 years. Government revenues in Germany increased from 36.4 percent of GDP in 1980 to 38.3 percent in 2020, and the OECD average increased from 30.1 to 33.5 percent over the same period (Fig. 4.). [ 20] Incidentally, in 1965 taxes and social security contributions accounted for only 31.7 percent of German GDP,[21] in the German Empire before 1914 it was only 18 percent.[22]

Figure 4. Government revenue to GDP ratio (1980-2020, France, Germany, US, UK, OECD average)

Source: OECD.

Total government spending as a percentage of GDP increased even more, especially under the pretext of fiscal stimulus packages allegedly to spur “post-Covid recovery”. From 1990 to 2020, the share of government spending in GDP in Germany rose from 46.3 to 51.5 percent, which means that the state already accounts for more than half of the German economy. The EU average increased from 45.4 percent in 2007 to 53.6 percent in 2020 (Fig. 5.).[23]

Fig. 5. Government expenditure as a percentage of GDP (1990-2020, France, Germany, US, UK)

Source: OECD.

One can see that corporate tax rate cuts in the West have not resulted in leaner states, but rather that their fiscal capacity has continued to grow stubbornly.

International state cartel

Agreements between companies to set a floor price are rightly criticized by mainstream economic theory and rightly prohibited by antitrust law because they impede competition between companies, causing them to offer goods and services of lower quality and quantity.

Seen in this way, international treaties on global minimum taxes are the same as price fixing at the private level and should therefore also be prevented. Tax competition between states is just as beneficial as price competition between firms: states compete with each other for skilled labour and for business localization by offering more/better public goods at lower prices, i.e. tax levels. A worldwide lower tax limit will prevent or at least dampen the incentives for tax cuts, including for high-tax countries such as Germany.

Subsidy competition

Financial economists argue that the global minimum tax will encourage governments to reduce tax competition and are more likely to compete in other areas by improving other locational advantages such as infrastructure, e-government, workforce education, and so on. [24]

Germany, as one of the countries with the highest wage taxes, [25] wage costs [26] and electricity prices [27] worldwide, urgently needs to improve its location conditions.

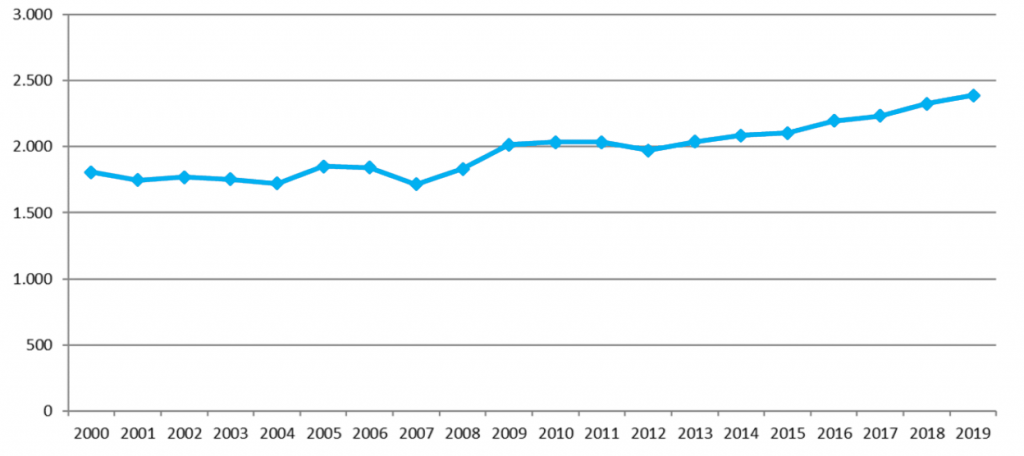

However, it is likely that states will compete for companies by offering them larger subsidies instead. This is already the case: Studies by the IfW show that state subsidies in Germany (per capita) have risen from 1,800 euros in 2000 to almost 2,500 euros in 2020 (Fig. 6.).[28] According to the traffic light coalition agreement, state subsidies for e-mobility, energy transition and CO2 avoidance should amount to 237.6 billion euros (2.864 euros per capita) by 2030.[29]

Fig. 6. Subsidies per German resident (2000-2019, in euros)

Source: IfW Kiel.

