_ EDB. Moscow, 16 April 2024.*

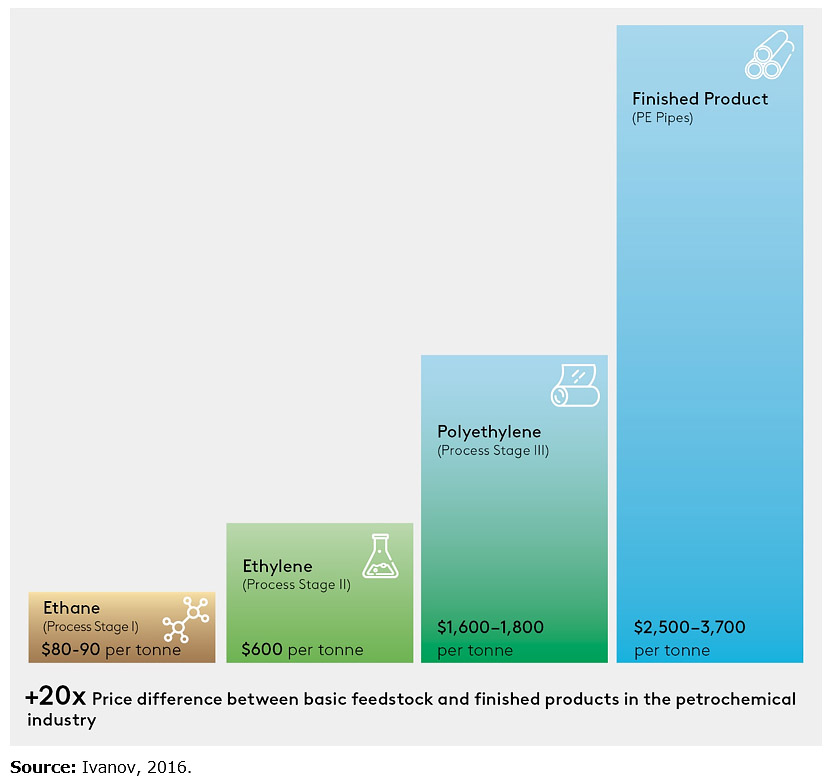

Petrochemicals is a significant sector of the global economy and has a high multiplier effect. The industry is characterised by a rapid increase in value added in the technological chain. Advancing production upstream allows for a multiple increase in the value added created domestically. The price difference between basic raw materials and final polymer products can exceed 20 times.

Fig. 1. Product value per tonne at different process stages from raw materials to finished products

Today, the industry is undergoing global structural changes. A new energy transition is taking place, which in general is closely linked to an increase in the depth of processing of petrochemical products. There is a shift in demand to developing countries, primarily in the Asia-Pacific region and India. The Eurasian region’s close geographical location to the largest promising Asian markets offers great opportunities.

Although the petrochemical industry in the Eurasian region is developing rapidly, the region currently accounts for only 2.1% of the global petrochemical industry and is positioned primarily as a supplier of raw materials (mainly oil and gas). However, the region has all the prerequisites for its transformation into a global centre of polymer production.

The region has a huge resource potential. Total proven oil reserves (as of 2022) are 115 MMbbl (more than 7% of world reserves), while total proven gas reserves are 62.8 TCM (about 30% of world reserves).

Just like industrially developed countries, the region has a long-standing tradition of petrochemical industry development, including both production per se and creation of the related scientific and technological basis, and a successful track record of implementation of large-scale chemicalisation programmes.

The countries of the region are already proactively pursuing government policies aimed at advancement of petrochemical projects. There are more than 20 ongoing large-scale petrochemical projects with a total value of more than $200 billion.

The region is geographically close to the emerging Asian markets. By 2035, the Asia-Pacific Region and India will account for more than 40% of the global petrochemical market. Their immense growth potential can be attributed to their relatively modest current per capita polymer consumption levels relative to developed economies. The Eurasian region is putting considerable effort into maintaining logistical connectivity with those markets

Therefore, strengthening the petrochemical industry is a natural strategic priority of the economic policy of the Eurasian region.