Relocation of production unlikely

From a national conservative point of view, the global minimum tax could have a positive aspect if it promoted the relocation of production sites back to Germany. Currently, the author could not find any research publications on the possible impact of a global minimum tax on reshoring. One clue could be the effect on international investment flows. According to a recent study by UNCTAD, the second pillar of global tax reform will reduce FDI flows from multinational corporations to offshore financial centres by 4 to 7.3 percent, while FDI flows to developed countries will increase by 0.4 to 0.6 percent will. However, developing countries will see a relatively much larger rise in FDI flows of 1.5 to 2.9 percent.[30]

In fact, research by NBER shows that eliminating tax havens, rather than encouraging reshoring, can be detrimental to home employment: as international corporations that used to be registered in offshore financial centres now face higher corporate taxes, they have let off workers in domestic subsidiaries.[31]

Policy recommendations

Global minimum taxes are unnecessary and counterproductive. As an international state cartel, they dampen tax and location competition. They are unlikely to encourage the relocation of production facilities. Anyway, reshoring should be stimulated through more attractive conditions for doing business, not by softening the competition. Global government revenue in relation to economic output continues to grow and the welfare state continues to expand. Dwindling tax revenues are really not an issue. Instead, the global minimum tax would put a significant burden on the most important German companies – up to 6.7 billion euros annually.

- The federal government should refrain from participating in the global minimum tax regime.

Market country taxation

If global minimum taxation is the more far-reaching change, the first pillar of the OECD tax reform is the more revolutionary, since it converts the taxation principle from the 19th century permanent establishment principle to measuring value added by the size of the sales market. This is the so-called market country principle.

The permanent establishment principle was sufficient as long as most of the added value took place in factories. With the emergence of digital platform economies and the increasing importance of intangible assets such as patents, trademarks, software codes and big data, most value creation is less and less dependent on a company’s physical presence.

The new market country principle therefore envisages a redistribution of taxation rights for particularly profitable corporations between the country of residence and the market country.

Affected are the largest multinational corporations with worldwide annual sales of more than 20 billion euros and a return on sales of at least 10 percent, i.e., gross profit in relation to total turnover. The amount above this 10 percent return on sales is called residual profit, of which three quarters remain unaffected. A quarter of this residual profit may be taxed by the market country according to its share of the company’s total worldwide sales.

Since the raw materials sector and the regulated financial market are exempt from the new regulation and industrial companies generally have a return on sales of less than 10 percent due to high fixed costs, market country taxation primarily affects international mega-corporations with a digital business model, i.e., digital platform companies and online sales marketplaces. For example, the largest German company, Volkswagen, had a return on sales of “only” 5.9 percent in 2021 (14.8 billion euros gross profit to 250 billion euros in sales).

Hardly any additional tax revenue, but also hardly any additional burden

Compared to the global minimum tax, the German economy is only slightly affected by the redistribution of taxation rights.

According to estimates by the ifo Institute, the tax reform will only affect 88 multinational corporations worldwide. In 2018, their cumulative residual profits amounted to 328 billion euros. Depending on the structure, the expected additional government revenue from the taxation of the companies affected, which generate added value from the German market, amounts to 0.8 to 1.9 billion euros annually.[32]

Of these, only 7 have a registered office in Germany, with a cumulative residual profit of 4.3 billion euros, i.e., a quarter of this amount would have to be taxed abroad. The German corporations affected would be: Ceconomy, Deutsche Telekom, Henkel, RWE, Bayer, SAP, Adidas.[33] Given a global average weighted corporate tax rate of 25.44 percent, these seven German companies would lose 1.1 billion euros annually.[34] Nevertheless, according to the Centre for Tax Policy and Administration of the OECD, Pillar I is unlikely to have any significant impact on global investment levels.[35]

One of the most contentious issues in implementing the reallocation of taxing rights is the avoidance of double taxation, likely carve-outs and, once again, of course, the associated additional bureaucracy for tax offices and compliance departments.[36]

Ordoliberal taxation of digital business models

Market country taxation is “justifiable” from two other points of view. First, it taxes a new way of adding value in connection with the business model of digital platforms, which largely depends on the size of the sales market, i.e., the size of the network and the number of “users”.[37]

Due to economies of scale, e.g., through the processing of big data, network effects and lock-in effects, digital platform companies can achieve a dominant position and generate significant profits. For example, in July 2022, Google (owned by Alphabet – with a 29.5 percent return on sales) had an 83.8 percent share of the global search engine market, 8.9 percent was held by bing (owned by Microsoft – with a 38.5 percent return on sales!).[38]

Market country taxation is therefore an ordoliberal instrument for appropriately taxing profits from the new business model of digital platforms.

Protecting the nation state

Secondly, proponents of the nation-state criticize the increasing uncontrolled power of global corporations. Their turnover is comparable to and often exceeds the economic size of many countries. In 2021, Amazon made sales of almost 400 billion euros, which is comparable to Austria’s GDP. With sales of 328 billion euros, Apple was on par with the Danish economy. Alphabet’s turnover of 219 billion euros exceeded the GDP of Portugal, and Microsoft’s sales (156.4 billion euros) were larger than the Hungarian economy.[39]

Large digital corporations have immense and largely uncontrolled influence over governments at all levels. Digital platform companies such as Apple, Google and Meta (owner of Facebook) are among the largest lobbying organizations in the EU: each of them spent between 6 and 7 million euros advocacy at the EU institutions in 2021.[40]

Given the market power of global digital platform corporations mentioned above and their poorly understood influence on governments, market country taxation seems a welcome tool to curb the growing power of these non-state actors.

Policy recommendations

In the dawning age of digitalization, market country taxation makes sense in order to appropriately tax the new business model of digital platforms. Other potentially adequate approaches are the expansion of source taxes on interest and license fees [41] or a pure digital tax based on the market country principle, as already considered by the EU Commission [42] and demanded by the German AfD party. [43]

It seems be a useful fiscal tool to somewhat constrain the power of multinational corporations vis-à-vis the nation state. At the same time, the redistribution of taxing rights would primarily affect US and Chinese multinationals, but only a modest burden on Germany’s largest companies.

- The federal government should participate in the international redistribution of taxation rights according to the market country principle, as long as its current configuration remains, and Germany’s industry and small and medium-sized enterprises remain unaffected by it.

Literature

Asen E. (2019). Germany’s Tax System: Developments and Competitiveness. Tax Foundation. URL: https://taxfoundation.org/germany-tax-system-competitiveness/

Bachas P. et al. (2022). Globalisation and the effective taxation of capital versus labour. World Bank. URL: https://cepr.org/voxeu/columns/globalisation-and-effective-taxation-capital-versus-labour

Boskin M.J. (2010). Junk the Corporate Tax. Hoover Institution. URL: https://www.hoover.org/research/junk-corporate-tax

Deutsche Bank Research (2018). German corporate taxes. URL: https://www.dbresearch.com/PROD/RPS_EN-PROD/PROD0000000000476988/German_corporate_taxes%3A_Growing_need_for_action.pdf?undefined&realload=v/QJe3RPAcUkpPRqVWoHOXlH2k8E1CoRjK86BV7VCk0GpPsrphMoeDaBky4N5LDO

Durante A. (2021). Who Bears the Burden of Corporation Taxation? A Review of Recent Evidence. Tax Foundation. URL: https://taxfoundation.org/who-bears-burden-corporate-tax/

Hartlieb A. (2021). Eine neue globale Steuerordnung – profitiert Deutschland davon? KAS. URL: https://www.kas.de/documents/252038/11055681/Globale+Steuerordnung.pdf/9dddd228-a1c2-0521-59b8-cb901bdf77b7?#:~:text=Konrad%2DAdenauer%2DStiftung%20e.,-V.&text=nach%20der%20Neuregelung%20ein%20Hochsteuerland,auf%20dem%20Weltmarkt%20zu%20steigern.