Looking ahead to 2035, unlocking the potential of the petrochemical industry has significant economic benefits for the entire region. The industry can provide:

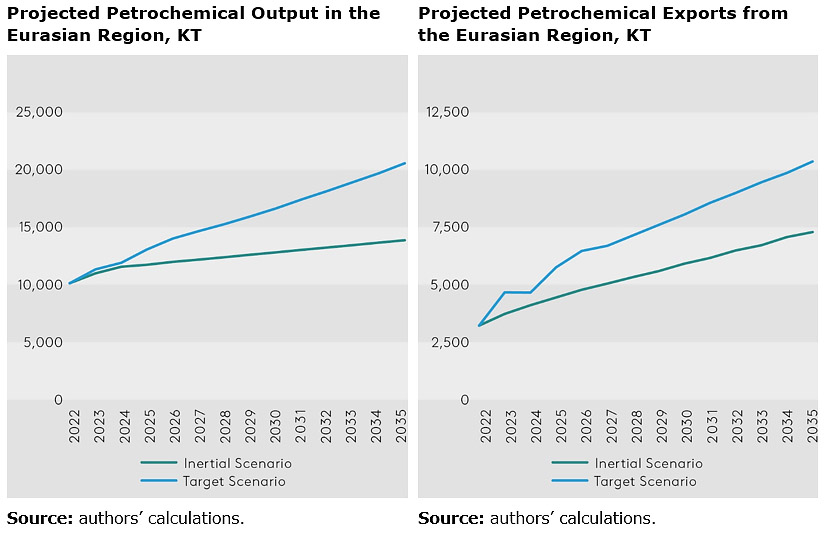

- an annual increase in the output of base polymers and synthetic rubber of up to 5.8%. In total, the volume of polymer production may increase to more than 20 MT annually, with the current output more than doubling;

- an annual increase in the Eurasian region’s GDP of up to 0.44 pp (ratio of the average annual total investment and output growth effect on GDP to GDP volume in 2022). The indicator for the Russian Federation is 0.32 p.p., and for the Republic of Kazakhstan – 1.38 p.p. In total, by 2035, the region’s GDP may receive an additional $153.5 billion;

- a 3.2-fold increase in petrochemical exports to 10.4 MT annually.

In order to unlock the petrochemical production potential of the region, the study proposes a set of 5 priority blocks of measures, which include the following areas:

Creation and accelerated development of modern petrochemical clusters in natural centres of attraction within the Eurasian region close to major sources of hydrocarbon materials (oil and gas).

Innovative and low-tonnage petrochemical production is likely to be the most promising growth area in the Eurasian region as a driver for the development of the entire petrochemical industry. Subject to the environmental aspects of evolution of the petrochemical industry in the Eurasian region, it is advisable to take into consideration global circular production and rational consumption trends, primarily in connection with the deployment of circular economy mechanisms.

It is necessary to come up with transport and logistical solutions to enable effective delivery of polymer products to the emerging markets in the Middle East and the Asia-Pacific region that are already becoming the main drivers of petrochemical consumption in the world.

Using the international status of multilateral development banks (MDBs) to attract investment capital to the industry. To carry out the steps listed above, it will be necessary to secure long-term investments from a consortium of oil, gas, and petrochemical companies, states, and diverse financial institutions. MDBs can also offer umbrella programmes for international investment partners, use their access to international financial markets, and facilitate development of the petrochemical industry by employing a broad range of financial instruments (including trade finance support, funded participation, and soft export loans).

Given the industry’s high level of technological sophistication and significant multiplier effects, the development of petrochemical industry can help the Eurasian region get out of the «path dependence» rut of inertial development.

* The full version of the report Petrochemical industry in Eurasia: Opportunities for Deeper Processing is available at the EDB website.