Johannesen N. (2022). The Global Minimum Tax. CESifo, University of Copenhagen. URL: https://www.cesifo.org/DocDL/cesifo1_wp9527.pdf

Liberales Institut (2022). Globale Mindeststeuer: Bedrohung für die Freiheit. URL: https://www.libinst.ch/?i=globale-mindestbesteuerung

Monopolkommission (2020). Wettbewerb 2020. XXIII. Hauptgutachten der Monopolkommission. URL: https://www.monopolkommission.de/images/HG23/HGXXIII_Gesamt.pdf

Riedel N. (2021). Gut gemeint, aber wirkungsschwach. Universität Münster, Wirtschaftsdienst. URL: https://www.wirtschaftsdienst.eu/inhalt/jahr/2021/heft/5/beitrag/mindeststeuern-gut-gemeint-aber-wirkungsschwach.html

Schaltegger C.A. (2022). Globale Mindeststeuer: Bedrohung für den Föderalismus? Liberales Institut, IWP.

vbw (2019). Unternehmenssteuern für Innovation und Wachstum. URL: https://www.baymevbm.de/Redaktion/Frei-zugaengliche-Medien/Abteilungen-GS/Wirtschaftspolitik/2019/Downloads/191007-vbw-Position-Unternehmensteuern.pdf

Notes

[1] BMF (2022). Global corporate tax reform is on the way. URL: https://www.bundesfinanzministerium.de/Content/EN/Standardartikel/Topics/Taxation/Articles/global-corporate-tax.html#:~:text=Under%20the%20auspices%20of%20the,revolution%20in%20international%20tax%20law.

[2] Fuest C., Peichl, A. Siegloch S.. (2018). Do Higher Corporate Taxes Reduce Wages? Micro Evidence from Germany. ifo Institute. American Economic Review. URL: https://www.aeaweb.org/articles?id=10.1257/aer.20130570

[3] Baker S. et al. (2020). Corporate Taxes and Retail Prices. NBER. URL: https://www.nber.org/papers/w27058

[4] Dedola, L., Osbat, C., Reinelt, T. (2022), Tax thy neighbour: Corporate tax pass-through into downstream consumer prices in a monetary union. ECB. URL: https://www.ecb.europa.eu/pub/economic-research/resbull/2022/html/ecb.rb220527~d6f37f59e7.en.html

[5] Falck F., Kerkhof A., Pfaffl C. (2021). Steuern und Innovation: Wie steuerliche FuE-Förderung Innovationsanreize in privatwirtschaftlichen Unternehmen schafft. ifo Institut. URL: https://www.ifo.de/publikationen/2021/aufsatz-zeitschrift/steuern-und-innovation-wie-steuerliche-fue-foerderung

[6] Álvarez-Martínez M.T. et al. (2018). The economic consequences of corporate tax rates reductions in the EU: Evidence using a computable general equilibrium model. IMF. URL: https://onlinelibrary.wiley.com/doi/full/10.1111/twec.12703

[7] York E. (2018). The Benefits of Cutting the Corporate Income Tax Rate. Tax Foundation. URL: https://taxfoundation.org/benefits-of-a-corporate-tax-cut/

[8] Sheppard P. (2021). The Long-Run Economic Effects of Raising the Corporate Tax Rate to 28 Percent,. Herigtage Foundation. URL: https://www.heritage.org/taxes/report/the-long-run-economic-effects-raising-the-corporate-tax-rate-28-percent

[9] Durante A. (2021). Reviewing Recent Evidence of the Effect of Taxes on Economic Growth. Tax Foundation. URL: https://taxfoundation.org/reviewing-recent-evidence-effect-taxes-economic-growth/

[10] Gauland A. (2019). Nation, Populismus, Nachhaltigkeit: Drei Reden. Antaios. URL: https://antaios.de/gesamtverzeichnis-antaios/reihe-kaplaken/87215/nation-populismus-nachhaltigkeit

[11] OECD (2022). Statutory corporate income tax rate. URL: https://stats.oecd.org/index.aspx?DataSetCode=TABLE_II1

[12] Fuest F., Hugger F., Neumeier F. (2022). Die Aufkommenseffekte einer globalen effektiven Mindeststeuer. ifo Institut. URL: https://www.ifo.de/en/publikationen/2022/article-journal/die-aufkommenseffekte-einer-globalen-mindeststeuer

[13] Destatis (2020). Umsatzsteuerstatistik (Voranmeldungen). URL: https://www.destatis.de/DE/Themen/Staat/Steuern/Umsatzsteuer/Publikationen/Downloads-Umsatzsteuern/umsatzsteuer-2140810197004.pdf?__blob=publicationFile

[14] Greive M., Hildebrand J., Volkery C: (2021). Was die Steuerrevolution für deutsche Firmen bedeutet. Welt. URL: https://www.handelsblatt.com/politik/deutschland/globale-steuerreform-was-die-steuerrevolution-fuer-deutsche-firmen-bedeutet/27270812.html

[15] Bahadori B. (2022). S-Finanzgruppe wichtig für KMU und Großunternehmen. Helaba Research. URL: https://www.helaba.de/blueprint/servlet/resource/blob/kundenresearch/585218/fe6bc58e9c6c16b954c22c3185de91cb/chartbook-20220505-data.pdf

[16] Fuest C. (2019). Die G-20-Beschlüsse: Durchbruch zu einer besseren internationalen Besteuerung. ifo Institut. URL: https://www.ifo.de/publikationen/2019/ifo-standpunkt/die-g-20-beschluesse-durchbruch-zu-einer-besseren-internationalen

[17] OECD (2021). Tax Database. Key Indicators 2021. URL: https://www.oecd.org/tax/tax-policy/tax-database-update-note.pdf

[18] OECD (2021). Revenue Statistics 2021. URL: https://www.oecd.org/tax/tax-policy/revenue-statistics-highlights-brochure.pdf

[19] Büttner T. et al. (2020). Der Beitrag der Familienunternehmen zum Steueraufkommen in Deutschland. ifo Institut, Stiftung Familienunternehmen. URL: https://www.ifo.de/projekt/2020-04-01/der-beitrag-der-familienunternehmen-zum-steueraufkommen-deutschland

[20] OECD (2022). General government revenue. URL: https://data.oecd.org/gga/general-government-revenue.htm

[21] BMF (2021). Abgabenquoten im internationalen Vergleich. BMF Monatsbericht 2021. URL: https://www.bundesfinanzministerium.de/Monatsberichte/2021/01/Inhalte/Kapitel-6-Statistiken/6-1-21-abgabenquoten-im-internationalen-vergleich.html

[22] Plumpe W. (2021). Ein wilhelminisches Wirtschaftswunder? Wirtschaftsdienst. URL: https://www.wirtschaftsdienst.eu/inhalt/jahr/2021/heft/4/beitrag/ein-wilhelminisches-wirtschaftswunder.html

[23] OECD (2022). General government expenditures. URL: https://www.oecd-ilibrary.org/sites/6c445a59-en/index.html?itemId=/content/component/6c445a59-en

[24] Becker J., Englisch J. (2019). Internationale Mindestbesteuerung von Unternehmen. Wirtschaftsdienst. Unversität Münster. URL: https://www.wirtschaftsdienst.eu/inhalt/jahr/2019/heft/9/beitrag/internationale-mindestbesteuerung-von-unternehmen.html

[25] OECD (2022). Taxing Wages 2022. URL: https://www.oecd.org/tax/taxing-wages-20725124.htm

[26] Schröder C. (2020). Arbeitskosten international: Deutschland in der Spitzengruppe. IW Köln. URL: https://www.iwkoeln.de/studien/christoph-schroeder-deutschland-in-der-spitzengruppe-484233.html

[27] GPP (2022). Strompreise privater Haushalte in ausgewählten Ländern weltweit im Jahr 2021. Statista. URL: https://de.statista.com/statistik/daten/studie/13020/umfrage/strompreise-in-ausgewaehlten-laendern/

[28] Laaser C.F., Rosenschon A. (2020). Kieler Subventionsbericht 2020: Subventionen auf dem Vormarsch. IfW Kiel. Die Schätzungen sind ohne das fiskalische Corona-Konjunkturpaket. URL: https://www.ifw-kiel.de/de/publikationen/kieler-beitraege-zur-wirtschaftspolitik/kieler-subventionsbericht-2020-subventionen-auf-dem-vormarsch-0/

[29] Kofner Y. (2022). Economic policy of Germany’s new coalition government: economic and welfare effects. MIWI Institute. URL: https://miwi-institut.de/archives/1617

[30] UNCTAD (2022). The Impact of a Global Minimum Tax on FDI. Global Investment Report 2022. URL: https://unctad.org/system/files/official-document/wir2022_ch03_en.pdf

[31] Juan Carlos Suárez Serrato J.C.S. (2018). Unintended Consequences of Eliminating Tax Havens. NBER. URL: https://www.nber.org/system/files/working_papers/w24850/w24850.pdf

[32] Clemens F., Herold E., Neumeier F. (2021). Die Neuordnung der internationalen Unternehmensbesteuerung. ifo Institut. URL: https://www.ifo.de/publikationen/2021/aufsatz-zeitschrift/die-neuordnung-der-internationalen-unternehmensbesteuerung

[33] Fuest C. et al. (2021). Nationale Steueraufkommenswirkungen einer Neuverteilung von Besteuerungsrechten im Rahmen der grenzüberschreitenden Gewinnabgrenzung: Ergänzende Berechnungen. ifo Institut, BMF. URL: https://www.ifo.de/en/publikationen/2021/monograph-authorship/nationale-steueraufkommenswirkungen-einer-neuverteilung-von

[34] Bray S. (2021). Corporate Tax Rates around the World, 2021. Tax Foundation. URL: https://files.taxfoundation.org/20211207171421/Corporate-Tax-Rates-around-the-World-2021.pdf

[35] Saint-Amans P. (2020). Die OECD-Vorschläge zur Reform der Unternehmensteuer – ein Plan mit unerwünschten Nebenwirkungen? OECD, ifo Institut. URL: https://www.ifo.de/DocDL/sd-2020-03-saint-amans-etal-oecd-unternehmensteuerm-2020-03-11.pdf

[36] Petkova K., Greil (2022). Wer wird Amount A zahlen? ifo Institut. URL: https://www.ifo.de/DocDL/sd-2022-04-petkova-greil-doppelbesteuerung.pdf

[37] Kofner Y. (2021). Better regulation of digital platform markets in Germany and the EU. MIWI Institute. URL: https://miwi-institut.de/archives/1030

[38] StatCounter (2022). Worldwide desktop market share of leading search engines from January 2010 to July 2022. Statista. URL: https://www.statista.com/statistics/216573/worldwide-market-share-of-search-engines/

[39] Forbes (2022). The Global 2000. 2022 Edition. URL: https://www.forbes.com/lists/global2000/?sh=7bb7f6c45ac0

[40] Zandt F. (2022). So viel geben Firmen für EU-Lobbyismus aus. Statista. URL: https://de.statista.com/infografik/17833/ausgaben-von-unternehmen-fuer-lobbyarbeit-in-der-eu/

[41] Fuest C. (2020). Unternehmen am Ort der Wertschöpfung besteuern – eine neue Leitidee für die internationale Besteuerung? ifo Institut. URL: https://www.ifo.de/DocDL/sd-2020-03-fuest-oecd-unternehmensteuerm-2020-03-11.pdf

[42] ifo Institut (2018). Die Besteuerung der Digitalwirtschaft: Zu den ökonomischen und fiskalischen Auswirkungen der EU-Digitalsteuer. IHK München und Oberbayern. URL: https://www.ifo.de/DocDL/Studie-Digitalsteuer-2018.pdf

[43] AfD-Fraktion im Bayerischen Landtag (2021). Freiheit in Netz und Medien IX: Digitalwirtschaft fairer besteuern. Drucksache 18/15791. URL: https://www1.bayern.landtag.de/www/ElanTextAblage_WP18/Drucksachen/Basisdrucksachen/0000010000/0000010147.pdf

3 comments